Dogecoin has had quite an eventful few days in terms of price action, trading volume, trading activity, and interest among investors. Dogecoin led the entire market in inflows, outperforming even Bitcoin in the past week. This momentum has introduced a compelling shift in Dogecoin’s technical outlook, particularly with the Bollinger Bands on the DOGE/BTC chart.

This interesting outlook was highlighted by crypto analyst Tony Severino, who pointed out that the Bollinger Bands have tightened to a degree not seen in years. In fact, Severino notes that the bands are now tighter than they were before Dogecoin’s rally in 2021.

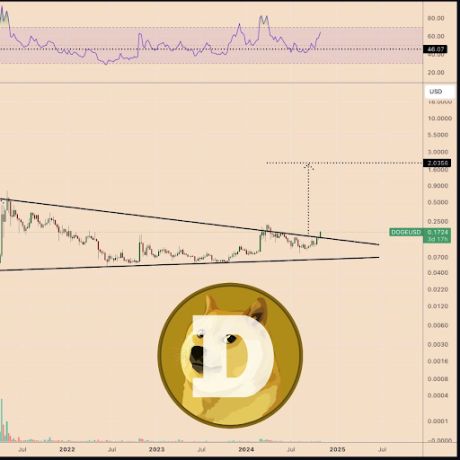

Dogecoin Bollinger Bands Squeeze To Tightest Level

Bollinger Bands are widely used technical indicators that mark price volatility boundaries. When the bands narrow, it generally signals low volatility. On the other hand, widening bands indicate high volatility. A squeeze, where the bands move closer together, suggests that the asset is trading within a tight range. In the case of Dogecoin, Severino’s observation notes that the DOGE/BTC Bollinger Bands are now closer than they’ve ever been on the monthly timeframe.

Related Reading

The last the Bollinger bands were at such a squeeze was just before the 2021 rally, which saw the meme coin surge exponentially during the meme coin craze. Going by the history of the Dogecoin-Bitcoin pair, if the outcome plays out like its previous price action, Dogecoin could be on the cusp of a strong rally in the coming months that could even lead to more returns than the 2024 rally.

DOGE Breakout From Three-Year Channel

As noted earlier, Dogecoin’s rally over the past few days has been impressive. Particularly, Dogecoin went on a 72% rally to peak at $0.176, its highest point in over six months. This upward momentum allowed Dogecoin to break out of a three-year-long channel pattern on the price chart defined by a downward-sloping upper trendline dating back to the 2021 high. This breakout is significant, as it marks Dogecoin’s move beyond a key resistance level that had contained its growth since the 2021 peak.

Related Reading

The likelihood of a Dogecoin rally in the upcoming months has increased massively due to this breakout, although there remains a possibility of a retest. According to a crypto analyst on social media platform X, $2 is a potential peak target if the momentum holds. However, it is important to note that several resistance levels lie between the current price and this ambitious target. Two examples of notable resistance levels are the 2024 high of $0.22 and the all-time high of $0.7316.

At the time of writing, the Dogecoin price is trading at $0.1585, which means it has reversed by about 10% from $0.176 to retest the channel breakout.

Featured image created with Dall.E, chart from Tradingview.com