IntoTheBlock data shows the path for Bitcoin to $100K is supported by 458K addresses holding 344K BTC, strengthening its foundation for future growth.

The crypto market is experiencing a resurgence, with Bitcoin recovering strongly from a weekend dip. After briefly consolidating, Bitcoin rebounded from $95,000 to approach $99,000, sparking renewed optimism about its potential to surpass the $100,000 threshold.

Amid these fluctuations, data from IntoTheBlock highlights pivotal factors influencing Bitcoin’s price action. The analysis reveals that 60,000 addresses accumulated approximately 22,740 BTC above the current price of $96,192.64.

Meanwhile, significant market support exists below, with 458,000 addresses holding a combined 344,000 BTC. This clustering of strong support positions Bitcoin well for potential gains, according to the analysis. Immediate resistance at $98,490 is expected to be a temporary obstacle as Bitcoin continues its push toward the $100,000 threshold.

Chart analysis also shows strong market participation in the current price range. This is reflected by a large concentration of addresses that are either profiting or breaking even, which could help sustain Bitcoin’s bullish momentum.

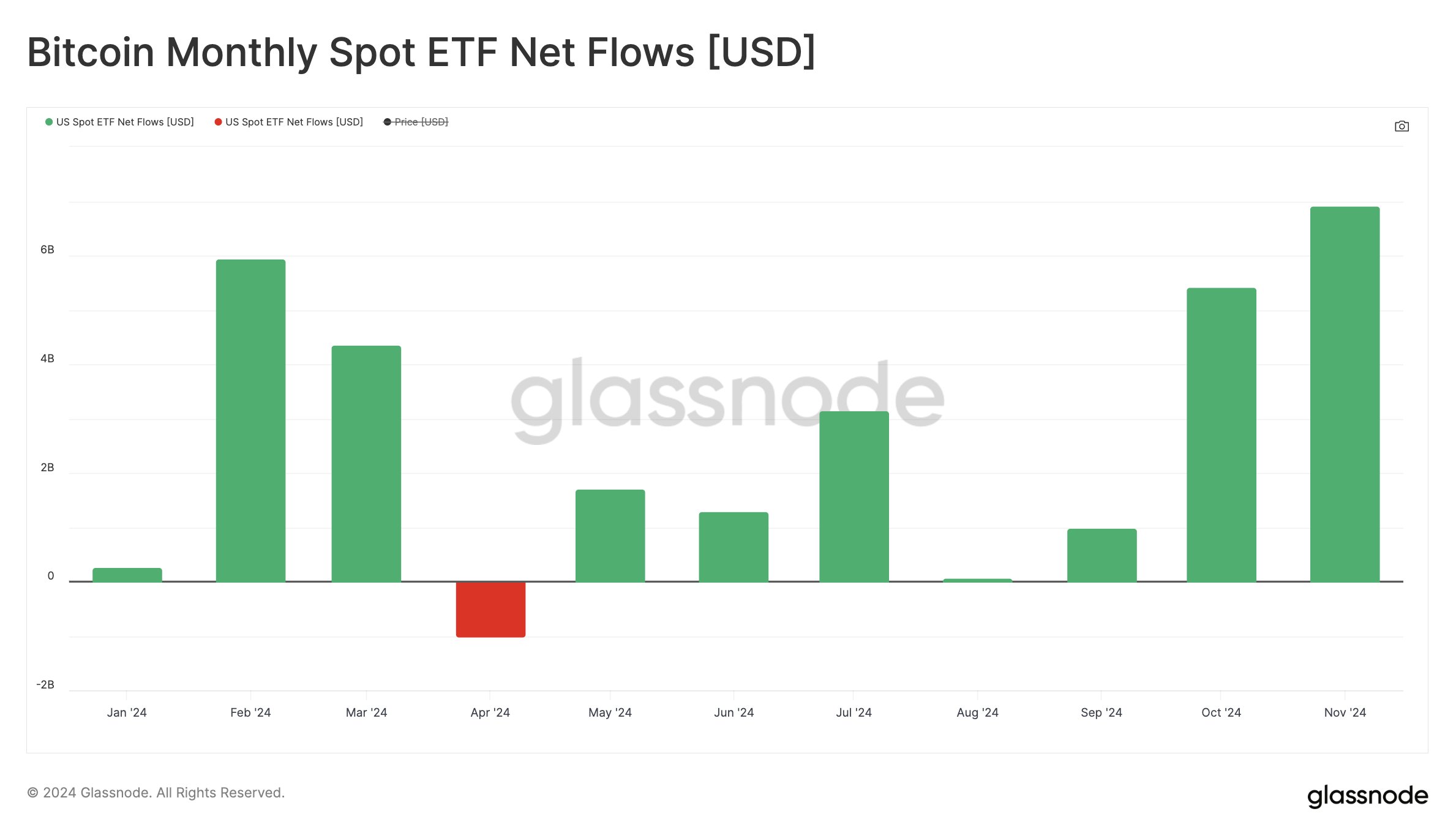

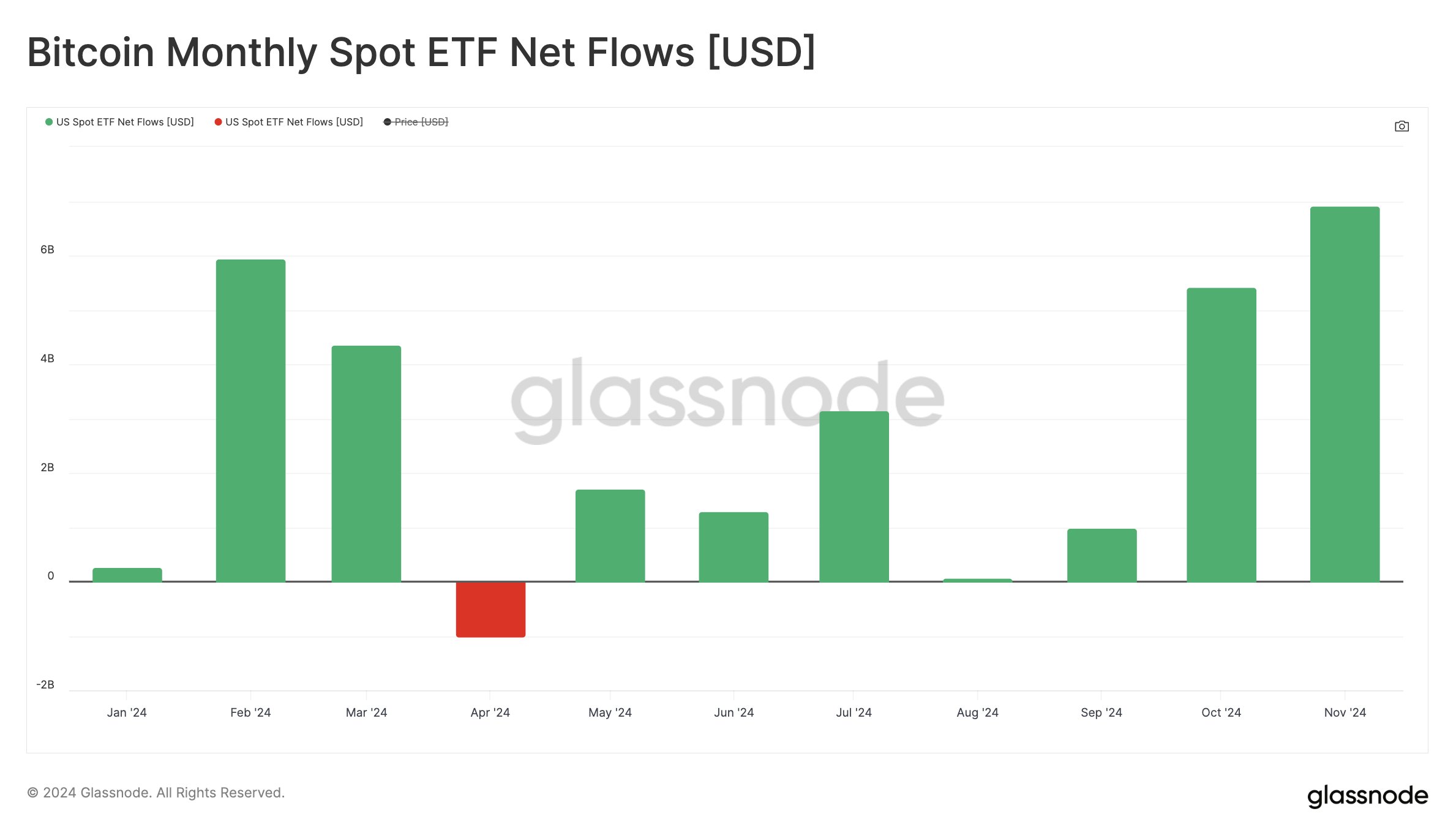

Bitcoin ETFs See Record Inflows

In addition, Bitcoin spot ETFs are continuing to play a major role in fueling market momentum. November has seen nearly $7 billion in net inflows into Bitcoin ETFs, surpassing February’s record inflows of $6 billion. Since their inception, Bitcoin ETFs have only experienced one month of outflows, highlighting sustained investor interest.

Weekly reports from CoinShares add further weight to this trend. Crypto investment products recorded a historic $3.13 billion in weekly inflows, the highest on record.

U.S.-based spot Bitcoin ETFs led the surge, with BlackRock’s iShares Bitcoin Trust attracting $2.32 billion. In contrast, European markets experienced $141 million in outflows, particularly in Germany, Sweden, and Switzerland.

The demand for ETFs pushed Bitcoin to a new all-time high of $99,655, just shy of the $100,000 milestone.

Analysts noted the rapid pace of Bitcoin ETF adoption, far surpassing the early performance of U.S. gold ETFs, which attracted only $309 million in their first year.

DisClamier: This content is informational and should not be considered financial advice. The views expressed in this article may include the author’s personal opinions and do not reflect The Crypto Basic opinion. Readers are encouraged to do thorough research before making any investment decisions. The Crypto Basic is not responsible for any financial losses.