- DOGE has capitalized on Bitcoin’s breakout, finally pushing above the $0.13 mark after two failed attempts.

- To avoid a retracement, one key strategy is essential.

Dogecoin [DOGE] is making a strong comeback, reclaiming its spot in the top 5 with a 20% weekly gain. Currently trading at $0.1321, DOGE broke past the $0.13 mark, a level it hadn’t touched in over 150 days, following two failed attempts.

Typically, as Bitcoin nears a key psychological level, liquidity often flows into high-cap memecoins, and DOGE has been a clear beneficiary.

Over the past three days, DOGE has seen impressive daily gains exceeding 7%, supported by robust trading volume reaching $3 billion. However, it’s not all good news.

DOGE might be on the brink of a reversal

The sharp increase in trading volume mirrors past cycles when Dogecoin made significant gains as Bitcoin approached a bullish peak.

If this trend holds, a reversal could be imminent for DOGE, especially as market overheating could lead to a shakeout of weak hands locking in their gains.

This potential reversal was further bolstered by the RSI which has reached overbought territory, with 83% of price movement over the past two weeks being upward.

Additionally, the elevated RSI suggests that DOGE may face some selling pressure as the rally cools off.

As noted earlier, Dogecoin has had its most lucrative week, even outpacing BTC in daily gains.

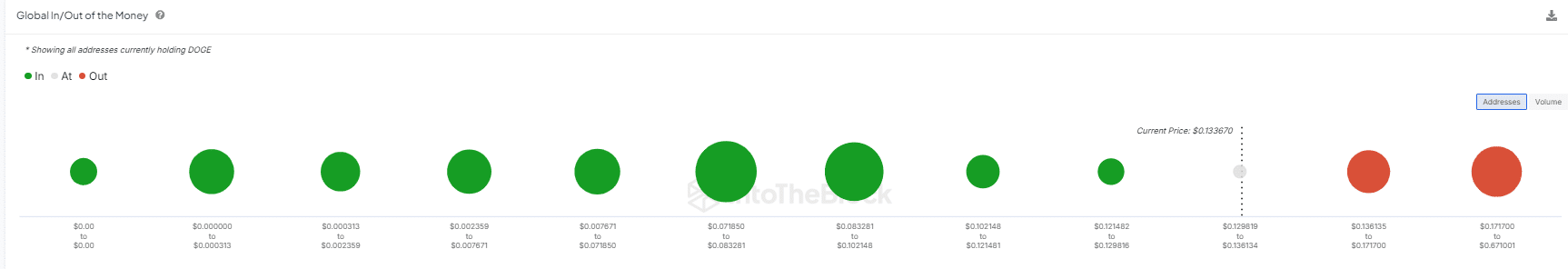

This surge allowed DOGE to break through a historically challenging price range, pushing half a million holders into net profits – particularly those who had been in losses for over three months.

Investors acquired many of these positions at an average price of $0.09, which is significantly lower than the current levels.

Therefore, maintaining the $0.13 support is crucial. If DOGE retraces, around 60 billion DOGE tokens could flood the market, increasing selling pressure.

However, there may still be some room for growth. This approach is not overly optimistic, given BTC’s continued climb past $68K. Now, the key question is whether DOGE will reach $0.14 or if it has already hit its market top.

The chart below has the answer

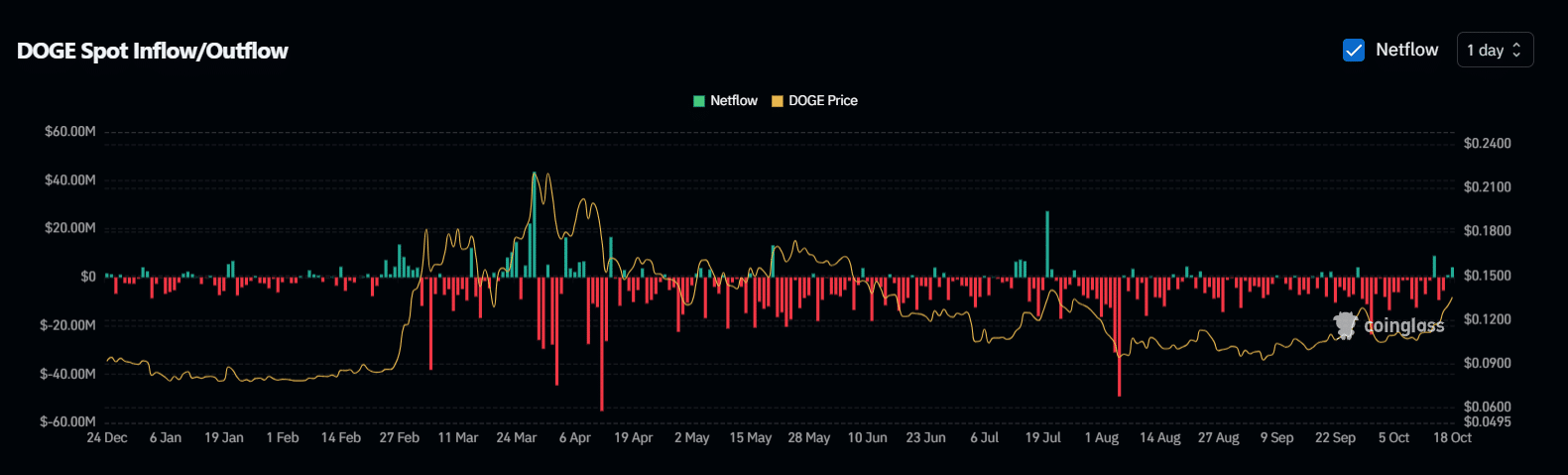

Typically, a market bottom sparks fresh interest as prices hit local lows, inviting buyers to step in. As noted earlier, Dogecoin has trended bearishly for the past 150 days, reaching a low of $0.09.

This price level was seen as a “dip,” encouraging buyers to accumulate DOGE at a discounted price with hopes of future gains. This is reflected in a sustained outflow of DOGE tokens from exchanges, hitting $50 million on the day it dropped to $0.90.

However, with DOGE jumping 25% this week, benefiting from BTC’s uptrend, it’s reasonable to assume that traders are beginning to exit their positions, as shown by the green wick indicating inflows.

Read Dogecoin’s [DOGE] Price Prediction 2024–2025

In summary, the market appears to be overheating, which could lead to a pullback for BTC. Meanwhile, DOGE may continue to see notable gains in the coming days as BTC owners anticipate their next move.

Therefore, while a bull rally to $0.14 might have to wait for another cycle, a retracement to $0.12 seems more likely.

![Decentralized Science [DeSci] crypto hits $1.3B market cap – AIMX leads](https://cryptosheadlines.com/wp-content/uploads/2024/11/DeSci_crypto-1-1000x600.webp-150x150.webp)