Coinbase has been selected as a crucial infrastructure provider for Blackrock’s newly introduced tokenized investment fund, as disclosed by the crypto exchange.

According to Blackrock’s head of digital assets, this move represents the evolution of their digital assets strategy. Their aim is to create solutions in the digital assets realm that address genuine challenges for their clients.

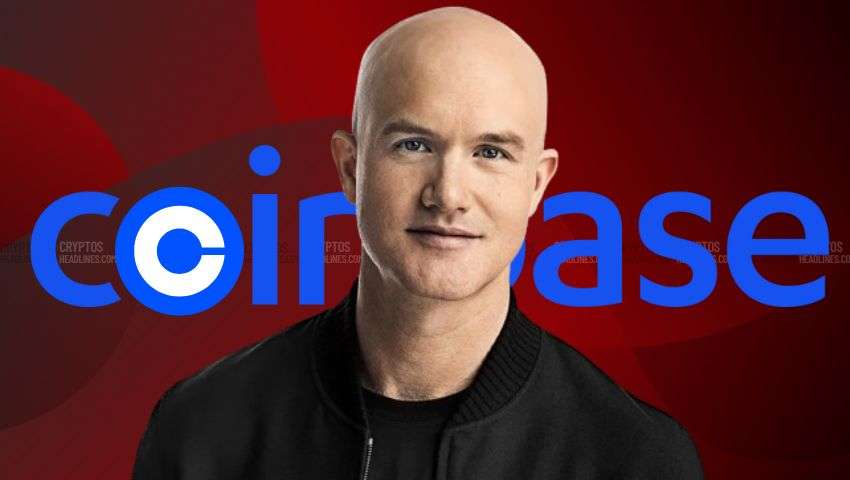

Blackrock Introduces Tokenized Fund with Coinbase’s Support

On Wednesday, Blackrock, the world’s largest asset manager, unveiled its inaugural tokenized fund, issued on a public blockchain. This collaboration with Securitize Markets resulted in the creation of the Blackrock USD Institutional Digital Liquidity Fund (BUIDL).

Coinbase Institutional proudly announced on social media platform X that it has been selected to provide vital infrastructure for Blackrock’s new fund. Coinbase emphasized its commitment to connecting institutions to crypto and highlighted its ability to support the rapidly growing tokenization sector.

Qualified investors will have the opportunity to earn U.S. dollar yields by subscribing on the blockchain through Securitize Markets. The fund invests 100% of its total assets in cash, U.S. Treasury bills, and repurchase agreements. This strategy allows investors to earn yield while holding tokens on the blockchain. The BUIDL fund aims to maintain a stable value of $1 per token and distributes daily accrued dividends directly to investors’ wallets as new tokens each month.

Blackrock Expands Digital Assets Strategy with Coinbase’s Support

Coinbase extends its services to Blackrock beyond infrastructure provision, offering custody services for Blackrock’s bitcoin holdings in the Ishares Bitcoin Trust (IBIT), the world’s largest asset manager’s spot bitcoin exchange-traded fund (ETF). Furthermore, Blackrock has submitted an application to the Securities and Exchange Commission (SEC) to launch its Ishares Ethereum Trust.

Robert Mitchnick, Blackrock’s head of digital assets, emphasized the evolution of their digital assets strategy. Mitchnick expressed Blackrock’s commitment to developing solutions in the digital assets space to address real problems for their clients. He also expressed excitement about collaborating with Securitize.

The initial participants in the BUIDL ecosystem include Anchorage Digital Bank NA, Bitgo, Coinbase, and Fireblocks. Blackrock Financial Management will act as the investment manager of the fund, while Bank of New York Mellon will serve as the custodian of the fund’s assets and its administrator. Securitize will play a crucial role as Blackrock’s transfer agent and tokenization platform.

Important: Please note that this article is only meant to provide information and should not be taken as legal, tax, investment, financial, or any other type of advice.

Join Cryptos Headlines Community

Follow Cryptos Headlines on Google News