ETH is gaining attention in the crypto market and for a very good reason. Analysts predict Ethereum could reach $3,000 by year-end. This ETH December price prediction has investors and traders interested in finding out more. So, let’s look at what’s driving this optimistic outlook for the ETH price surge.

Can we earn large profits this December? Let’s find out!

Also Read: Shiba Inu Member Explains How SHIB Can Reach $0.01

Ethereum Market Analysis: December Price Predictions and Investment Insights

Surge in ETH Options Activity

The ETH options market is buzzing. It shows growing confidence in Ethereum’s future price. QCP Capital, a Singapore-based crypto trading firm, reports:

“The options market witnessed renewed interest in ETH, with over 20k contracts targeting the $3k level by December 27. The year-end outlook for ETH could be shaping up to be significant.”

Also Read: XRP in September: Buy or Sell? Find What Experts Think Inside!

This surge in options activity, especially for the $3,000 price point, suggests investors expect an ETH price surge by year-end.

Institutional Interest and Market Structure

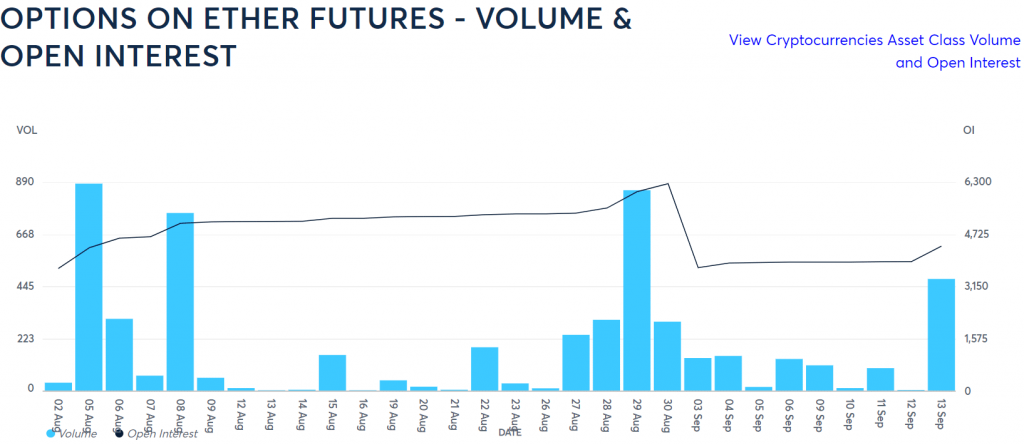

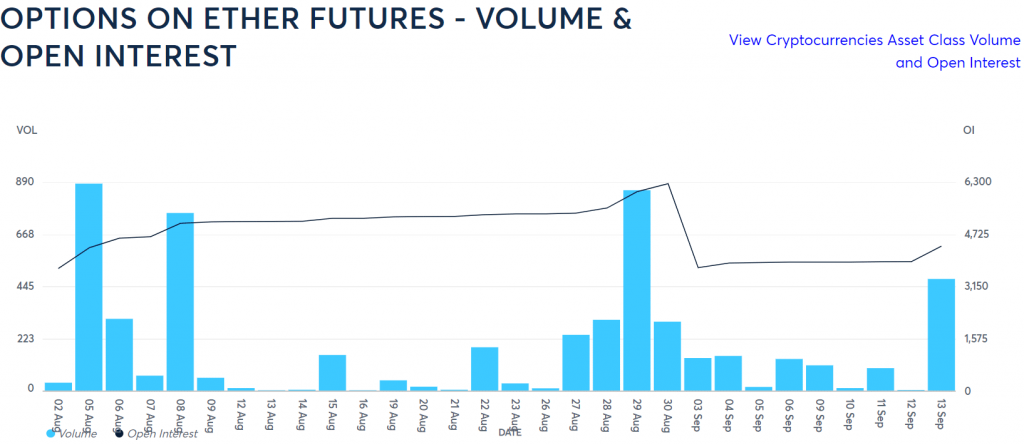

Chicago Mercantile Exchange (CME) data backs up this bullish view on Ethereum. On September 13, Ethereum saw a sharp rise in volume and Open Interest (OI). OI jumped to $3.1 billion, and volume neared $700 million. These numbers show growing institutional interest in Ethereum.

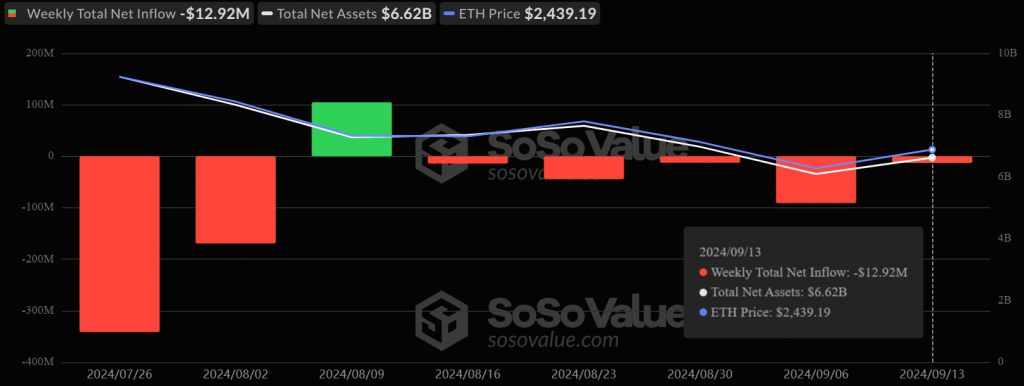

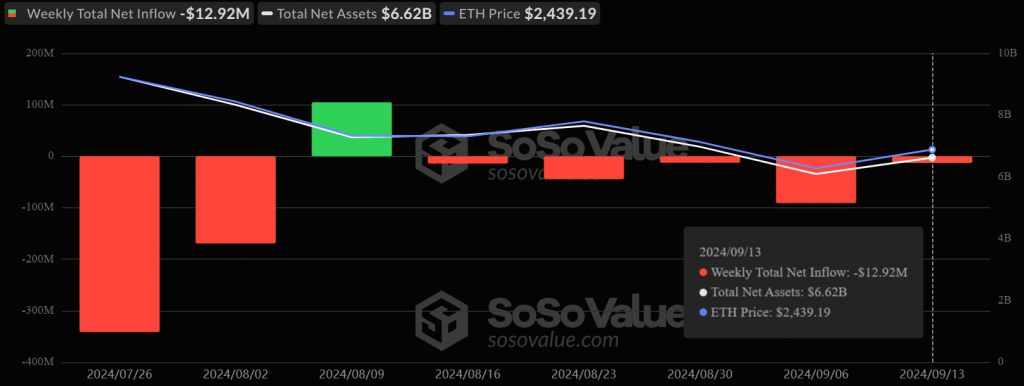

However, US ETH ETFs aren’t seeing much demand. They had a $1.5 million daily inflow, but there was a $12.92 million net outflow over the week.

Short-Term Challenges and Price Outlook

ETH’s long-term outlook looks good. But it faces short-term hurdles. Coinbase analyst David Duong says ETH’s slow price growth is due to market structure. He notes:

“crypto investors were tied to other altcoin positions, limiting capital flow to ETH.”

Another challenge: about 100,000 Ethereum tokens moved to exchanges before the Fed’s rate decision on September 18. This could affect short-term prices.

Despite these challenges, Ethereum was worth $2,439.19 at reporting time. That’s a 5% increase over seven days. This rise, plus the surge in options activity, shows market optimism. Many believe the ETH December price prediction of $3,000 could come true.

Also Read: Top 3 Cryptocurrencies To Watch This Week

The next few months are going to be extremely important for Ethereum. It must endure market swings, new regulations, and economic factors. Investors should monitor its activity, institutional interest, and market sentiment to make informed investment decisions. We know we will!