Powell rate cuts are signaling potential changes for the cryptocurrency market. Federal Reserve Chair Jerome Powell recently outlined plans for future interest rate cuts. This has sparked discussion about impacts on digital assets and inflation fears.

Also Read: Solana (SOL) Predicted To Grow 5x To $776: Here’s When

Understanding the Impact of Powell’s Rate Cuts on Crypto Market Boost and Inflation Fears

Powell’s Economic Assessment and Rate Cut Plans

At the National Association for Business Economics conference in Nashville, Powell described future interest rate cuts. He said further cuts are possible. To ease people’s minds he also stated that they’ll be smaller than the last ones.

Powell stated:

“Our decision to reduce our policy rate reflects our growing confidence that strength in the labor market can be maintained.”

He also said:

“Looking forward, if the economy evolves broadly as expected, policy will move over time toward a more neutral stance. But we are not on any preset course.”

Also Read: Coinbase to Add Proof of Reserves to Bitcoin Wrapper cbBTC

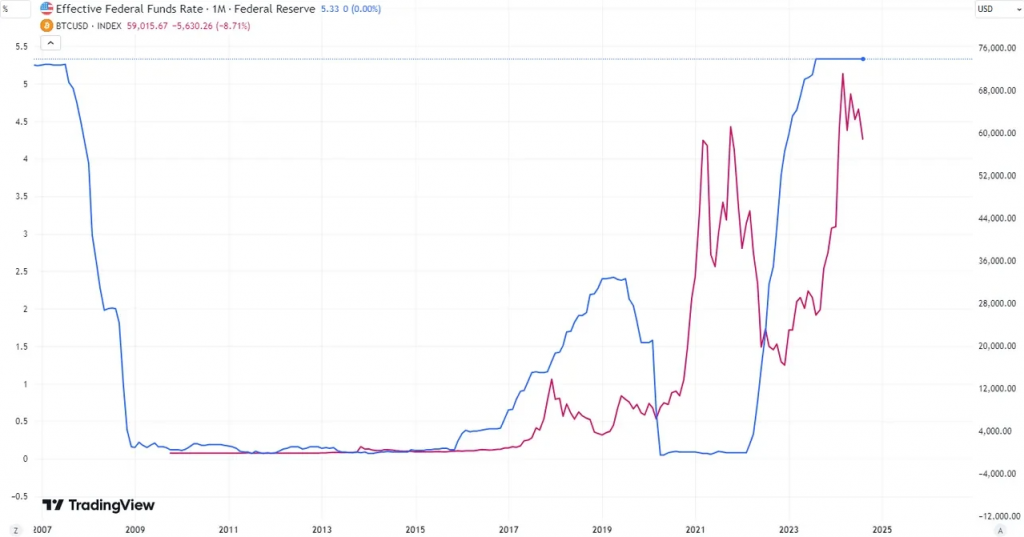

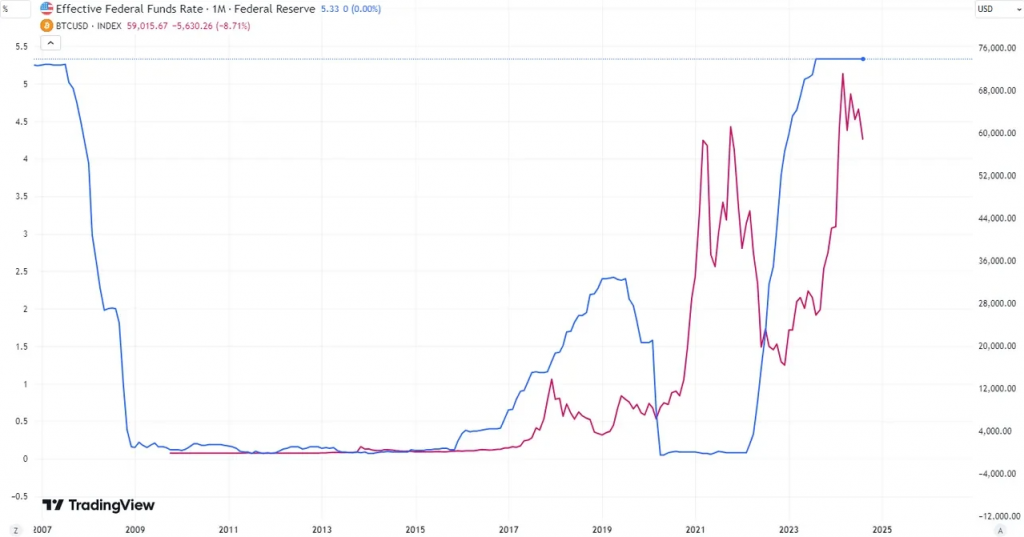

Potential Boost for Crypto Markets

The crypto market could benefit from these planned rate cuts. Recent cuts have already increased trading volumes. Experts predict more positive effects on digital asset prices.

Richard Teng, Binance’s CEO, said:

“We expect that rate cuts will have a significant impact on digital asset prices. Lower interest rates increase liquidity in the financial system, driving demand for higher-yield, higher-risk assets, including cryptocurrencies.”

Balancing Optimism with Caution

While rate cuts might boost crypto growth, some analysts urge caution. David Morrison from Trade Nation also continued by saying:

“If talk switches back to recessions, inflation and of course, geopolitical tensions, this will drive investors toward ‘safe-haven’ assets like gold and silver.”

The crypto industry remains cautiously optimistic about Powell’s comments. Short-term benefits from rate cuts are clear. However, a balanced approach may work best long-term.

Also Read: Dogecoin: Why DOGE May Rally 1,200% To $1.6

As the Federal Reserve manages economic challenges, the crypto market adjusts to changing monetary policies.