Publicly listed crypto exchange Coinbase has partnered with payments giant Visa to integrate Visa Direct into its platform. With the integration, Coinbase customers in the US and EU can now buy cryptocurrency directly through Visa debit cards.

According to Visa’s official announcement, this new partnership will make transferring funds easier and more secure for Coinbase users, enabling real-time money transfer.

It said:

“Coinbase already has millions of users with a debit card connected to their account, and this new feature will help unlock real-time 1delivery of account funds for those using an eligible Visa debit card.”

As Visa noted, the importance of easy and fast transfers in the crypto market cannot be overstated, as they enable traders to take advantage of opportunities as they come.

Visa head of Visa Direct Yanilsa Gonzalez noted that Coinbase users with eligible trading cards can now fund their accounts 24/7 for any trading opportunity. Coinbase executive Akash Shah echoed similar sentiments, noting that it guarantees trust, flexibility, and security.

He said:

“Bringing this feature to our customers supports our mission of increasing economic freedom in the world. The integration with Visa Direct gives our eligible customers real-time 1 access to their funds for trading.”

Meanwhile, the feature will also enable users to send funds directly from their debit cards to Coinbase. Eligible customers will also be able to cash out their crypto assets and the funds in their bank account in real time. However, Visa noted that banks and regions could determine fund availability.

Tradfi institutions are returning to crypto

The new partnership continues the existing relationship between Coinbase and Visa, with Visa already powering crypto debit cards for Coinbase and other exchanges. The move also highlights a return of TradFi companies to crypto exchanges after the collapse of FTX in 2022 and the banking crisis due to crypto custody in 2023.

This return is a result of several developments in the industry over the last 18 months, particularly the Securities Exchange Commission (SEC) approving spot Bitcoin exchange-traded funds (ETF). Still, Visa has been one of the biggest traditional partners for the crypto industry, with the firm recently signing a similar debit card deal with fintech and crypto custodian FV Bank.

Crypto companies are also strengthening their relationships with financial institutions to capitalize on the industry’s resurgence and demand. Binance recently launched Binance Wealth, a new product for wealth managers that gives their clients access to crypto products.

Coinbase is no longer the US’s biggest exchange

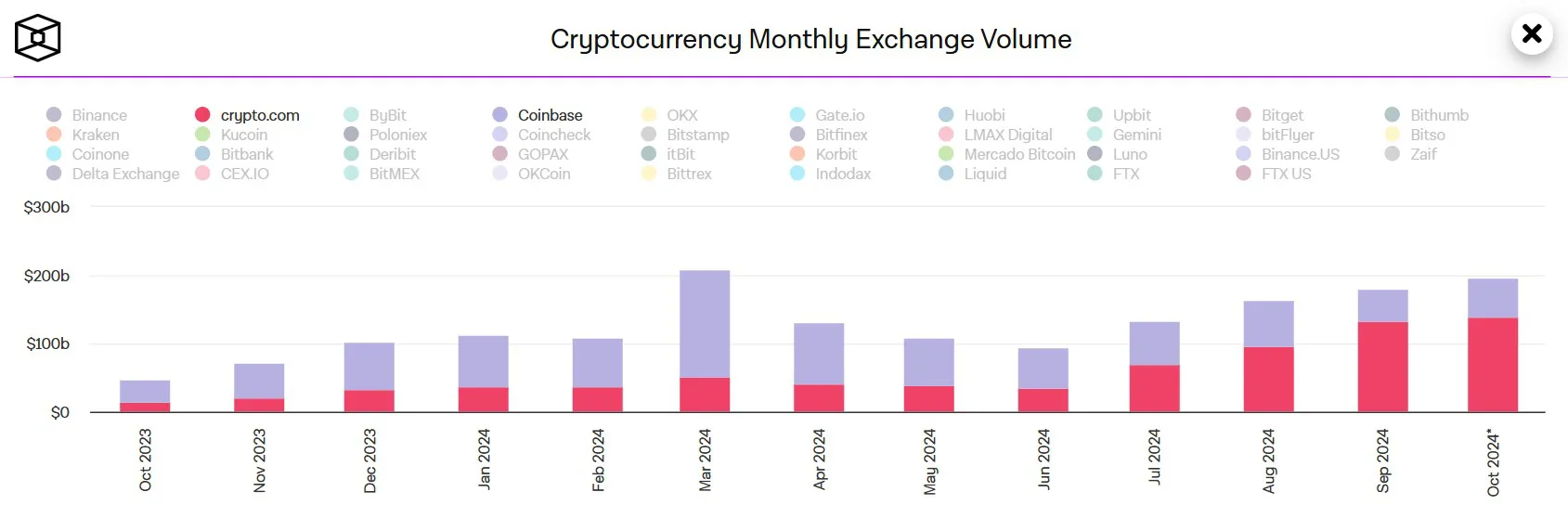

Despite Coinbase’s status as the only crypto company publicly listed in the US, the exchange has seen its dominance in the North American market decline in recent times. It is no longer the top crypto exchange in the country after losing that position to Crypto.com in July.

Recent data shows that Crypto.com has only extended its dominance between July and September. Crypto.com’s spot trading volume went from $34 billion in July to $134 billion in September, dwarfing Coinbase’s $46 million.

While many factors drive the surge in Crypto.com’s volume, experts believe its wide range of assets is a major factor. Compared to Coinbase, which has less than 300 assets available for trading, Crypto.com lists around 400 cryptocurrencies, including memecoins and ecosystem tokens. However, Bitcoin and Ethereum dominate its trading activity.

Coinbase’s muted performance is reflected in how its stock has fared compared to the flagship asset, Bitcoin. According to Yahoo Finance data, COIN is up 30% year-to-date, less than half of Bitcoin’s 63% gains within the same period.