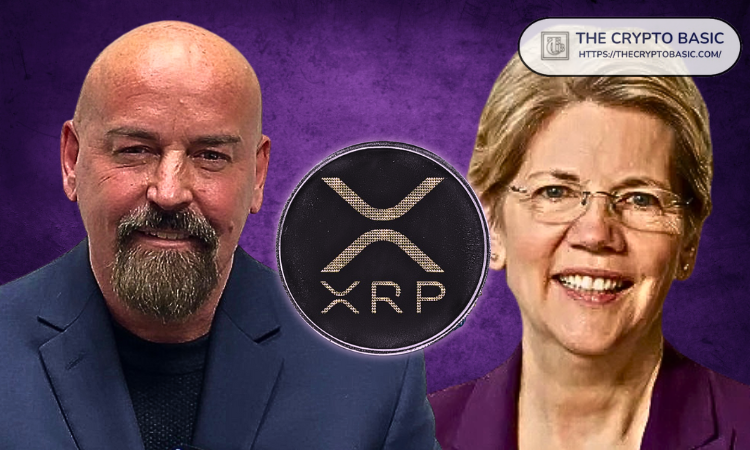

Pro-crypto Senate candidate John Deaton highlighted the direct impact of his victory in the XRP case during debate against Senator Warren.

In a heated debate between Senator Elizabeth Warren and Senate candidate John Deaton, crypto regulation took the spotlight, with Deaton pointing to his victory in the SEC vs. Ripple case as a major accomplishment.

Deaton, a prominent lawyer renowned in the crypto community, noted that his legal battle to protect small retail investors from the SEC’s overreach in the XRP lawsuit had major consequences beyond the case itself.

Deaton Spotlights Victory in XRP Case

During the debate, Deaton took the opportunity to highlight how his efforts in the XRP case have had ripple effects—both literally and politically. He claimed that his work, which he said he conducted pro bono, helped to prevent the SEC from unfairly targeting small investors.

The Massachusetts Senate candidate also mentioned that his efforts led to a federal judge declaring XRP not a security, a significant win in the legal battle between Ripple and the SEC.

In the debate, Deaton recounted his role in the lawsuit, framing it as a fight for justice. He pointed out that the judge who ruled in his favor was a lifelong Democrat. This fact underlined the bipartisan nature of his victory.

Deaton also boasted about the accolades he received for his work on the case, including awards for Lawyer of the Year and Consumer Advocate of the Year. According to Deaton, his defense of XRP was not only a victory for crypto but also a win for everyday investors.

He linked his legal success to recent political donations. The attorney noted that Ripple Chairman Chris Larsen, who supported his Senate campaign, had recently donated millions of XRP tokens to Vice President Kamala Harris’s campaign.

Deaton argued that without his amicus brief and the victory in the XRP case, such contributions would not have been possible. He humorously directed his comments to Harris, noting, “Madam Vice President, if you’re watching, you’re welcome.”

Broader Debate

While Deaton framed his involvement in the XRP case as a defense of small retail investors, Senator Warren took a different stance on crypto regulation.

She maintained her position as a staunch advocate for stricter regulations in the crypto industry. Warren argued that cryptocurrencies pose a threat to financial stability, consumer protection, and even national security.

She defended her stance on building an “anti-crypto army,” stating that she simply wants crypto to follow the same rules as traditional financial institutions like banks and credit unions.

Warren also raised concerns about Deaton’s financial ties to the crypto industry, suggesting that he might be serving the interests of his crypto backers rather than the people of Massachusetts.

Throughout the debate, the two candidates clashed over the implications of cryptocurrency regulation. Deaton positioned himself as a champion of the underdog, someone fighting against both government overreach and big banks that have historically failed the poor.

He cited personal experiences from his own life, particularly his mother’s struggles with traditional banking fees, as reasons why he believes in the potential of Bitcoin and other cryptocurrencies to help unbanked populations.

Questions Around JP Morgan Case

During the debate, Deaton criticized Senator Warren for her focus on cryptocurrency while avoiding other pressing issues, particularly her lack of action regarding the sex trafficking case involving J.P. Morgan and Jeffrey Epstein.

Deaton accused Warren of not asking a single question about the bank’s $290 million settlement related to Epstein’s trafficking operation when she had the opportunity to question the CEO of J.P. Morgan.

He pointed out the senator’s apparent silence on the issue, suggesting it was due to connections involving Democratic donors and political allies. However, Warren avoided directly addressing Deaton’s claims, instead reiterating her broader fight against predatory banking practices.

DisClamier: This content is informational and should not be considered financial advice. The views expressed in this article may include the author’s personal opinions and do not reflect The Crypto Basic opinion. Readers are encouraged to do thorough research before making any investment decisions. The Crypto Basic is not responsible for any financial losses.