- Two dormant Bitcoin wallets reawaken after 15 years, transferring 100 BTC worth over $6.24 million.

- Institutional investors are increasingly shifting toward Bitcoin ETFs, with BlackRock and Fidelity leading the trend.

Two long-dormant Bitcoin miner wallets have suddenly resurfaced, igniting interest and conjecture in the cryptocurrency world. These wallets, which had been inactive for more than 15 years, recently launched substantial transactions, gaining attention owing to the huge value involved.

Old Bitcoin Wallets Stir Market with Multi-Million Transfers

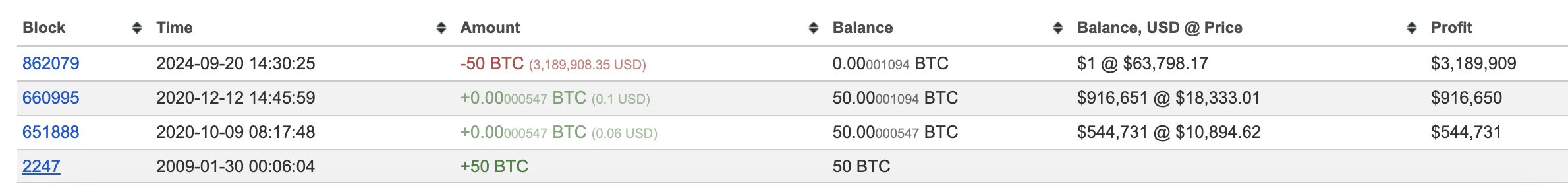

According to Lookonchain, the first wallet, which had been undisturbed for 15.7 years, transferred 50 BTC, which is presently worth almost $3.05 million.

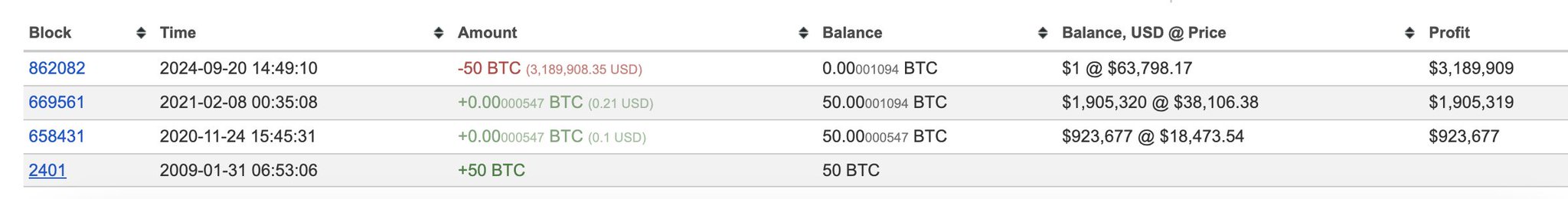

Meanwhile, the second wallet, which had been idle for 15.6 years, sent an additional 50 BTC, worth around $3.19 million. The total amount transferred was roughly $6.24 million.

The resurgence of such ancient wallets has always piqued the market’s interest, raising questions about the motivations behind such movements and if they signal wider trends or are simply individual actions.

Interestingly, inactive Bitcoin wallets have revived several times in recent months. CNF has previously noted a younger wallet that, after five months of idleness, sold 200 BTC, resulting in an astounding profit of more than $168 million.

Such fluctuations indicate that some holders, whether individuals or institutions, are deliberately timing their withdrawals to maximize profits as the price of Bitcoin continues to rise.

This type of action frequently influences market sentiment, sparking concerns about probable whale movements and their impact on Bitcoin price dynamics.

As Bitcoin undergoes these large transfers, it also sees significant inflows, indicating increased investor optimism. According to recent data, the cryptocurrency saw an inflow of almost $436 million, indicating that investors are more confident in its future potential.

This pattern contrasts dramatically with Ethereum’s current predicament, in which concerns about the profitability of its Layer 1 network have resulted in significant outflows.

This disparity between Bitcoin and Ethereum highlights the market’s evolving dynamics, with Bitcoin becoming perceived as the more stable and reliable option in times of uncertainty.

Institutional interest in Bitcoin has recently increased, highlighting the cryptocurrency’s appeal as a long-term investment. As previously reported by CNF, institutional investors are demonstrating a rising preference for Bitcoin ETFs, with financial giants like BlackRock and Fidelity leading the way in terms of Bitcoin-related assets.

This move underlines Bitcoin’s growing acceptance in traditional finance circles, which has long been a key element in broader adoption. Furthermore, wealth management organizations like Goldman Sachs and Morgan Stanley aren’t just watching from the sidelines.

These corporations have considerably increased their investments in Bitcoin ETFs, reflecting institutional players’ continued interest in the digital asset sector.

This growing institutional participation is critical because it indicates a level of legitimacy and trust in Bitcoin that was previously lacking. Such actions by reputable financial institutions lay a solid foundation for Bitcoin’s value, making it less susceptible to extreme volatility than in previous years when retail investors were the main drivers.

The current situation reflects a maturing asset that is gradually integrating into mainstream finance, a move that has been years in the making. Meanwhile, BTC is currently trading at approximately $63,020.75, up 4.75% over the last seven days.

Recommended for you:

No spam, no lies, only insights. You can unsubscribe at any time.