Cronos (CRO) has been on a tear recently, skyrocketing by 148% over the past week. Currently, the altcoin trades at $0.17, a level last seen in May 2022.

With demand for Cronos rising, its rally appears positioned to break above the $0.20 mark for the first time in two years. This analysis examines the factors that could drive the price higher in the near term.

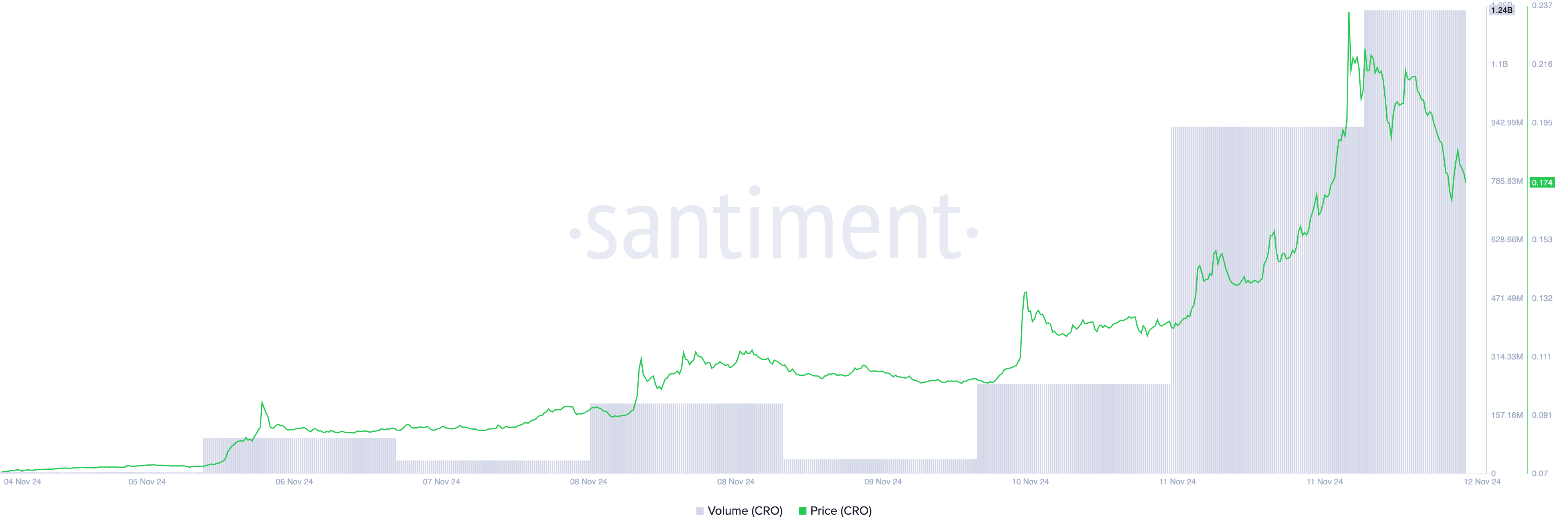

Cronos Sees Spike in Trading Activity

Over the past 24 hours, CRO’s value has surged by 21%. During the same period, its trading volume totaled $1.24 billion, spiking by over 300%.

When a high trading volume backs an asset’s price rally, it signals strong momentum behind its current trend. This indicates sustained interest and confidence among traders. It suggests the asset is attracting new buyers and seeing increased demand from existing investors. This demand can lead to a self-reinforcing rally as more investors jump in, expecting prices to continue climbing.

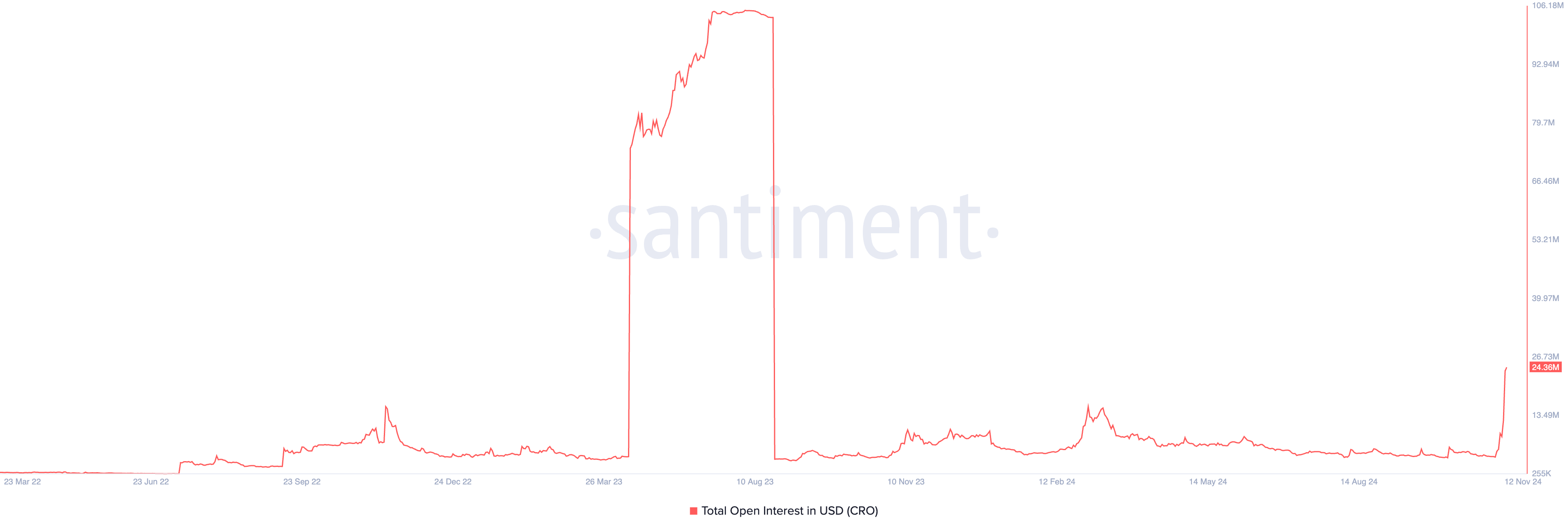

Notably, its rising open interest confirms the surge in CRO trading activity. At press time, this sits at $24.36 million, its highest since August 2023.

Open interest tracks the total number of active or unsettled contracts in the market, such as futures or options. When it rises, the total number of active or outstanding contracts increases.

This uptick usually reflects new participants entering the market or existing traders expanding their positions, bringing additional liquidity. When open interest and an asset’s price rise simultaneously, this indicates a bullish sentiment and raises the potential for a sustained rally.

CRO Price Prediction: $0.20 May Come Soon

At its current price, CRO trades above the $0.14 resistance level, which it recently broke above. Sustained buying pressure will flip this price level into a support floor upon retest, propelling the Cronos price rally toward the $0.22 mark.

However, if selling activity gains momentum, the $0.14 price level will not hold as support, causing CRO’s price to plummet toward $0.04.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.