Asian stock and crypto markets have rallied in the last 24 hours, sparked by optimism following the latest US inflation report supporting expectations of a Federal Reserve rate cut. Gains in the region extended a positive trend set by Wall Street, with tech stocks leading the charge.

According to recent news, November US inflation was 2.7%, slightly above the previous month but consistent with market expectations. This figure has prompted economists to forecast a 0.25% rate cut by the Federal Reserve next week.

Asian equities have mirrored the rally seen in US markets according to reports. Japan’s Nikkei 225 closed 1.2% higher, supported by its export-heavy composition, while China’s blue-chip CSI 300 index added 1%, surpassing the 4,000-point mark. In Hong Kong, the Hang Seng climbed 1.6%, rounding out a day of broad regional gains.

Analysts have attributed the uptick to strong performances in US tech stocks, which pushed the Nasdaq 100 up 1.9%. The Nasdaq Composite also broke new ground, closing above 20,000 points for the first time.

“The strong reaction in the U.S., especially in tech stocks, has influenced Asian markets,” said Mitul Kotecha, head of emerging markets and macro strategy at Barclays. “The inflation numbers play to a continued easing scenario, which is favorable for markets.”

Asian crypto and stock markets rally post-inflation rates announcement

Following the news of US inflation rates rising, Asian crypto markets experienced a slight uptick. Ripple (XRP) is up by about 2% since yesterday on the popular South Korean exchange Upbit. At press time, the coin is changing hands at around 3,400 won, up from a 24-hour low of 3,389.

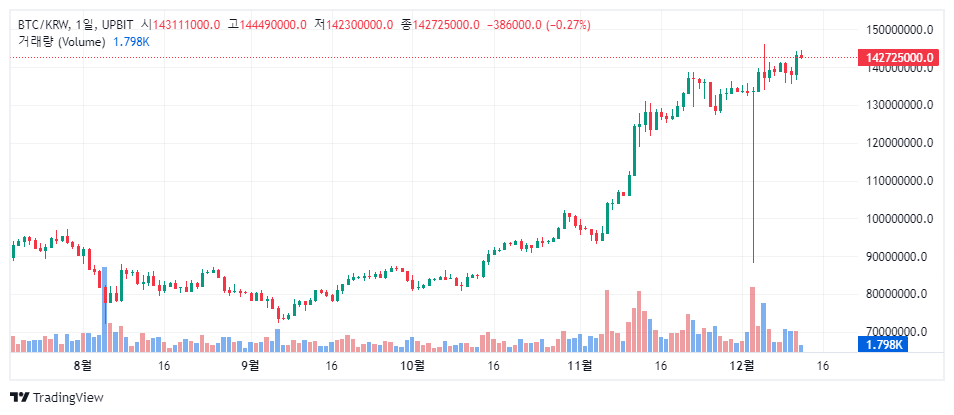

Bitcoin (BTC) recovered its $100,000 price level on global exchanges in the late hours of December 11. It also jumped from 142,300,000 won on Upbit and is now hovering around the 143,000,000 won price level, per TradingView data.

The largest crypto by market cap, BTC also experienced notable gains in the wake of the US presidential election, climbing 30% in the month following Donald Trump’s victory. This growth far outpaced the 14% increase posted by the Roundhill Magnificent Seven ETF (MAGS), which tracks Wall Street’s seven largest companies by market capitalization.

Asian stocks traded mostly higher on December 12, bolstered by Wall Street’s gains following a US inflation update that reinforced expectations for further Federal Reserve support. Investors in the region welcomed signs of economic resilience and policy adjustments in key markets.

According to a Yahoo Finance insight, Chinese equities climbed as leaders met in Beijing to debate economic goals and initiatives for the upcoming year. Among the key announcements was the expansion of trial private pension programs across the country, set to begin on December 15. The Shanghai Composite Index rose 0.9% to 3,461.50, while Hong Kong’s Hang Seng Index jumped 1.4% to 20,441.57.

South Korea’s Kospi posted a strong performance, advancing 1.6% to 2,482.12. Taiwan’s Taiex followed suit, gaining 0.6%, while Thailand’s SET edged up 0.2%.

Meanwhile, Australia’s S&P/ASX 200 slipped 0.3% to 8,330.30, and India’s Sensex dipped 0.2%, bucking the broader regional trend.

Asia-Pacific leads global crypto adoption

Beyond traditional markets, the Asia-Pacific region reaffirmed its leadership in cryptocurrency adoption and innovation. The 2024 Global Crypto Adoption Index revealed that Central and Southern Asia and Oceania (CSAO) accounted for seven of the top 20 most active nations in both centralized and decentralized finance (DeFi) protocols.

The research also revealed Indonesia as a standout performer, recording over $30 billion (475.13 trillion rupiah) in cryptocurrency transactions between January and October 2024. This marked a staggering 350% growth compared to the same period in 2023, highlighting the region’s growing appetite for digital assets.

Asia’s prominence extends beyond adoption, as the continent has become a hub for crypto development. Since 2015, Asia’s share of global cryptocurrency developers has risen from 13% to 32%, surpassing North America, whose share declined from 44% to 25%.

Lastly, the ranking of crypto app users in South Korea in November 2024 has been released. Upbit ranked first with 4.36 million users, followed by Bithumb and Pi Network with 2.24 million and 1.34 million users, respectively. Coinbase, Binance, Bitget, and Bybit ranked fourth, fifth, sixth, and eighth, respectively, and MetaMask ranked tenth.

A Step-By-Step System To Launching Your Web3 Career and Landing High-Paying Crypto Jobs in 90 Days.