Key Points

- Bitcoin’s volatility remains high as institutional investors consider stockpiling the cryptocurrency.

- Despite high buying pressure, indicators suggest a sustained price drop in the short term for Bitcoin.

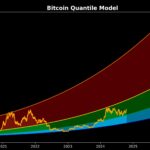

Bitcoin [BTC] has experienced significant fluctuations in recent weeks, with the cryptocurrency crossing $64k before falling below $60k within a matter of days.

Despite this volatility, institutional investors are showing interest in accumulating more of the cryptocurrency.

Institutional Interest in Bitcoin

Last month, Bitcoin underwent a +9% price correction and currently trades at $58,184.19, boasting a market capitalization of over $1.13 trillion.

Crypto influencer, Vivek, recently shared a tweet indicating a sharp increase in BTC balances on new addresses with more than 1k BTC, suggesting that institutional investors’ confidence in Bitcoin is growing.

Bitcoin’s Prospects in September

An analysis of CryptoQuant’s data reveals that BTC’s exchange reserves dropped sharply on 27 August, indicating high buying pressure, which often results in price hikes.

However, not all indicators are bullish for Bitcoin. The Coinbase premium turned green, suggesting strong selling sentiment among U.S investors. Furthermore, the Funds premium was also red, indicating weak buying sentiment among investors in funds and trusts, including Grayscale.

An assessment of Glassnode’s data shows that Bitcoin’s accumulation trend score currently stands at 0.35. This score reflects the relative size of entities that are actively accumulating coins on-chain in terms of their BTC holdings. A score closer to 0 suggests a reluctance to accumulate, while a score closer to 1 indicates increased buying pressure. With the current score being closer to 0, it appears that buying pressure is decreasing.

An analysis of BTC’s daily chart, including the technical indicator MACD, suggests a bearish crossover. Both its Chaikin Money Flow (CMF) and Relative Strength Index (RSI) show downticks, indicating that investors may have to wait longer in September for Bitcoin to turn bullish.