- DIMO crypto has traded within a range since June.

- The lack of steady buying volume meant the recent surge would need time to expand further.

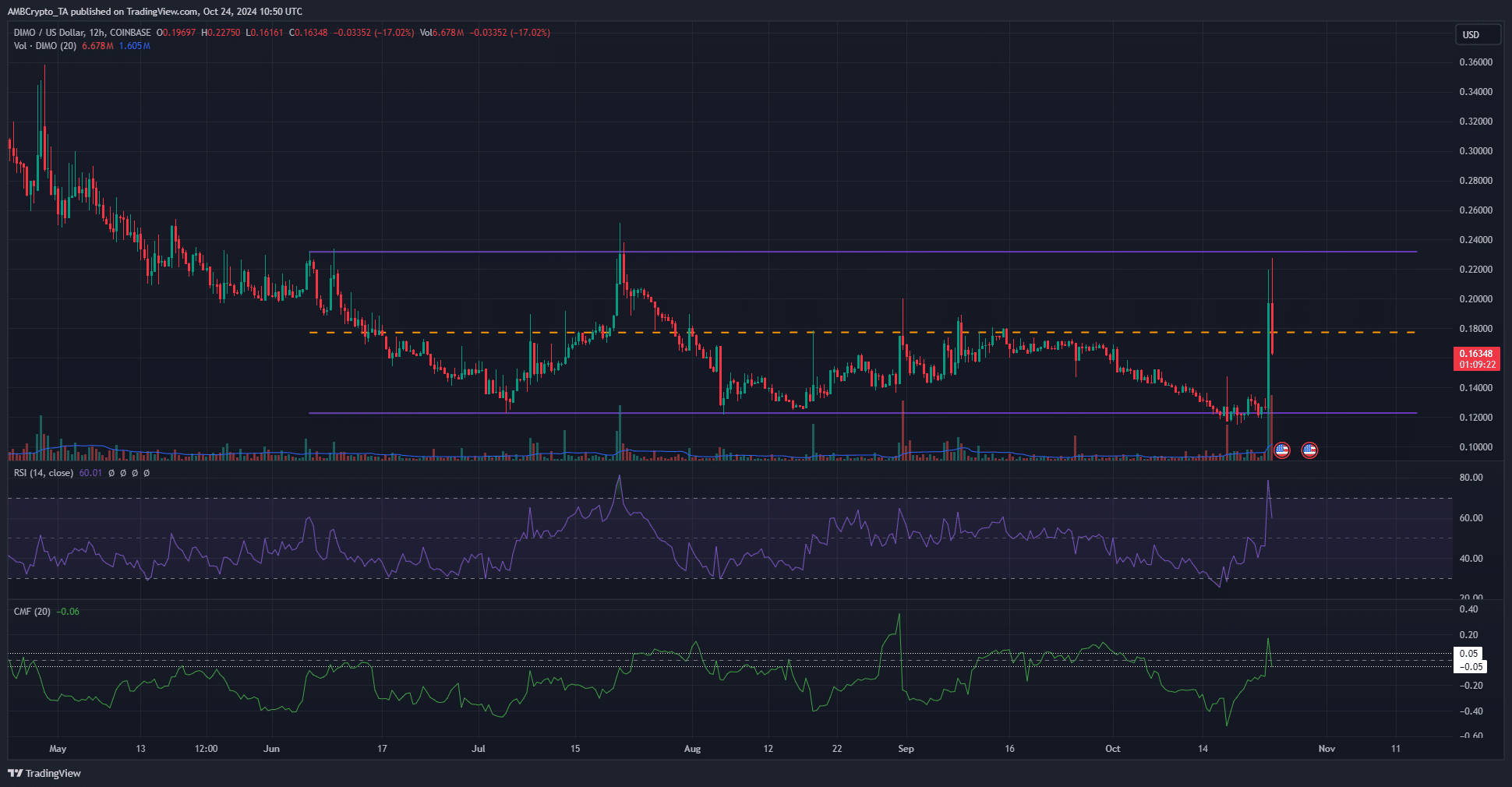

DIMO [DIMO] was in a consolidation phase on the higher timeframes. In the past 24 hours, it managed to jump by nearly 82%, going from $0.122 to $0.227. In recent hours, the price has been forced to drop to $0.163.

This retracement represented a 28% move from the recent highs. In doing so, the $0.18 support zone was ceded. Will the bulls push prices back above this level and resume the upward move?

Rejection from the range highs in recent hours

At press time, DIMO crypto was down 28% from the local high of $0.227. The RSI on the 12-hour chart briefly climbed into the overbought territory to reach 78.75 before dropping.

The CMF was at -0.06 and has been below -0.05 for a significant portion of October. This showed that the selling pressure has been dominant, and the price chart of the past two months agrees.

The recent surge was an anomaly, for DIMO crypto has traded within a range since June. A move from the range lows at $0.123 to the highs at $0.232 generally takes weeks, like it did in July.

This one-day move meant the market was likely overextended.

Even so, the bulls would hope that they can reclaim the mid-range level at $0.18 as support and consolidate there before the next impulse move.

Encouraging sign for long-term DIMO crypto investors

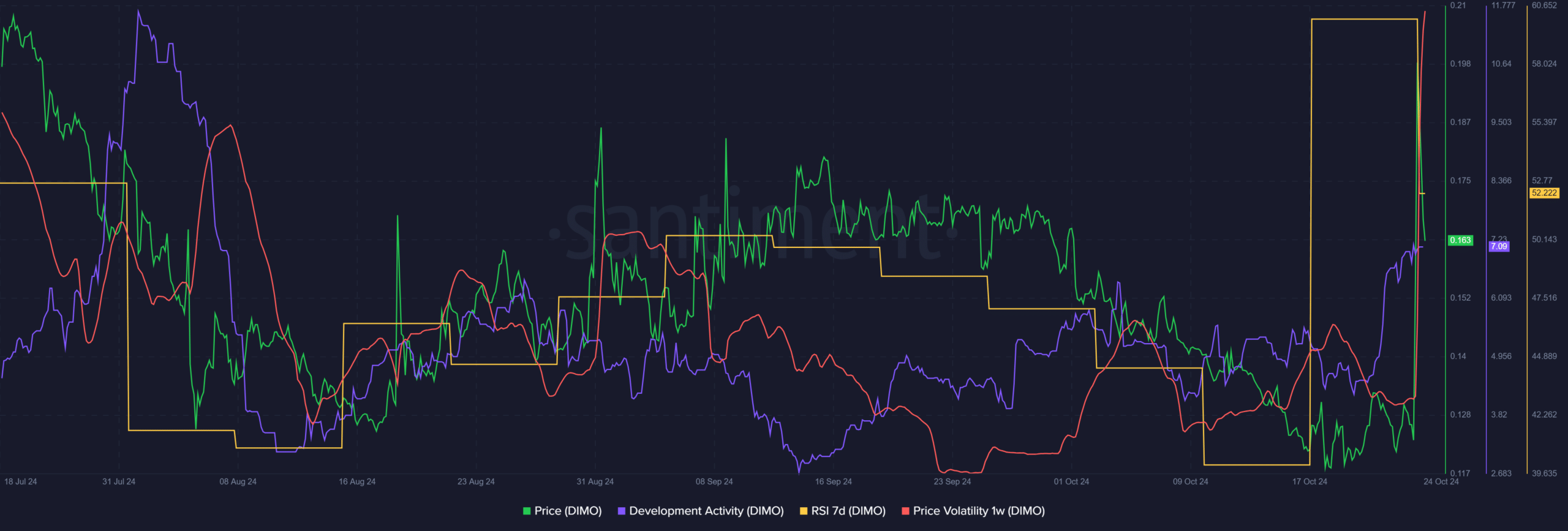

Source: Santiment

The token saw a decent development score in 2024. The activity was considerably down compared to May 2024 but has been stable since July. This was an encouraging sign for long-term investors.

Realistic or not, here’s DIMO’s market cap in BTC’s terms

It showed steady activity behind the scenes, even though the token was within a consolidation phase.

The lack of steady buying pressure meant that a DIMO breakout past the range highs might not be imminent. A breakout and retest of the $0.23 level would offer a buying opportunity.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion