- Bitcoin maintains its dominance as a store of value, accepted for both real-world and digital purchases.

- Ethereum’s smart contracts and decentralized applications have driven blockchain innovation, supporting NFTs and gaming platforms.

- Stablecoins like Tether and USD Coin provide a safe haven for investors during periods of market volatility.

cryptocurrency landscape is more vibrant than ever, with top tokens like Bitcoin, Ethereum, Tether, and BNB leading the charge. These digital assets are not just financial instruments; they represent a transformative shift in how we view value, transactions, and investment. Join us as we delve into the roles and innovations of these cryptocurrencies, exploring their potential to reshape our financial futures.

Bitcoin(BTC): Cryptocurrencies Ownership

Current price:$63,599.78

Market cap:$1.2T

The first cryptocurrency to issue an initial public offering is known as bitcoin. It is the most recognized virtual currency and remains the most significant in terms of market cap. Commonly termed digital gold, many view it as an investment. Its unique characteristics and total supply have made it the asset of choice for people looking for long-term investments. At the same time, Bitcoin’s growth is sustained by the spreading of the network as those accepting it grow.

Ethereum(ETH): Whose Transactions Are Facilitated by Cryptocurrency

Current price:$2,629.94

Market cap:$316.6B

Ethereum, launched in September 2016, is now positioned as the second-largest virtual currency. Apart from that, Ethereum ditches Bitcoin by developing a Decentralized Application Platform (DAPP) and Smart Contract, which can run a program by itself without intervention. In this sense, Ethereum can be considered dominant in applying NFT, DeFi, and other entertainment & games based on blockchain. The advanced structure and the logic of innovation led Ethereum to occupy the essential position in developing all blockchains.

Tether(USDT): Governance Blockchain

Current price:$0.9999

Market cap:$119.6B

Regarding the USDT, it is well known that the coin is wrapped to the US dollar at 1:1. Investors highly favor this cryptocurrency because of its predictability, especially when one wants to reduce risks during market volatility periods. Tether brings a calm alternative for transacting with volatile crypto assets to cool down the exchange rate of digital currencies. Also, it provides a refuge in turbulent periods of the economy.

Read CRYPTONEWSLAND on

google news

USD Coin: Convenience of the Stable Coin

Current price:$0.9999

Market cap:$36.0B

AUSD Coin can also be called ‘the US dollar coin’ as it has more than ‘revenue or shares, i.e., a non-inflationary and standing on the stablecoin.’ Unlike other cryptocurrencies, USDC is available on specific platforms like the USD coin, which is backed by US dollars and serves as a stable coin. It serves the purpose mainly for the people who are ranking high risk to the crypto market and do not want such minimization of volatility. It assists in apportioning volatile crypto assets like exchanging for willing coins or just holding currencies with minimal risk of losing a significant value.

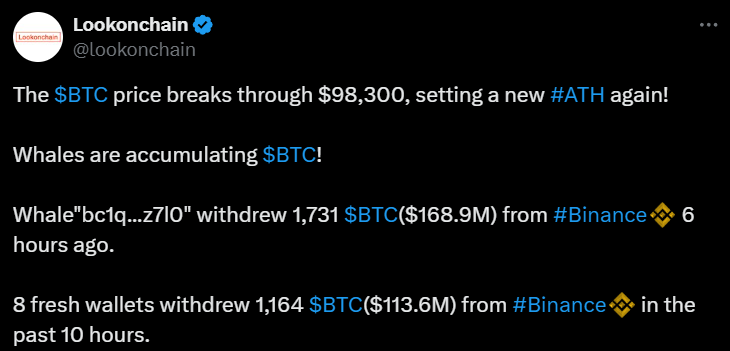

BNB: Fueling the Binance Ecosystem

Current price:$574.66

Market cap:$83.8B

BNB is the native currency of the world’s leading cryptocurrency exchange known as Binance. The clients of Binance are allowed to cover the commission charges made by the exchange’s currency in the form of BNB and also benefit through a discount. The other utility is that BNB is tradable for various coins and tokens in the Binance exchange, further increasing the value of ownership of the BNB.

Crypto News Land, also abbreviated as “CNL”, is an independent media entity – we are not affiliated with any company in the blockchain and cryptocurrency industry. We aim to provide fresh and relevant content that will help build up the crypto space since we believe in its potential to impact the world for the better. All of our news sources are credible and accurate as we know it, although we do not make any warranty as to the validity of their statements as well as their motive behind it. While we make sure to double-check the veracity of information from our sources, we do not make any assurances as to the timeliness and completeness of any information in our website as provided by our sources. Moreover, we disclaim any information on our website as investment or financial advice. We encourage all visitors to do your own research and consult with an expert in the relevant subject before making any investment or trading decision.