- The FCA reported a 51% decrease in crypto-based company registrations in the U.K. over the past three years.

- As per the report, Q1 of 2024 saw just seven applications, indicating a further decline.

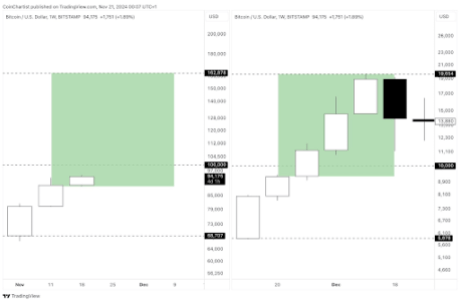

- The global crypto market is experiencing a bearish trend, with the market cap dropping to $2.11 trillion.

In recent years, several nations have actively pursued becoming global hubs for cryptocurrency, leading to a significant increase in crypto-related registrations.

A report from mid-August 2024 highlighted a notable surge in the registration of crypto-based companies in the United Arab Emirates.

However, the Financial Conduct Authority (FCA) recently reported that the registration percentage of crypto-based companies in the United Kingdom fell over 51%.

Reed Smith, a global law firm, has obtained data through a Freedom of Information (FOI) request, revealing a striking 51% decrease in applications for crypto-asset exchange or custodian wallet provider registration over the past three years. This decline suggests a cooling interest in the cryptoasset sector.

FCA quotes that the number of applications for crypto asset registration has continued to plummet. The latest figures reveal that only 29 applications were submitted in the past year, a significant drop from 42 and 59 in the previous two years.

The Q1 of 2024 was particularly slow, with just seven applications received, marking the second-lowest quarterly total in three years.

Additional information states that the average registration approval time is 459 days; as per speculation, the extended approval time hinders the registration and growth of cryptocurrencies in the United Kingdom.

Other Market News

Following the surged global crypto adoption, BlackRock, the leading asset manager, constantly explores digital asset potentials. The institution has successfully launched its Ethereum spot ETF in Brazil.

ETHA39 by BlackRock will be traded on the nation’s B3 exchange, the regional exchange of Brazil. The interest investors can trade ETHA39 as a Brazilian Depositary Receipt.

BlockDAG, a known distributed ledger, announced a $10M, three-year global partnership with Borussia Dortmund (BVB), a leading football club in Germany.

As of writing, the total intraday net inflow of the Bitcoin ETF in the U.S. reached $127.5 Million. ARKB spot ETF saw a massive outflow of $101.97 Million, followed by GBTC and BITB spot.

Russia is set for the trial of a cryptocurrency exchange on September 01, 2024. During the initial trials, the National Payment Card System (NPCS) will be leveraged to enable the conversion of rubles for cryptocurrencies.

The proactive approach of Russia over cryptocurrencies came following the surge in reliance on international trade on the United States dollar. Russian crypto users are expected to reach 37.94 million by 2028.

In the past 24 hours, the broader crypto market has mirrored a bearish momentum, resulting in a decline in market cap reaching $2.11 Trillion.