A well-regarded crypto analyst is cautioning about a possible Bitcoin (BTC) correction on the horizon, following the cryptocurrency’s impressive performance in the previous week.

According to trader Justin Bennett’s recent blog post, Bitcoin (BTC) has experienced an impressive rally since June 15th, with a substantial surge of around 25% in less than two weeks.

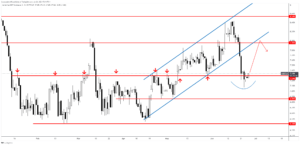

However, Bennett suggests that Bitcoin might soon experience a pullback, leading to a partial loss of its recent gains. He believes that latecomers who joined the rally may face a downturn, potentially resulting in a retreat towards the $28,000 range to clear out these late Bitcoin long positions.

The outcome of Bitcoin’s price movement within the $27,000 to $28,000 range, if it is tested, will significantly influence the cryptocurrency’s trend in July, as stated by the crypto strategist. The strategist’s short-term bearish perspective would be proven incorrect if Bitcoin successfully surpasses its immediate resistance level at $31,000.

On the other hand, if Bitcoin manages to consistently surpass the $31,000 level, it would indicate that the market is still controlled by bullish investors. This breakthrough could potentially lead to further gains, with the next target being around $32,500.

Source: Justin Bennett/DailyPriceAction

Bennett is also closely monitoring the Tether dominance chart (USDT.D), which measures the proportion of cryptocurrency capital held in the stablecoin USDT.

Traders pay attention to this chart because when it shows bullish activity, it indicates that market participants are converting their cryptocurrency holdings into stablecoins like USDT to safeguard the value of their capital.

Bennett advises his 112,400 Twitter followers to be cautious if the USDT.D (Tether dominance) surpasses the 8% level, as it could potentially expose Bitcoin to a significant correction. He suggests monitoring the situation closely and highlights that if the USDT.D reaches the 8% mark, it could indicate a potential 10% decline in Bitcoin’s value.

Source: Justin Bennett/Twitter

Important: This article is intended solely for informational purposes. It should not be considered or relied upon as legal, tax, investment, financial, or any other form of advice.

Follow Cryptos Headlines on Google News

Join Cryptos Headlines Community