The Oracle of Omaha and CEO of Berkshire Hathaway, Warren Buffett, is an investment prodigy and a legend when it comes to making impeccable financial investments. His knack for making money out of underrated or known stocks inspires many in the investment domain, making him an ideal figure to pay heed to. As we continue to decode his portfolio layer by layer, here’s another of Buffett’s favorites, a stock Buffett has been loyal to since 1991.

Also Read: Shiba Inu (SHIB) & Bitcoin (BTC) Price Prediction For Mid-October 2024

American Express: The Evergreen Stock

Warren Buffett has invested nearly 13.3% of his portfolio in American Express, one of the leading credit service providers. According to The Fool, American Express is the second-longest holding of Berkshire Hathaway. Since 1991, it’s been a consistent source of revenue for Buffett, making AmEX a loyal stock choice he keenly pursues.

American Express is noteworthy in many crucial ways. For instance, the firm practices a strategy known as the “double dip.”

In general finance, a double dip simply refers to a firm’s ability to make money from two different sources simultaneously.

To elaborate, the firm is known as the third largest payment processor by credit card network purchase volume in the US. The firm has developed a knack for availing predictable fee patterns from its consumers, keeping them dependent on its services holistically.

On the other hand, the firm also stays afloat via its lending capabilities. The firm is generating high revenue metrics by offering lending services to clients and accumulating annual fees and interest from its cardholders.

Also, the firm boasts an elite clientele and always attracts high-spending individuals who do not alter their spending habits, making them a great source of revenue for the firm to serve.

Also Read: Top 3 Cryptocurrencies That May Rally Over 30% This Weekend

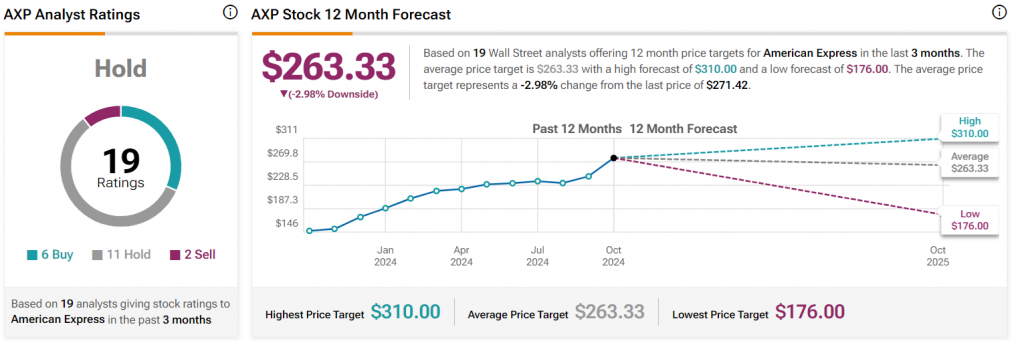

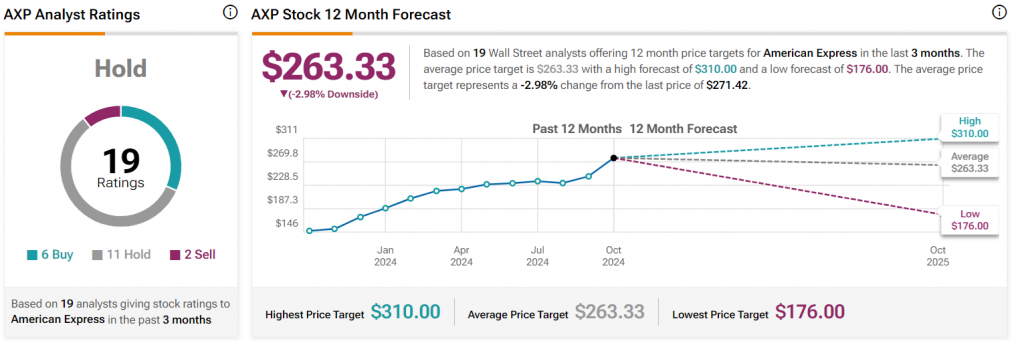

AXP Stock Forecast: Hitting $310 Soon?

According to TipRanks’ prediction, AXP may hit a new milestone of $310 in the next 12 months. It is currently sitting at $271. If AmEx continues to expand its client base, it may help the firm double its revenue sooner than predicted timelines.

“Based on 19 Wall Street analysts offering 12-month price targets for American Express in the last 3 months. The average price target is $263.33 with a high forecast of $310.00 and a low forecast of $176.00. The average price target represents a -2.98% change from the last price of $271.42. American Express’s analyst rating consensus is a hold. This is based on the ratings of 19 Wall Street analysts.”

Also Read: U.S. Prosecutors File First-Ever Crypto Market Manipulation Charges!