Crypto Coins and Tokens Experience Significant Losses Amid Market Downturn

In a notable downturn, the crypto market experienced a substantial decline this morning, impacting a wide range of altcoins. The market saw heavy losses across various cryptocurrencies, indicating a significant shift in investor sentiment.

This downward trend reflects the current volatility and uncertainty prevailing in the crypto space, prompting cautious reactions from market participants.

Among the top 100 cryptocurrencies by market capitalization, EOS, Polygon, and Dash witnessed the most substantial losses, with each of them experiencing a significant drop ranging between 24% and 25%.

These notable declines highlight the challenging market conditions that affected these particular cryptocurrencies, reflecting the broader downward trend observed in the crypto market.

Investors and traders closely monitor such price movements as they assess the potential impact on their portfolios and investment strategies.

Leading cryptocurrencies also faced substantial declines in value, with Cardano experiencing a significant drop of 23% and Solana witnessing a decline of 20%. These prominent coins, known for their market position and investor interest, were not immune to the market downturn.

The downward movement in their prices underscores the overall bearish sentiment prevailing in the crypto market during this period. Investors and market participants closely monitor such price fluctuations as they evaluate the implications for their investment decisions and overall market sentiment.

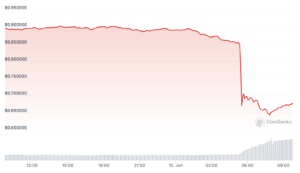

The price of EOS fell sharply this morning. Image: CoinGecko.

Several tokens, including Polygon, Cardano, Solana, Dash, and The Sandbox, experienced significant price drops, coinciding with their identification as securities in the recent lawsuits filed by the Securities and Exchange Commission against Coinbase and Binance.

Also Read: Cardano Chief Calls for Unity in Crypto Industry After SEC’s Binance Lawsuit

The regulatory scrutiny surrounding these tokens likely contributed to the market sell-off and investor uncertainty. Despite being less affected than the altcoins, Bitcoin and Ether, the top two cryptocurrencies in terms of market capitalization, still witnessed declines of 3% and 5%, respectively.

These market movements highlight the broader impact of regulatory actions on the cryptocurrency market and its major players. Investors continue to monitor the situation closely as regulatory developments shape the industry’s future trajectory.

Binance CEO Changpeng Zhao took to Twitter to refute claims suggesting that Binance had converted its crypto holdings to fiat as a reason for the market crash. Zhao clarified that the decrease in Binance’s stablecoin reserves, which are utilized for operational expenses like salaries, was offset by an increase in their crypto reserves. By clarifying the situation, Zhao aimed to dispel any speculation regarding Binance’s actions during the market downturn.

Also Read: Solana NFT Showdown to Determine NFT Brands with Actual Usefulness

Important: This article is intended solely for informational purposes. It should not be considered or relied upon as legal, tax, investment, financial, or any other form of advice.