Top 10 Cryptocurrency Exchanges Experience Substantial Outflows Amid Rising FUD Surrounding Binance and Coinbase

In the past week, both Binance and Coinbase faced legal action from the US Securities and Exchange Commission (SEC), resulting in a widespread sell-off across the global cryptocurrency market. However, the current state of affairs indicates a return to stability as market conditions appear to have normalized.

Based on on-chain data from Glassnode, the leading crypto assets, namely bitcoin (BTC), ethereum (ETH), and tether (USDT), have experienced significant outflows amounting to over $4.6 billion in the past week. This notable movement of funds highlights the shifting dynamics within the cryptocurrency market.

🚨 Weekly On-Chain Exchange Flow 🚨#Bitcoin $BTC

➡️ $6.4B in

⬅️ $7.2B out

📉 Net flow: -$806.8M#Ethereum $ETH

➡️ $2.9B in

⬅️ $5.9B out

📉 Net flow: -$3.0B#Tether (ERC20) $USDT

➡️ $4.6B in

⬅️ $5.5B out

📉 Net flow: -$869.8Mhttps://t.co/dk2HbGwhVw— glassnode alerts (@glassnodealerts) June 12, 2023

Furthermore, the outflows of BTC and USDT stand at $806 million and $869 million respectively, according to Glassnode. In contrast, Ethereum has recorded net flows of approximately $3 billion during the past week, as reported by Glassnode. These figures from Glassnode’s data underscore a significant sell-off in response to the legal actions taken by the US SEC against the top two cryptocurrency exchanges.

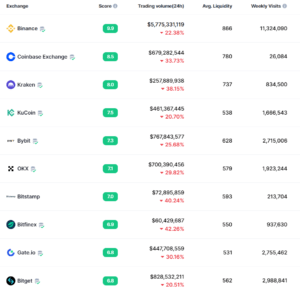

Additionally, according to CoinMarketCap (CMC) data, the 24-hour trading volumes of the top 10 cryptocurrency exchanges have experienced a substantial decline in the past day. Binance and Coinbase, in particular, witnessed significant drops of 22% and 33% respectively, reflecting a notable decrease in trading activity on these platforms.

Top 10 crypto exchanges – June 12 | Source: CoinMarketCap

Also Read This: SEC Lawsuits Against Binance and Coinbase Spark Unity in the Crypto Industry

As per CMC’s data, Bitstamp and Bitfinex experienced the most significant declines in trading volumes among the top 10 exchanges, with drops of 40% and 42% respectively. Notably, the global crypto trading volume reached nearly $50 billion on June 6, and subsequently surged even further to over $54.6 billion on June 11.

However, within the past 24 hours, the volume has plummeted to $27.6 billion, reflecting an approximate 50% decrease. These figures indicate a considerable fluctuation in trading activity within a short span of time.

The significant drop in global crypto trading volume indicates that the mass sell-off phase may have come to a conclusion. The decrease in trading activity suggests a potential stabilization in the market as investors have potentially finished offloading their assets. It remains to be seen how the market will evolve from this point forward.

Also Read This: SEC’s Strength to be Reinforced if Lawsuit Against Binance and Coinbase Succeeds

Important: This article is intended solely for informational purposes. It should not be considered or relied upon as legal, tax, investment, financial, or any other form of advice.

Follow Cryptos Headlines on Google News

Join Cryptos Headlines Community