- Dogecoin net flows increased by 19%, signaling growing interest and liquidity.

- A $5 million liquidation pool and rising social volume indicate a possible continuation of bullish sentiment.

Dogecoin [DOGE] has time and again taken investors by surprise for its ability to gain momentum in the market. From social media hype to active trading of the cryptocurrency, Dogecoin is in the spotlight of traders and enthusiasts alike.

While the broader crypto market remains volatile, the recent action of Dogecoin suggests the cryptocurrency is building up for yet another bullish movement.

Money flows in

The 19% rise in net flows indicates that more Dogecoin is flowing into exchanges than being withdrawn. This positive inflow suggests that investors are gearing up for potential price movements, possibly to the upside.

Increased inflows can sometimes signal bullish market sentiment, as traders may be positioning themselves for future gains.

Source: IntoTheBlock

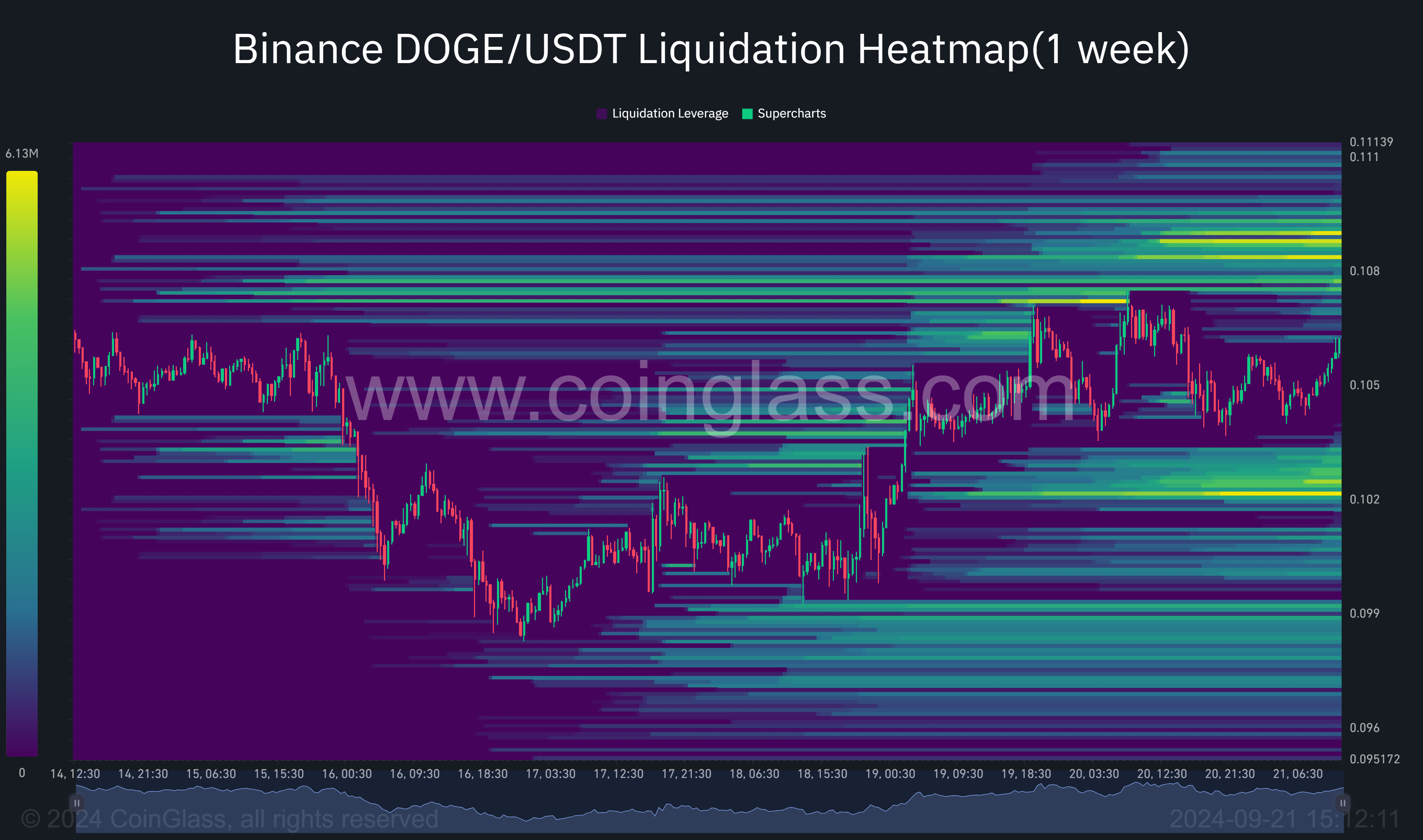

$5 million on the line, bulls ready to pounce

Coinglass data further adds a layer of bullishness. The Dogecoin liquidation pool is currently over $5 million at the $0.108 price level. This means there is very significant interest and leverage in the market, placing bets upward.

Liquidation pools of this magnitude typically point toward strong market activities and, in most cases, trigger further upward price surges if the market sentiments remain this way.

Source :Coinglass

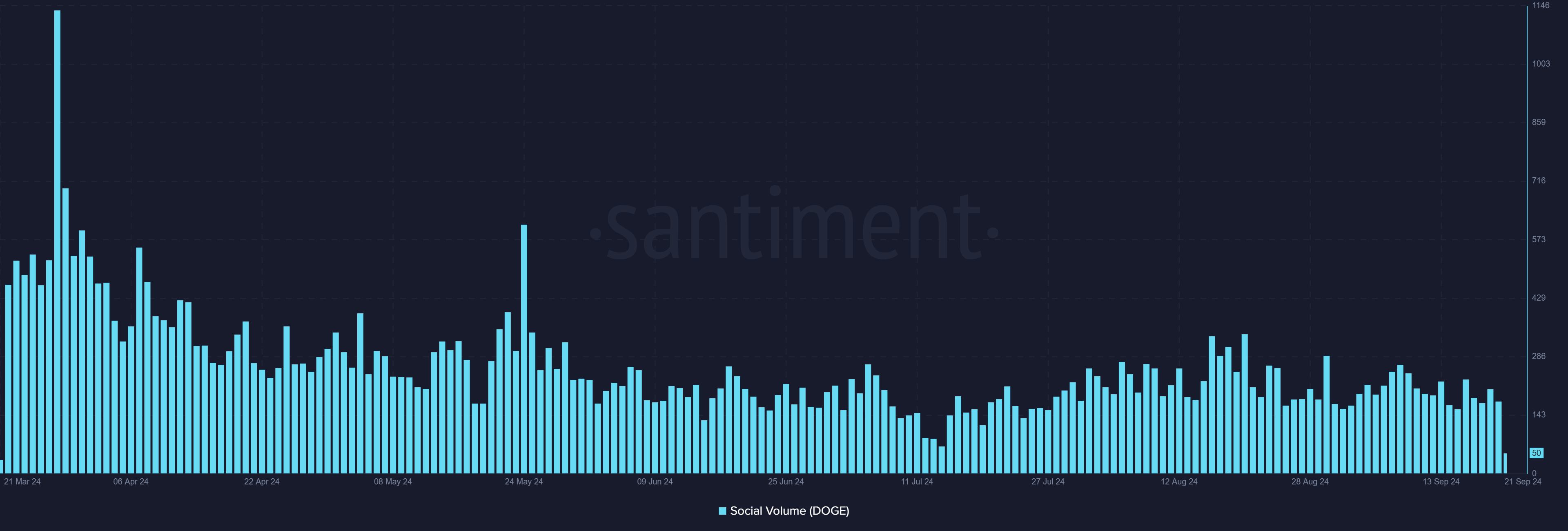

Rising social chatter fueling the Dogecoin bullish train

According to Santiment data, Dogecoin’s social volume has always seen moderate spikes in the last month. While this is not a direct driver of price action, it is definitely a key sentiment indicator.

Read Dogecoin’s [DOGE] Price Prediction 2024–2025

Quite often, growing social volume is a hint of community interest and market participation.

Source: Santiment

Given the large liquidation pool, periodic spikes in social volume, and a net flow increase of 19%, the current sentiment for Dogecoin is relatively bullish.