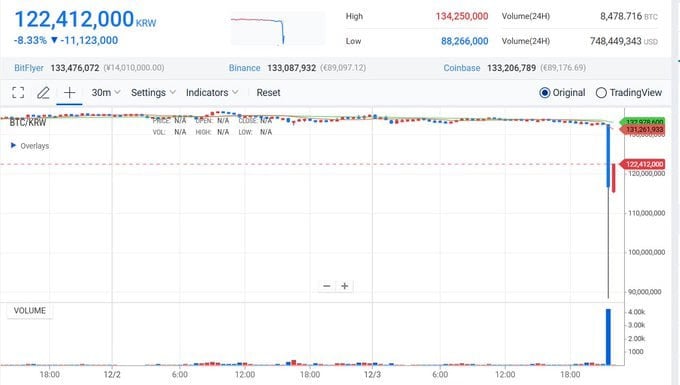

South Korea’s cryptocurrency market faced significant turmoil on December 3, 2024, as the government declared martial law nationwide. The sudden disruption led to a crash in Korean won (KRW) trading pairs, with Bitcoin falling to ₩66,500,000 (approximately $$50,000 ), and XRP dropping to as low as ₩1,160 KRW ($0.87 USD).

Both cryptocurrencies have since begun to recover, but the broader market remains shaken.

Exchange Operations Suspended

Upbit, South Korea’s largest cryptocurrency exchange, announced that its applications and Open API services were temporarily suspended due to a sudden surge in traffic.

The platform cited delays caused by unprecedented demand, exacerbated by the ongoing political situation. The exchange remains largely inoperable, with all cryptocurrency trading on South Korean platforms effectively halted.

Martial Law Announcement

The disruption coincided with the South Korean government’s implementation of Martial Law Order No. 1, issued by the Martial Law Command. The order, effective nationwide from 11:00 PM on December 3, 2024, introduced stringent measures, including:

- A ban on all political activities, demonstrations, and gatherings.

- Restrictions on speech, publications, and media under martial law control.

- Prohibition of strikes and other activities causing social disorder.

- A mandate for healthcare workers on strike to return to their posts within 48 hours.

- Authority for arrests, detentions, and searches without warrants for those violating the law.

These measures have heightened market uncertainty, leading to speculation about their impact on South Korea’s financial systems, including cryptocurrency trading.

Impact on the Cryptocurrency Market

The martial law announcement has created panic in South Korea’s heavily active crypto market. The country is known for its “Kimchi Premium,” where cryptocurrencies often trade at higher prices compared to global averages. The suspension of trading has effectively removed South Korean participation, causing temporary disarray in global markets for cryptocurrencies like Bitcoin and XRP.