Wintermute, a leading crypto trading firm, has teamed up with OSL Digital Securities and HashKey HK Exchange to provide liquidity for the newly launched spot bitcoin and ether exchange-traded funds (ETFs) in Hong Kong.

Wintermute will assist OSL and HashKey by facilitating the buying, selling, and delivery of BTC and ETH ETFs. These two companies, OSL and HashKey, are sub-custodians involved in managing the ETF operations.

Democratic Party Plans to Push for Bitcoin ETF Approval in South Korea

In South Korea, the newly elected Democratic Party is gearing up to advocate for a change in the Financial Services Commission (FSC)’s stance regarding spot Bitcoin exchange-traded funds (ETFs). A party official disclosed that this request will be formally submitted following the opening session of the National Assembly in June. With a significant victory in April’s elections, securing 175 out of 300 legislative seats, the Democratic Party is determined to revisit the FSC’s decision.

The FSC had expressed reservations in January regarding the listing of foreign spot BTC ETFs, citing potential breaches of capital market laws. This stance contrasted with the US Securities and Exchange Commission’s (SEC) approval of similar ETFs during the same month. Despite this, the prior administration had urged the FSC to reconsider its position on the matter, setting the stage for potential policy adjustments under the new government.

Bitcoin Consolidates Around $63,000-$64,000 Range

Bitcoin exhibited fluctuating prices between $63,000 and $64,000 on Tuesday, maintaining its position above $60,000 following a dip below $57,000 the previous week. Although it retreated from the high of $65,500 recorded on Monday, Bitcoin seems to have found stability within this range. As of the latest data, Bitcoin is trading at $64,114, reflecting a 10% monthly increase, which offsets the 16% decline witnessed in April.

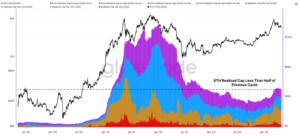

A notable trend accompanying Bitcoin’s recent price movements is the significant drop in exchange inflows, reaching the lowest levels in a decade since Bitcoin’s all-time highs of $73,800 recorded in April and May. This decline suggests reduced selling pressure or increased holding behavior among investors, contributing to the consolidation of Bitcoin’s price within the $63,000-$64,000 range.

Source: CryptoQuant

Ethereum’s Performance and Grayscale’s ETF Withdrawal

Ethereum’s Relative Performance: While Bitcoin has shown strong performance in 2024, Ethereum has lagged behind due to what analysts describe as “weaker capital rotation” from new speculative short-term holders. Despite this, the overall trend in the crypto market remains positive and upward.

ETH’s Price Chart – Source: Glassnode

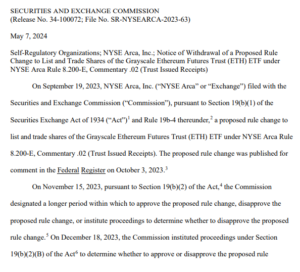

Grayscale’s ETF Application Withdrawal: In other crypto-related developments, Grayscale has decided to withdraw its application for an Ethereum futures exchange-traded fund (ETF) ahead of the SEC’s deadline for a decision in late May. This decision comes amidst uncertainties surrounding the regulatory landscape for crypto ETFs and signals a shift in Grayscale’s strategy in navigating the regulatory environment.

Snapshot of Grayscale’s notice of withdrawal. Source: SEC

Snapshot of Grayscale’s notice of withdrawal. Source: SEC

Botanix Labs Raises $8.5 Million for Spiderchain Development

Botanix Labs, the developer behind the layer-2 network Spiderchain, has secured $8.5 million in a recent funding round. This latest infusion of capital brings Botanix’s total raised funds to $11.5 million, following a $3 million pre-seed round conducted last year.

The funding round was led by prominent crypto investors, including Polychain Capital, Placeholder Capital, Valor Equity Partners, and ABCDE Capital. Botanix announced the participation of these notable investors on Tuesday.

Spiderchain is engineered to be compatible with the Ethereum Virtual Machine (EVM), enabling any Ethereum-based decentralized application (dApp) or smart contract to operate effectively on the Bitcoin network.

Botanix achieved a significant milestone with the launch of Spiderchain’s testnet in November 2023. Since its inception, the project has garnered over 200,000 active addresses and witnessed more than 10,000 experimental token deployments. With this momentum, the startup is now preparing for Spiderchain’s mainnet release in the coming months.

Important: Please note that this article is only meant to provide information and should not be taken as legal, tax, investment, financial, or any other type of advice.

Join Cryptos Headlines Community

Follow Cryptos Headlines on Google News