- ETH has surged by 4.36% over the past month.

- Ethereum was experiencing an upward momentum, signaling more gains if $2264 support holds.

Since hitting a local low of $2309, Ethereum [ETH] has seen a strong upward momentum. Thus, the recent gains have outweighed the losses to turn October green.

In fact, at the time of writing, Ethereum was trading at $2525. This marked a 2.44% increase over the past day. Equally, ETH has surged by 4.36% on monthly charts with an extension to the bullish trend by a 1.53% rise on weekly charts.

Looking further, the altcoin has seen a surge in trading activities. As such, its trading volume has increased by 35.51% to $12.43 billion.

As expected, these market conditions have left crypto analysts talking about the altcoin’s trajectory. One of them is the popular crypto analyst Man of Bitcoin who has suggested that the current bullish scenario is valid if ETH holds above $2264.

Market sentiment

In the analysis, Man of Bitcoin posited that ETH is moving sideways, implying it is in a consolidation range.

According to him, the current movements on price charts show weakness thus indicating a potential downside.

Therefore, the analysts argue that the bullish scenario identified is only valid as long as ETH trades above $2264.

With the altcoin holding this level, using the Elliot wave analysis, the potential next move is Wave -C of iii at $3096. This implies that the price range is within the third wave which is strongest and has the potential for further gains.

However, if the altcoin fails to hold this level and experiences a breakdown, it will imply that Wave -iv is moving to the downside.

What ETH charts say..

Undoubtedly, the analysis provided by Man of Bitcoin offers a cautious future outlook. However, it’s essential to counter-check and determine what other market indicators imply.

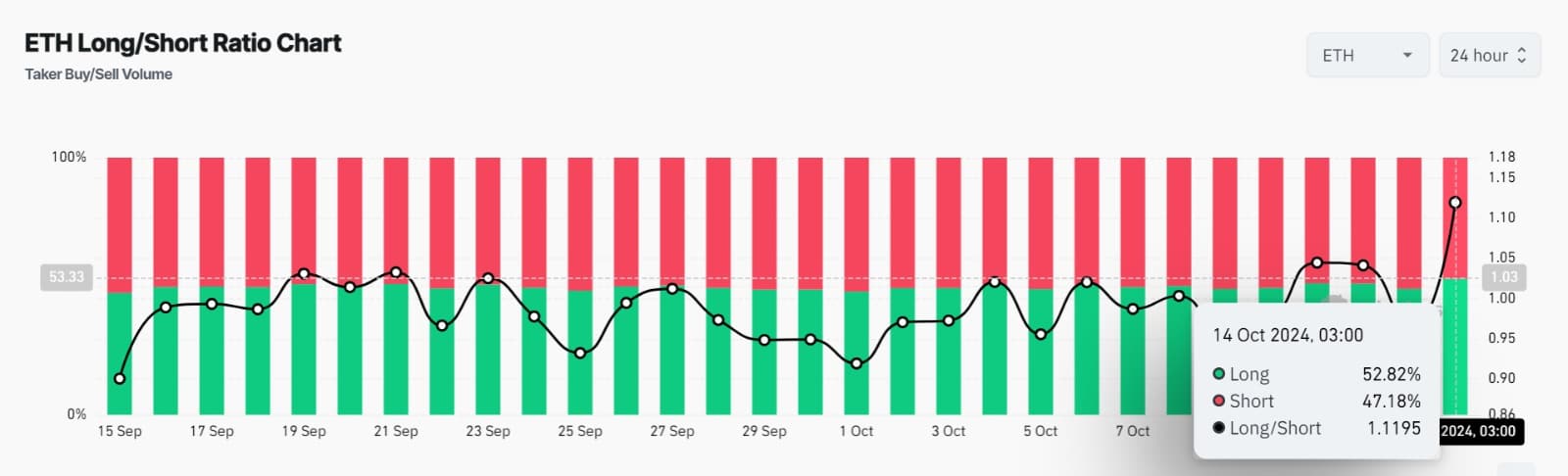

For example, Ethereum’s Long/Short ratio has remained above over the past 24 hours. At press time, ETH’s long/short ratio was 1.1195 signaling increased demand for long positions.

As such, long position holders are dominating the market as they continue to open new trades.

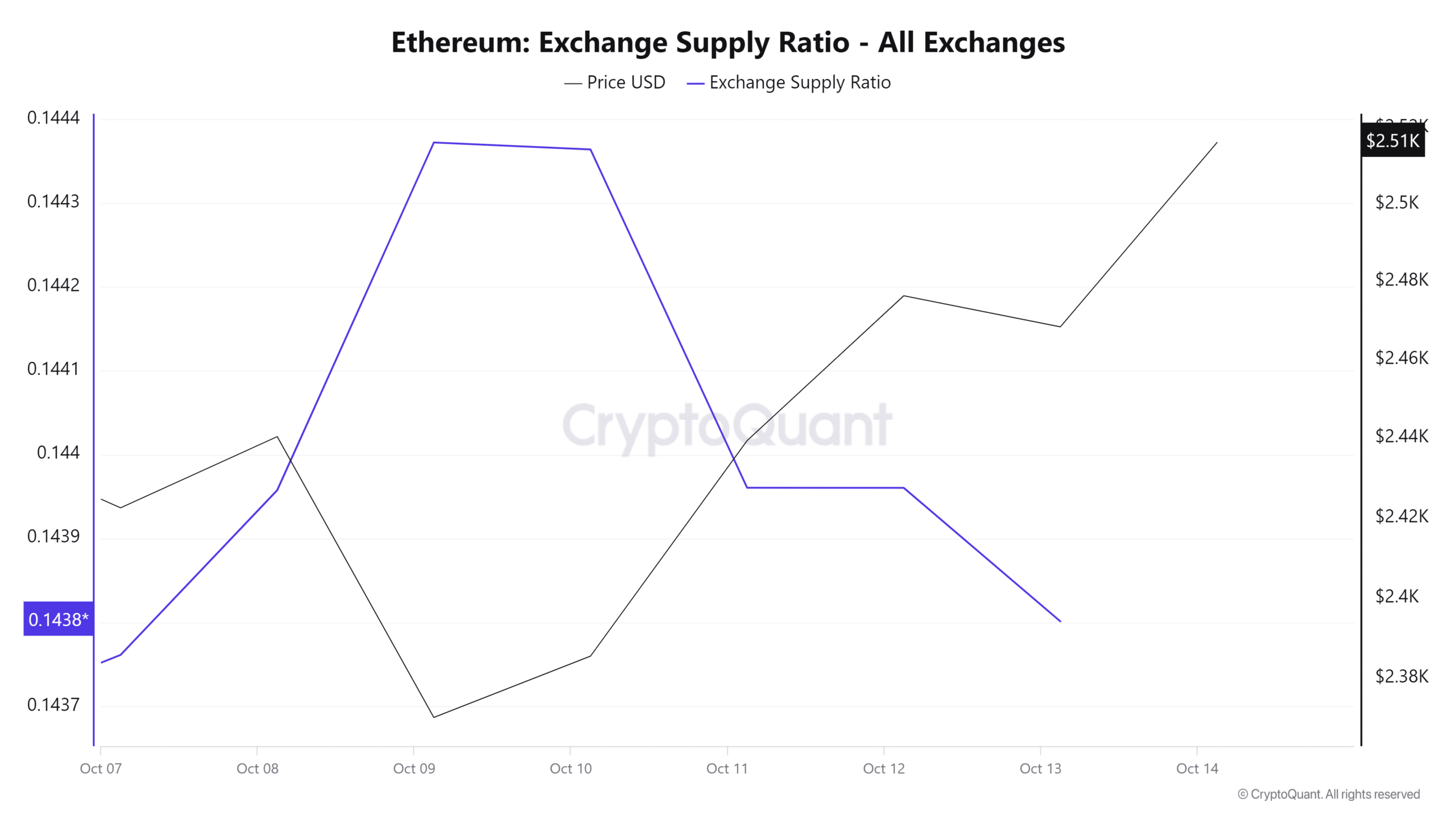

Additionally, Ethereum’s Supply exchange ratio has experienced a sustained decline over the past 5 days. A declining supply exchange supply implies that investors are opting to hold onto their ETH. This usually reduces tokens in supply resulting in to supply squeeze.

Source: Cryptoquant

Read Ethereum’s [ETH] Price Prediction 2024–2025

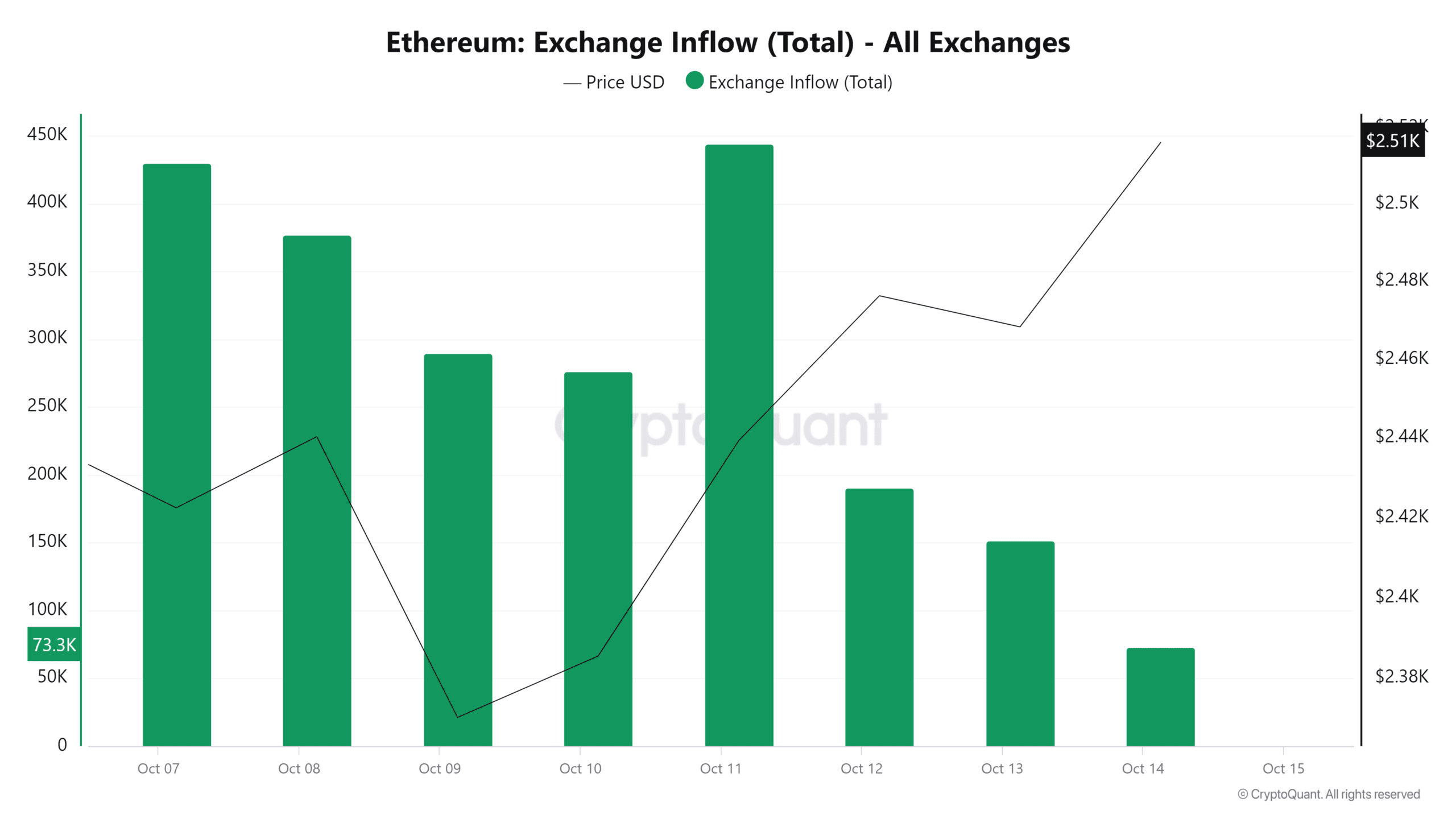

Finally, ETH exchange inflow has declined for the last 4 days signaling a shift in market sentiment to holding as illustrated by a decline in the supply exchange ratio.

Simply put, ETH is in a bullish phase, and as observed by the analyst earlier, this is valid as long as the $2264 support holds. Therefore, with positive market sentiment and investor favorability, ETH will attempt a $2727 resistance level in the short term.