CPI increase triggered fears of rate hikes, and Ethereum fell by 3%. Market uncertainty led to ETF outflows as investors looked for alternatives. ETH price has the potential of pumping by 12 per cent after hitting key support.

Ethereum Slides 3% Amid CPI Data Release

After news of Consumer Price Index data release which clocked Inflation of 2.4% a 0.1% rise Year on Year (YoY) led to a 3% drop of Ethereum. A small spike in inflation rattled investors worried about increasing interest rates to cool an already bearish crypto market.

Ethereum soon reacted and started declining against the $2,300 mark, as investors stepped in with selling. Ether’s uphill battle to regain bullish momentum has been further clouded by the outlook for overall market uncertainty, which includes further inflation data.

– Advertisement –

Bitcoin and Ethereum ETFs See Significant Outflows Amid Ongoing Market Uncertainty

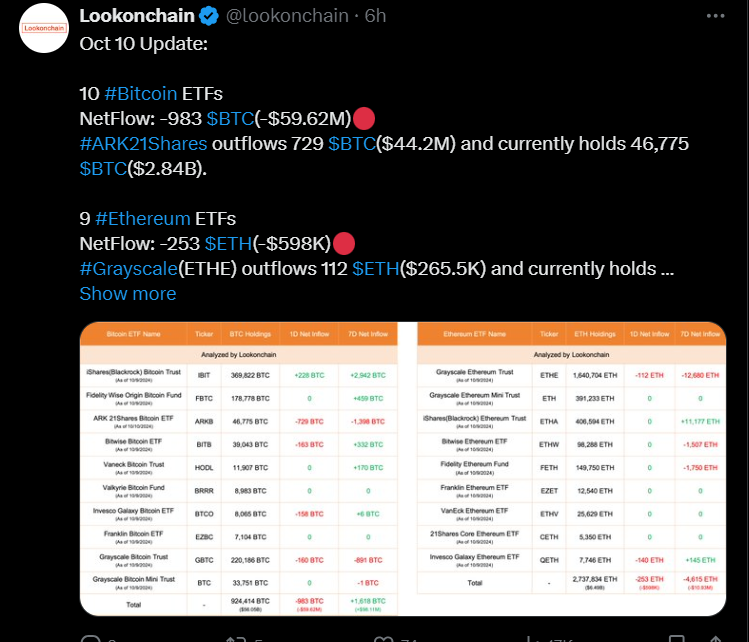

The latest data from Lookonchain reveals negative netflows for both Bitcoin and Ethereum ETFs, signaling continued selling pressure. Bitcoin ETFs experienced a significant net outflow of 983 BTC, equating to $59.62 million, with ARK21Shares alone accounting for 729 BTC of this outflow.

The ongoing outflows indicate cautious sentiment among investors amid uncertain market conditions. The larger narrative has affected ETH price as well.

Ethereum ETFs also saw negative netflows, with a total of 253 ETH outflowing, valued at approximately $598,000.

Grayscale’s Ethereum Trust recorded the largest outflow, shedding 112 ETH worth $265.5K. These outflows suggest persistent selling trends in Ethereum ETFs, reflecting broader market volatility and investor repositioning.

Ethereum Faces Further Decline Amid Market Pressure

Ethereum is grappling with ongoing selling pressure, which has intensified after the release of CPI data. ETH price is currently trading at $2,363 mark and is testing the $2,350 key support level.

A successful breakout above the $2,420 level and the slanting trendline could set the stage for a potential 12% surge. In this scenario, Ethereum may aim for the $2,720 resistance level, a target supported by historical price action.

The RSI is at 45, indicating a gradual shift from oversold conditions but still below the neutral 50 level, suggesting that selling pressure has eased but bullish momentum remains tentative.

ETH price is testing the key $2,350 support level, and a successful rebound here, coupled with a rising RSI, could signal a strong recovery. If the RSI crosses above 50, it would confirm growing buying interest.