Cryptocurrency attracted $321 million in inflows in the last week of September, indicating that more people are investing in it. This rise came after the Federal Open Market Committee (FOMC) moved to cut interest rates by 50 basis points, which boosted investors. Bitcoin (BTC) led the charge and saw the most inflows, while Ethereum (ETH) funds remained in the red with outflows.

Bitcoin Leads Crypto Inflows with $284 Million

BTC remained the most popular asset among investors, with a total of $284 million in inflows to the market. Short bitcoin products also attracted $5.1 million in investment, which suggests that some traders are pretty risk-averse.

However, Solana continued to exhibit a steady inflow pattern, with $3.2 million flowing into its funds, indicating that the altcoin still receives a fair amount of attention.

The United States dominated the figures for the month, with $277m invested in its crypto products. Switzerland was the second country on the list, with $63 million inflows.

Other countries, including Germany, Sweden, and Canada, had outflows. The increasing focus on the US market shows that the country remains the main driver of the crypto industry.

Ethereum Funds Face Fifth Week of Outflows

However, Ethereum assets reported a net withdrawal of $28.5m, which suggests that the funds have been in negative territory for the past five weeks. Grayscale’s spot Ethereum exchange-traded fund (ETF), ETHE, led this trend, contributing to outflows.

Furthermore, low trading volume in Ethereum ETFs also affected ETH funds’ performance in the period mentioned. Half of the nine Ether ETFs had no trading activity from September 16 to September 20, which shows that the market needs more momentum.

However, BlackRock’s ETHA fund saw $14.3 million in inflows, which indicates that there is still some hope or confidence that Ethereum will rise.

Fidelity’s FBTC Leads Bitcoin ETF Inflows

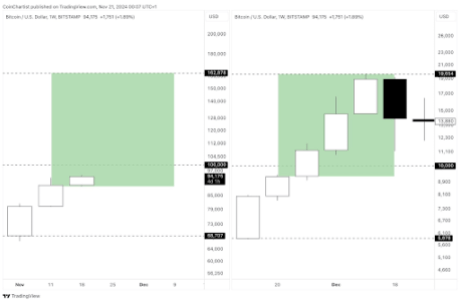

US-traded spot Bitcoin ETFs have had volatility in recent weeks, with nearly $1 billion in outflows between August 26th and September 6th. But most of those losses were regained by the middle of September, as Bitcoin ETFs added $801 million between September 9 and September 20.

Fidelity’s FBTC fund was the biggest draw, with a $138 million investment, while ARK 21Shares’ ARKB followed with $102 million flows. The outflows from Grayscale’s GBTC continued, with the fund losing $28.9m last week.

The highest inflows into the Bitcoin ETFs happened on September 17, just a day before the FOMC meeting, with $186.8 million invested in Bitcoin products. Interestingly, after that, these funds faced an outflow of $52.7 million, which shows that investors have given a mixed reaction to the interest rate cut.

Conversely, Ethereum ETFs were not as lucky, recording only $26.2 million in outflows in the last week.

ETH is still the largest Grayscale fund, and it suffered the most, with a $46.4 million outflow in four days. However, there was positive news: BlackRock’s ETHA ETF fund posted the largest inflows of all Ethereum ETFs.

US Leads Crypto Activity as Europe Lags

Although specific funds have shown divergent results, the overall assets of crypto products increased by 9%. This increase came alongside a 9% growth in trading volumes, which stood at $9.5 billion last week. FOMC’s interest rate decision played a big part in the positive market activity and boosted investor confidence.

The US remained the most active market; however, European markets had mixed engagement. The overall market trend shows that investors are regaining interest in digital assets, especially after major macroeconomic events.

This dominance has been attributed to increasing institutional adoption of the digital currency, while Ethereum’s performance indicates that more work needs to be done to drive more ETF product use.