De-dollarization is changing global finance in 2024. BRICS nations are moving away from the US dollar. They’re turning to cryptocurrency and Bitcoin instead. New data shows a major shift. The US dollar now makes up only 58.2% of global FX reserves.

Also Read: Shiba Inu: What’s SHIB’s Price If 99% of Tokens Are Burnt?

Exploring the Role of Cryptocurrency in Global De-dollarization Efforts

Shifting Reserve Patterns

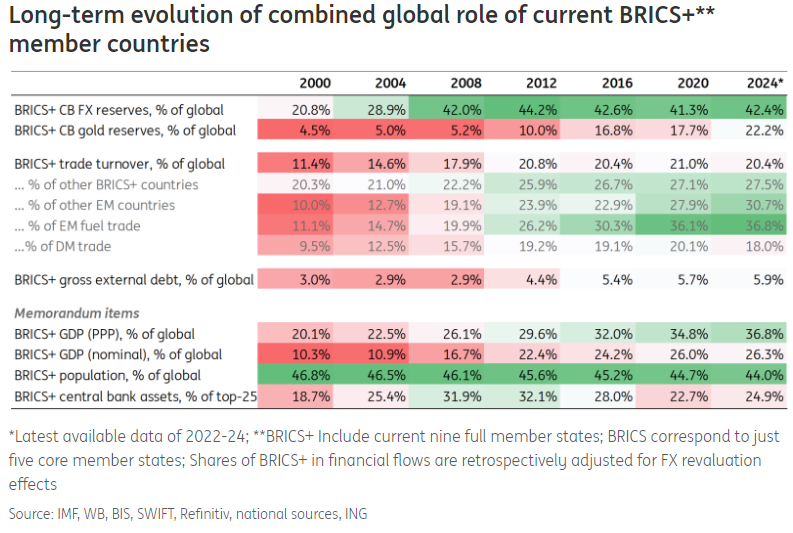

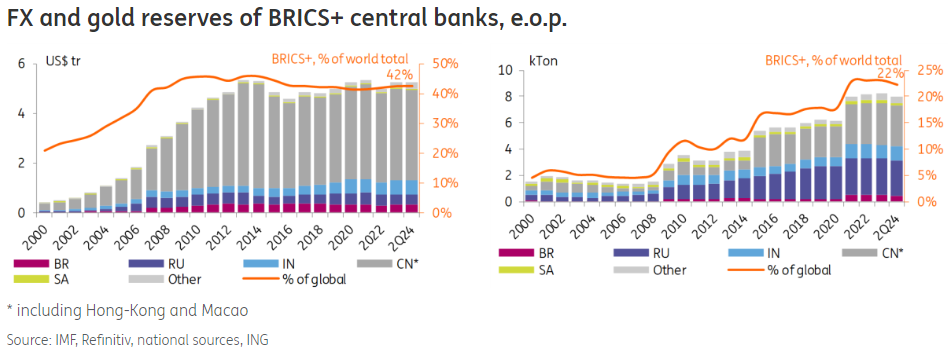

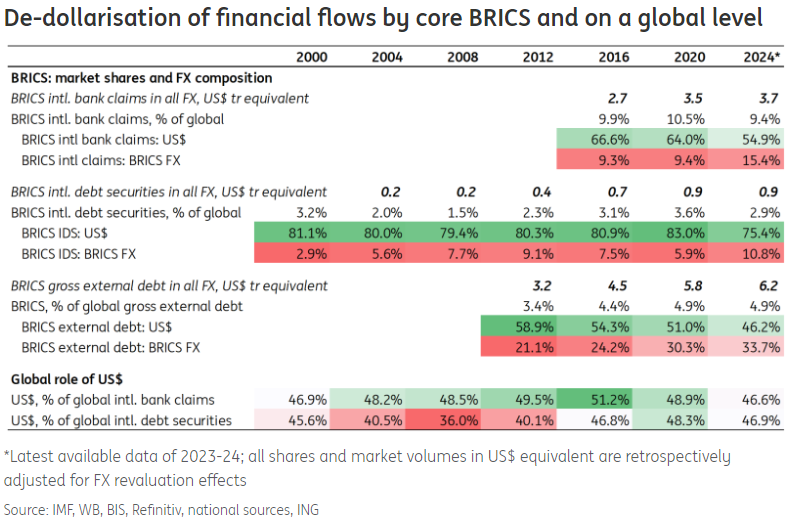

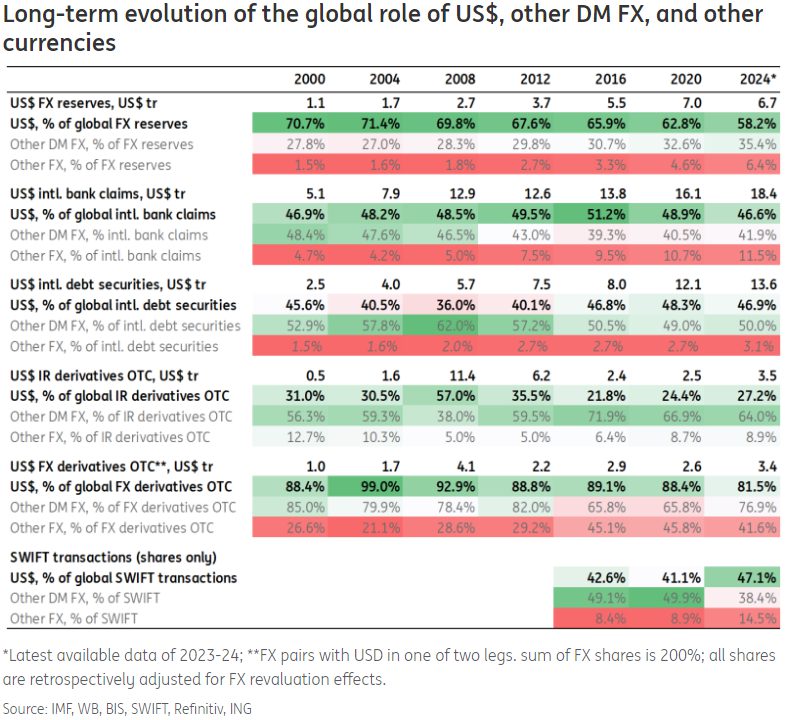

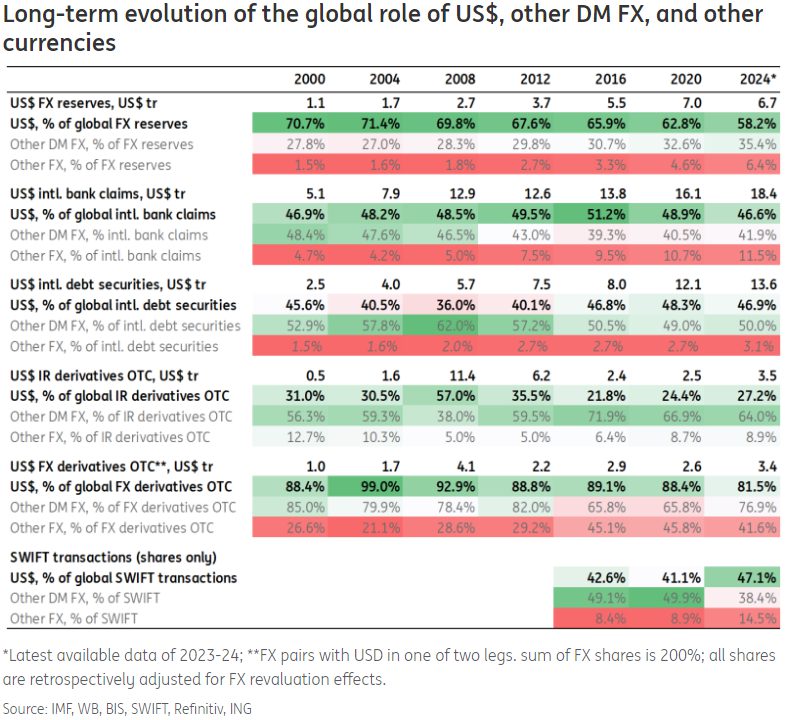

BRICS+ countries hold 42% of global central bank reserves. They’ve cut their US dollar holdings sharply. The numbers tell the story. Dollar holdings dropped from 70.7% in 2000 to 58.2% in 2024 due to the de-dollarization movement. At the same time, they bought more gold.

Chinese President Xi Jinping stated:

“There is an urgent need to reform the international financial architecture, and BRICS must play a leading role in promoting a new system that better reflects the profound changes in the international economic balance of power.”

Digital Currency Integration

BRICS created the m-Bridge system, which links member states’ digital currencies. BRICS currencies now make up 15.4% of international bank claims, which keeps growing due to de-dollarization efforts. The system helps members avoid Western payment networks. Digital currencies from central banks are key to this change.

Also Read: AI Sets PEPE Price For Thanksgiving 2024

Cross-Border Payment Evolution

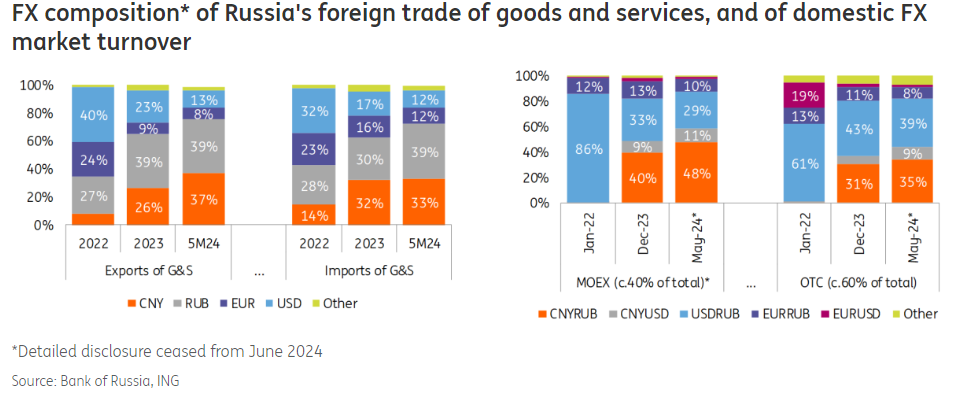

At the Kazan summit, Russian President Vladimir Putin spoke plainly: “The dollar was used as a weapon. If they don’t let us work with it, what else should we do? We should seek other alternatives.”

Russia then made a bold move. Its lawmakers suggested using Bitcoin for international trade and urged Russian miners to sell it to foreign buyers as part of their de-dollarization plan.

De-dollarization Financial Market Impact

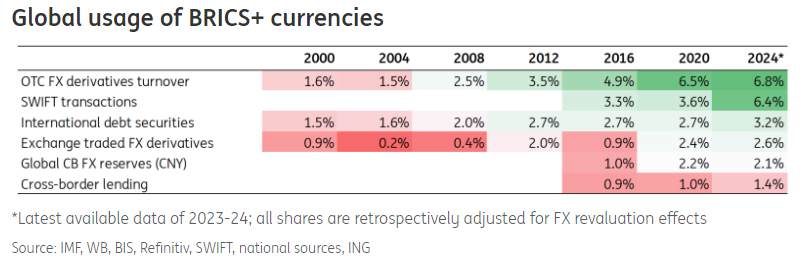

SWIFT payments show big changes. The US dollar’s share is now 47.1%. But BRICS currencies are gaining ground due to de-dollarization. They handle 6.4% of cross-border payments in 2024. China’s digital yuan leads this growth.

Technical Infrastructure Development

BitRiver teams up with RDIF, which is building crypto and AI centers across BRICS nations. This fits with Russia’s new mining rules from August 2024, which help miners and data centers work better in their drive for de-dollarization.

Also Read: Ripple: 3 Reasons Why XRP Could Surge To $5

Future De-dollarization Outlook

BRICS is making progress with crypto. Their currencies handle 1.4% of cross-border loans and issue 3.2% of international debt papers. More countries use BRICS payment systems now, and digital currencies play a bigger role in world trade as de-dollarization advances.