The latest Chainlink platform update has significantly boosted confidence in the token, prompting whales to accumulate. Despite this bullish sentiment, the LINK community lacks the necessary strength, potentially complicating the continuation of the bullish trend.

Bullish sentiment is sweeping through the crypto market, driven by Bitcoin’s strength and elevated performance of altcoins, including memecoins and popular tokens. Chainlink (LINK), after a period of intense bearish consolidation, has recently broken out with a 20% rise from its lows.

Chainlink’s Recent Surge and Whale Accumulation

Chainlink’s recent price jump is speculated to be driven by its latest platform update and completion of the Smart NAV Pilot program, aimed at accelerating fund tokenization. This initiative involved tests with major U.S. banks like JPMorgan, Templeton, and BNY Mellon.

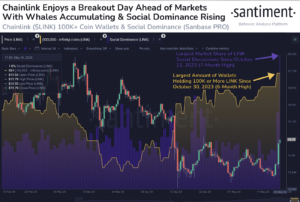

The update has reignited interest among whales, who have increased their accumulation significantly. Following a price drop, whales began accumulating again, particularly after a significant dip in the first half of April. This renewed accumulation has brought the accumulation level to a six-month high.

According to data from Santiment, there are now 564 whales holding more than 100,000 LINK tokens, marking a more than 5% increase in just five weeks. This surge in whale holdings may be driven by a notable rise in social dominance.

Looking ahead, if social dominance stabilizes and fear of missing out (FOMO) drives further investor interest, a new bullish uptrend could potentially push LINK prices above current highs.

Chainlink (LINK) Price Analysis and Outlook

Chainlink (LINK) recently broke out of a lengthy consolidation phase below $10, surging above $16 before encountering strong resistance near new yearly highs above $22. Since then, the price has been trading within a range of $13 to $16, facing challenges in surpassing the crucial resistance at $16.5.

Following the breakout, bulls established a solid support zone between $13 and $13.7, from where the price has begun a new upward movement. Despite this, breaking through the key resistance level at $16.5 has proven challenging.

Recent indicators show increasing bullish momentum, reflected in the bull-bear power dynamics and the RSI attempting to breach the upper trend line. These technical signals suggest a potential continuation of the upward trend for Chainlink (LINK), possibly targeting levels above $18.

However, achieving sustained levels above $20 may present a formidable challenge for LINK, requiring strong bullish conviction to overcome.

Important: Please note that this article is only meant to provide information and should not be taken as legal, tax, investment, financial, or any other type of advice.

Join Cryptos Headlines Community

Follow Cryptos Headlines on Google News