- Chainlink whales accumulated 15 million tokens worth $165 million over the last two months.

- LINK has surged by 21. 28% over the past month.

Chainlink [LINK] has experienced significant gains on its price charts over the past month. After hitting a local low of $10, the altcoin has surged to reach a local high of $15.36.

The recent uptrend has left analysts talking about factors driving it. According to Popular crypto analyst Ali Martinez, the main factor that stands out is the increased whale accumulation.

Chainlink whales accumulate $165M worth of LINK

According to Santiment, Chainlink whales have been actively accumulating over the past two months. As such, over this period, they have accumulated over 15 million Link tokens worth around $165 million.

When whales go on a buying spree, it reflects the overall market confidence. As such, this suggests that large holders are optimistic about a potential rally.

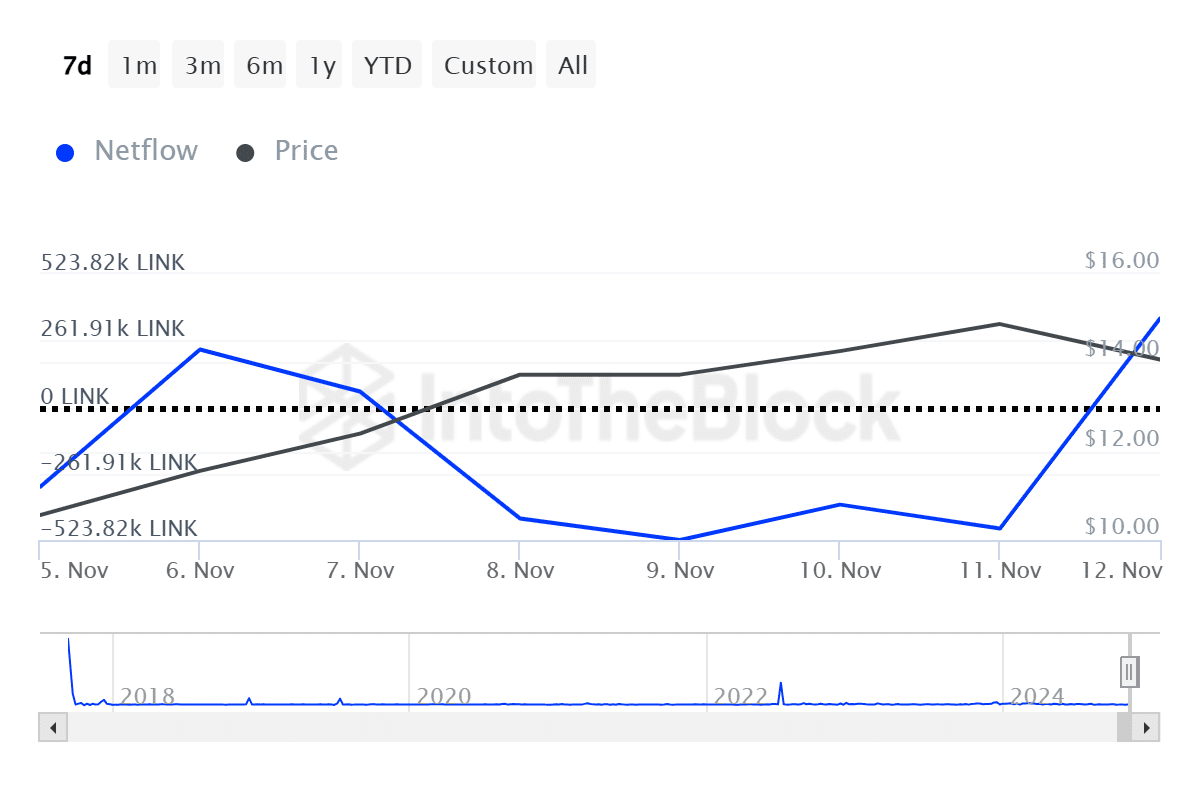

Notably, this market confidence among large holders was also evidenced by the fact that large holders’ netflow has turned positive after a sharp decline. This shows that there are more large holders accumulating than those selling.

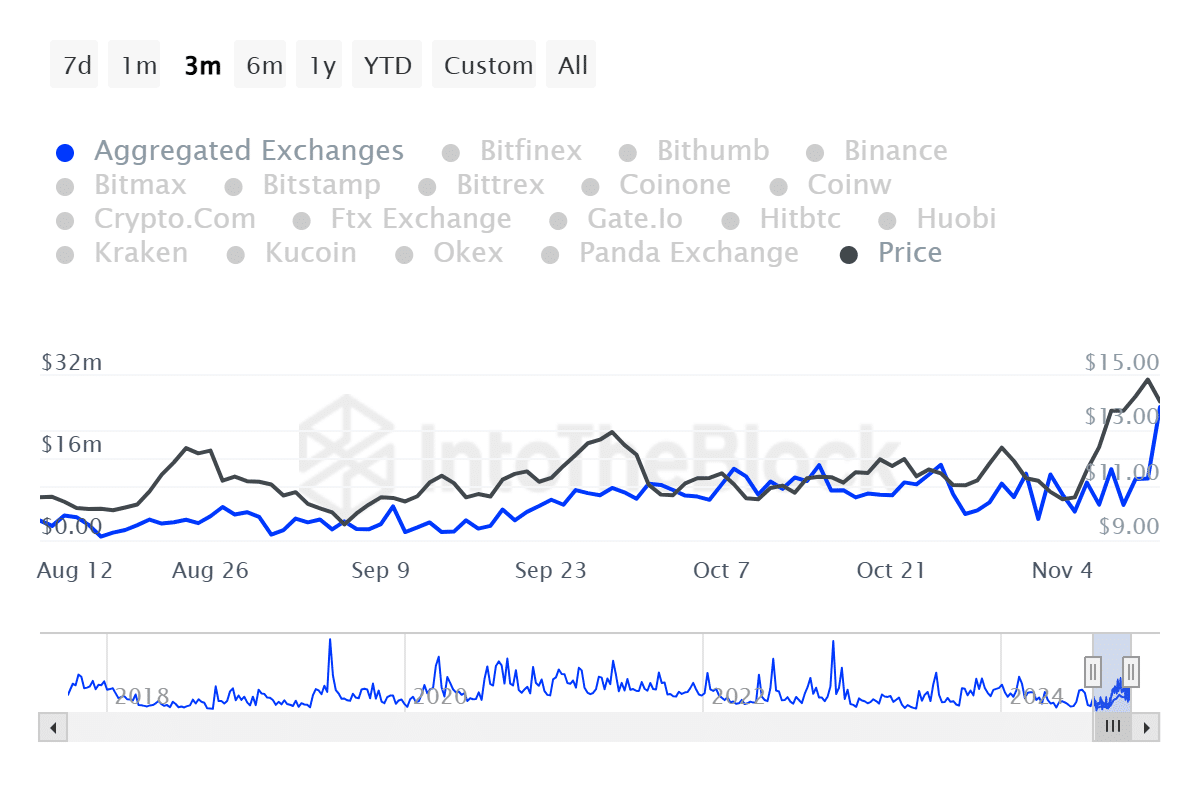

Additionally, we can also see this trend in regard to exchange outflow volume. IntoTheBlock data shows that outflow volume sits at a 3-month high with 1.8 million LINKs worth $25.92 million transferred into cold wallets. This reflects holding behavior with most LINK holders continuing to hold their tokens anticipating further price.

Therefore, the rise in whale accumulation is occurring within a broader market that’s highly bullish and anticipates gains on price charts.

Implications on LINK price charts?

Looking at the overall trends over the past month, it would be true to say that increased accumulation by whales and holding by retail traders, has had a positive impact on Link price charts.

As such Chainlink has surged by 21.28% over the past month to trade at $13.39. This bullish trend has maintained on weekly charts rising by 12.35%.

Is your portfolio green? Check out the LINK Profit Calculator

However, the altcoin has seen a shift in trend on daily charts declining by 10.82%. Despite this drop, the overall market sentiment is bullish as observed above.

Therefore, if these positive sentiments hold, LINK will break out of the $15 resistance level where it has faced multiple rejections. Consequently, if the drop in daily charts gives sellers market control, we could see a decline to reach a critical support level at $10.