Coinbase is making big changes to its services around the time of the G20 Summit. Some reports suggest they told Indian users to withdraw their funds by September 25, leading to speculation about them leaving the Indian market.

However, it seems they might be changing rules for all customers instead of completely stopping operations in India.

Coinbase, a crypto exchange, is making major changes to its services. They’ve sent out emails saying they’ll stop providing exchange services to customers in India after September 25. This news coincides with the G20 Summit, which India is hosting.

Coinbase Adjusts Customer Offerings Amid Challenges in India

Coinbase has advised Indian customers to withdraw their funds by September 25, according to a recent report by Techcrunch. This move initially sparked rumors that Coinbase was leaving India due to regulatory issues. However, it seems that Coinbase is actually tightening its rules for all customers.

It’s important to note that not all users received this withdrawal notice. It appears that Coinbase only sent it to account holders who didn’t meet the updated standards during a routine system review. This means they are focusing on accounts that don’t comply with the new rules. The email also clarified that this change doesn’t affect users’ access to Coinbase Cloud services.

Coinbase entered the Indian market last year but faced several challenges. Shortly after its launch, UPI support was suspended. Coinbase CEO Brian Armstrong revealed that this decision was influenced by “informal pressure” from India’s central bank. The National Payments Corporation of India (NPCI) also expressed unawareness of any crypto exchange using its instant payment system. These challenges led to the departure of key executives, including Durgesh Kaushik, the Senior Director for Market Expansion.

G20 Summit Sets Crypto Direction

During the G20 Summit held in India, the country, as the current president of the summit, aims to build agreement on cryptocurrency guidelines outlined in a policy document. Indian Finance Minister Nirmala Sitharaman has suggested that there’s progress toward creating a worldwide framework for regulating cryptocurrency assets.

Following the G20 meeting, it’s clear that India is considering the recommendations presented in a paper written by two global organizations, the International Monetary Fund (IMF) and the Financial Stability Board (FSB). This paper provides a plan for regulating crypto assets and incorporating digital currencies into the financial system.

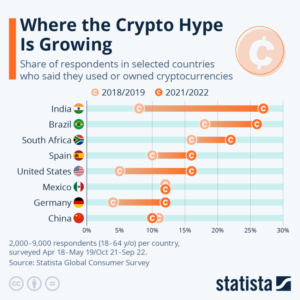

India has been consistently high-ranked in crypto ownership and use. Source: Statista / The Wire

In an interview, Gita Gopinath, who serves as the Deputy Managing Director of the IMF, expressed concerns about the differing approaches that countries are taking towards cryptocurrency. While she acknowledged the need for tailored regulations, Gopinath emphasized the importance of having common standards for cryptocurrencies that apply to all nations.

At the same time, the leaders of the G20 countries have collectively called for the swift development of a framework for cryptocurrencies.

Important: Please note that this article is only meant to provide information and should not be taken as legal, tax, investment, financial, or any other type of advice.

Join Cryptos Headlines Community

Follow Cryptos Headlines on Google News