Key Points

- The Crypto Fear and Greed Index remains in “Greed” territory, despite election-related market anxiety and Bitcoin’s pullback from near its all-time high.

- Options traders are eyeing $60k, $70k, and $80k targets, with crypto trading firm QCP Capital warning of underpricing potential post-election risks.

The current state of the crypto market is one of anxiety, as the U.S. Election Day is underway. Despite this, and Bitcoin’s [BTC] recent drop from near its all-time high to $68k, the Crypto Fear and Greed Index continues to indicate “Greed.” The current reading sits at 70.

Bitcoin Speculators Remain Optimistic

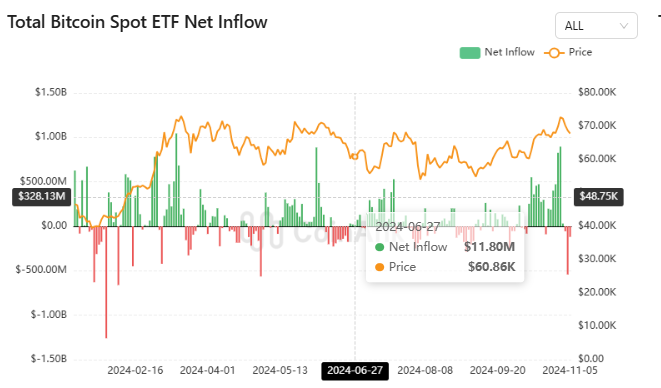

Despite Monday’s risk-off move across U.S Spot BTC ETFs, Bitcoin speculators remain undeterred. These products experienced a cumulative daily net outflow of $541 million, led by 21Shares (ARKB) and Bitwise’s BITB.

Spot On Chain reports that Monday’s sell-off was the second-largest daily outflow for these products. This reflects a broader market de-risking across U.S equities in anticipation of Election Day.

Market Confidence Amid Election Uncertainty

The confidence seen in BTC and crypto markets may be due, in part, to Trump’s lead across prediction sites and top election models. However, crypto trading firm QCP Capital warns that the market may be underestimating potential post-election risks or a potential win by Harris.

The firm predicts erratic BTC price swings as polling results come in. Amberdata projects that these price swings could be $6k-$8k in either direction. They suggest that a Harris win could push BTC to $60k, while a Trump win could trigger a new all-time high for BTC ($75K/$77K).

Over the weekend, the Options market saw large funds favor bullish outcomes with upside targets of $70k —$85k. Deribit data reveals that off-shore markets are eyeing $72k —$75k targets based on significant call buying from European and Asian markets on Monday.

There is also an increase in interest in put options (downside bets), targeting $60k, which aligns with Amberdata’s targets if Harris wins the election. Regardless of the election outcome, Option traders expect BTC to stay above $60k. On the price charts, $65k will remain a key level to watch if the decline continues.