As the cryptocurrency market continues to buzz with anticipation, ChatGPT has become the latest tool for investors seeking to forecast Bitcoin price. With its real-time information features and AI-driven analysis capabilities, the tool by OpenAI has emerged as a key player in the crypto price prediction space.

So, here we explore the potential time for BTC to hit $100K. Besides, we would also see what factors can aid the flagship crypto in its run toward the long-awaited target mark.

ChatGPT Predicts When & How Bitcoin Price Could Hit $100K

When asked about the potential timeline for Bitcoin price to hit $100K, ChatGPT outlines three potential scenarios based on key factors. In an optimistic scenario, the tool said that Bitcoin could reach $100,000 by late 2024 or early 2025 on halving impacts, ETF inflows, and favorable economic conditions.

On the other hand, a moderate timeline could see this goal realized by 2025 or 2026. However, a more conservative outlook, shaped by economic or regulatory challenges, suggests that Bitcoin may reach this level in 2026 or beyond.

Factors That Could Support The Rally

The tool predicts a flurry of critical factors as potential catalysts for Bitcoin price rally to $100,000, including market cycles, institutional participation, and economic trends. According to ChatGPT, the Bitcoin halving event earlier this year may initiate a supply squeeze that could significantly impact the price.

Historically, these halvings, which occur every four years and reduce the mining reward by half, have driven Bitcoin to new highs within 12–18 months. If this trend continues, Bitcoin could hit or approach the $100,000 level as early as late 2024 or early 2025.

Simultaneously, institutional adoption is also a major force behind BTC’s growth potential. The introduction of US Spot Bitcoin ETFs has opened the door for substantial capital inflows. With institutional investors gaining access to Bitcoin through familiar financial products, the asset is likely to witness enhanced legitimacy and accelerated growth.

Moreover, global economic conditions such as inflation and monetary policy shifts will likely play a significant role. Bitcoin, often seen as “digital gold,” appeals to investors as a hedge against inflation and fiat currency instability.

Considering that, ChatGPT suggests that if central banks, particularly the U.S. Federal Reserve, adopt more dovish policies in response to economic slowdowns, it may drive additional demand for Bitcoin, pushing its price higher. It’s worth noting that the US FOMC this week is expected to announce a 25 bps rate cut, which may spark a rally in the broader crypto market, let alone Bitcoin price.

What’s Next For BTC?

BTC price today traded in the red and exchanged hands at $68,747, while its trading volume soared 24% to $41.54 billion. Notably, the market expects heightened volatility ahead of the US election, scheduled today. Despite that, many anticipate that crypto make a swift rebound following the election, citing historical trends and other market factors.

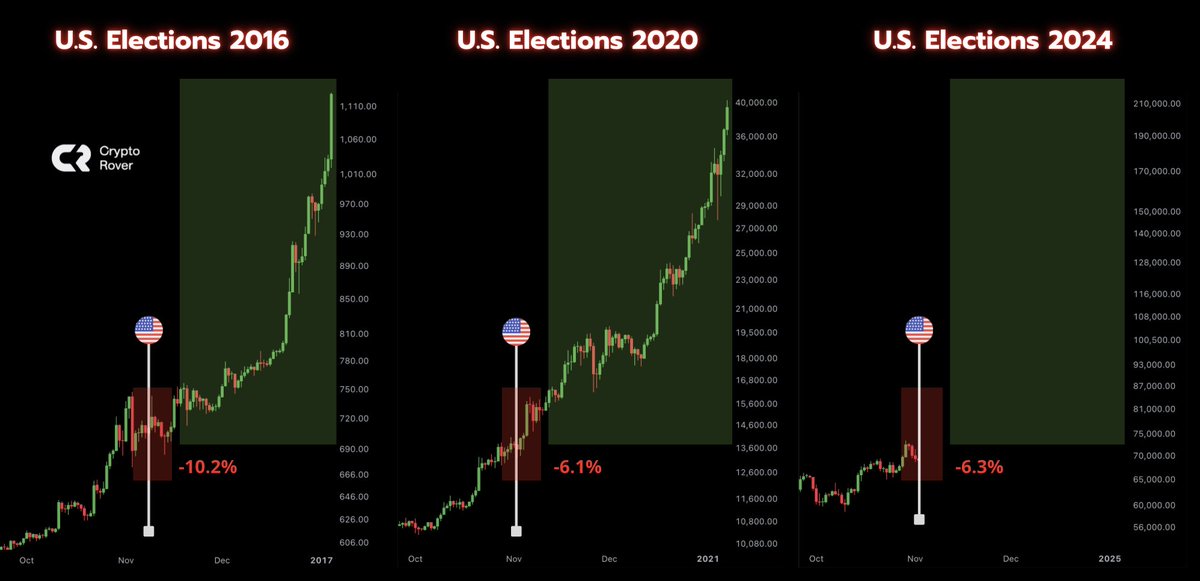

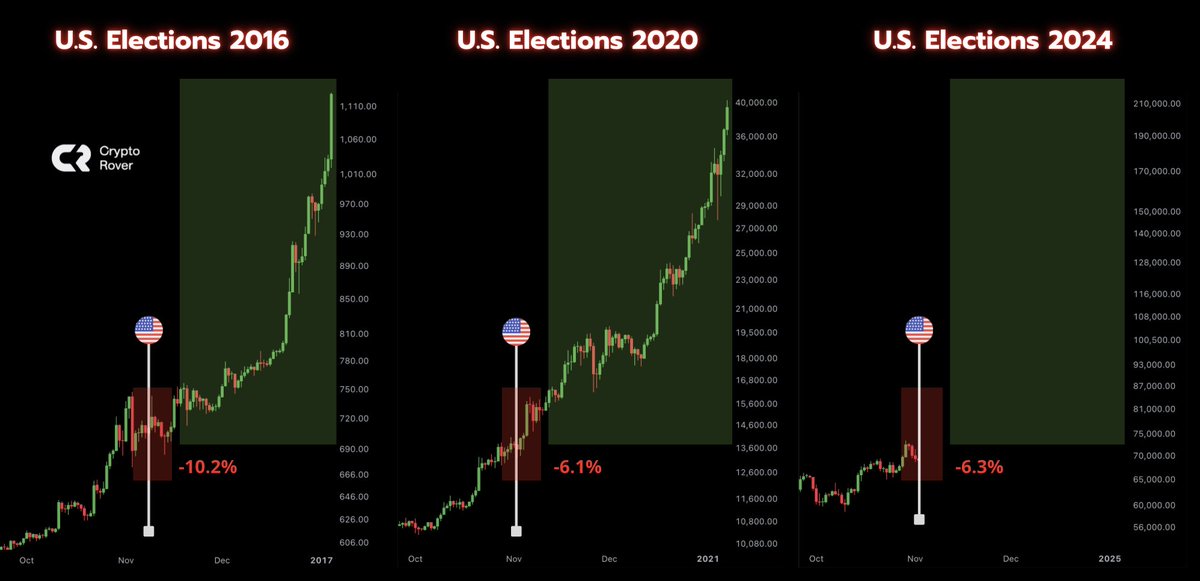

For context, a top crypto market expert, Crypto Rover, recently highlighted historical trends to showcase the volatility of BTC ahead of the election. In addition, he also showed how the crypto usually performs after the election, sparking market optimism.

Besides, according to derivatives data by CoinGlass, Bitcoin Futures Open Interest (OI) rose more than 1% today to $40.02 billion. However, analyzing the latest OI data, CoinGlass recently said that it expects BTC will “swing like a wild rollercoaster” irrespective of the winning candidate in the upcoming US election. Besides, the latest Bitcoin price prediction indicates that the crypto is likely to soar past the $84K level this month.

Will The Bitcoin Rally Continue?

Meanwhile, apart from the above-mentioned reasons, ChatGPT also cited other reasons that could further push the BTC price higher. For context, BTC’s limited supply of 21 million coins, with over 19 million already mined, creates an inherent scarcity that adds upward pressure on its price as demand grows.

Alongside this scarcity, a surge in global adoption and interest in Bitcoin for cross-border payments and remittance purposes could support a long-term price increase. The tool highlights that in emerging markets, where currency devaluation is a persistent issue, BTC’s popularity as a store of value is on the rise. This expanding adoption, both among retail users and in national economies, may bolster the crypto’s position as it advances towards $100,000.

Simultaneously, it is expected that the US Election would help BTC in its run towards the north. Historically, the US election has boosted the performance of the broader financial markets, let alone the crypto space. Besides, the upcoming US FOMC and other macroeconomic events are also expected to support a potential rally in the coming days.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

✓ Share: