Core Scientific has announced that favorable market conditions have improved its financial situation, increasing its available funds. As a result, the company has made revisions to its bankruptcy restructuring plan.

Core Scientific, a Bitcoin mining company currently in bankruptcy proceedings, is working on finalizing a restructuring plan that could be completed by September. The company anticipates an additional $46 million to be added to its funds as a result of positive market conditions.

According to a filing made on May 22 in a Texas Bankruptcy Court, Core Scientific’s financial situation has significantly improved since it initially filed for bankruptcy. As a result of this improvement, the company intends to submit a reorganization plan in the near future.

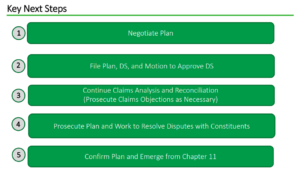

The reorganization plan is currently being discussed and negotiated with important parties involved. The filing states that the company is aiming to reach a consensus among stakeholders regarding the future structure of Core Scientific once it emerges from the bankruptcy proceedings.

The next steps in Core Scientific’s Chapter 11 proceedings. Source: Stretto

Chapter 11 bankruptcy enables a company to keep operating while stakeholders work towards reaching an agreement on a restructuring plan. This plan may involve actions like reducing business operations to lower debt or selling assets to repay creditors.

Also Read This Related: Core Scientific Aims for September Exit from Bankruptcy, Lawyers Optimistic

The company highlighted several market factors that have positively impacted its financial position. These include lower electricity costs, higher Bitcoin prices, and an increase in the blockchain’s hashrate, which have all contributed to the improvement in the company’s liquidity.

Core Scientific’s initial liquidity estimates vs current. Source: Stretto

When Core Scientific filed for bankruptcy on December 21, 2022, the price of Bitcoin was $16,904, as reported by CoinMarketCap. Since then, the price of Bitcoin has experienced a significant increase of over 60%, reaching approximately $27,000.

According to the filing, power prices have dropped by 24% since the date when the bankruptcy petition was filed. Additionally, the network hashrate, which measures the computing power used in Bitcoin mining, has increased by 54%.

Due to improved market conditions, Core Scientific anticipates an extra $46 million in funds once the restructuring plan is completed, even though there have been delays in the bankruptcy proceedings.

Furthermore, Core Scientific is anticipating a substantial financial gain as it claims that the bankrupt cryptocurrency lender, Celsius Network, owes them approximately $11 million.

The two companies are currently involved in a prolonged legal dispute that originated on October 19, 2022, when Core Scientific initially accused Celsius of not paying their electricity bills.

Important: This article is intended solely for informational purposes. It should not be considered or relied upon as legal, tax, investment, financial, or any other form of advice.