- Ethereum’s netflow neutrality hinted at accumulation, with potential volatility ahead.

- Active addresses and Open Interest surged, signaling growing retail interest.

Ethereum [ETH], trading at $3,135 at press time, gained merely 0.6% over the past 24 hours.

This modest uptick comes in contrast to Bitcoin’s [BTC] impressive performance, as the king coin hit a new all-time high of $97,836 after a 4.9% daily increase.

Bitcoin’s rally has driven the broader crypto market higher, but Ethereum has lagged behind, with a 2% decline in its weekly performance.

Despite Ethereum’s relatively subdued price movement, market dynamics suggest that ETH might be gearing up for significant action.

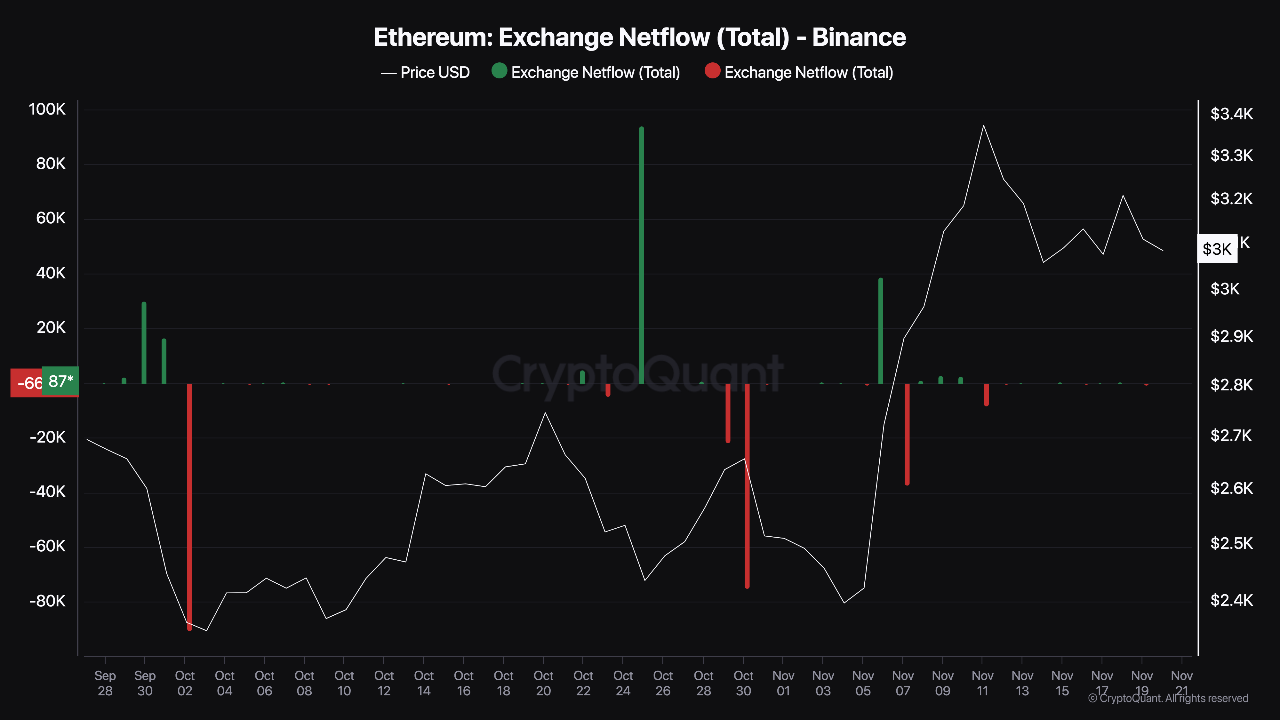

A CryptoQuant analyst known as Darkfost highlighted an intriguing trend in Ethereum’s netflow on Binance, which has recently turned neutral.

What this means for Ethereum

Ethereum’s netflow on Binance showed a balance between deposits and withdrawals on the exchange.

According to Darkfost, the neutral netflow suggested that Ethereum was in an accumulation phase, with investors neither showing strong buying nor selling pressure.

The neutral netflow could point to a potential buildup of momentum in Ethereum’s market.

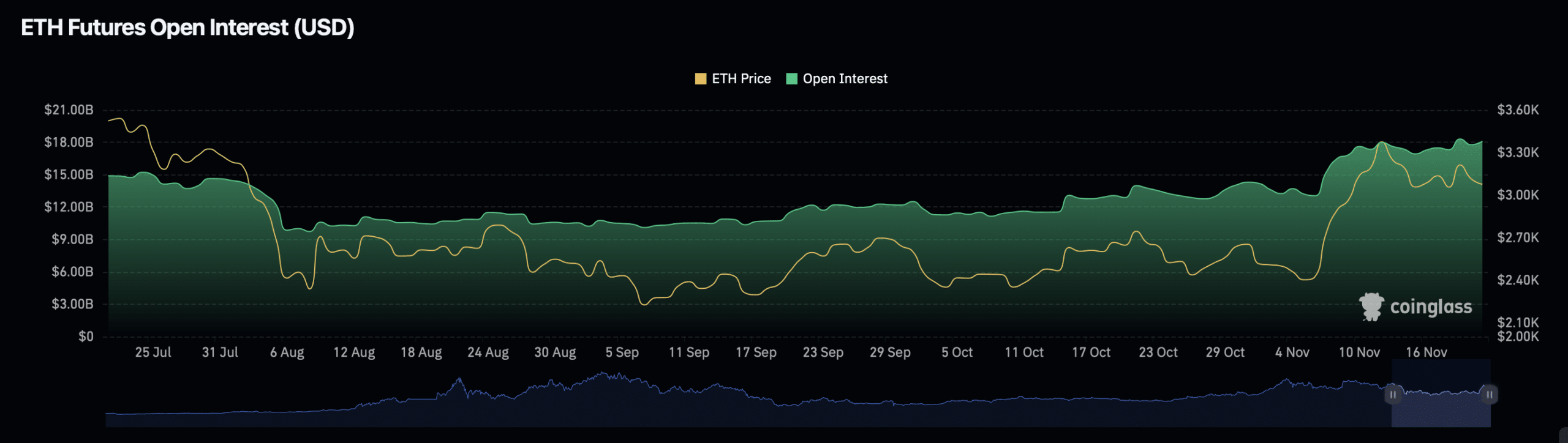

Darkfost elaborated that rising Open Interest in Ethereum Futures, which was nearing an all-time high on Binance at press time, could signal an impending price movement.

Open Interest measures the total number of outstanding derivative contracts, and its increase often precedes heightened market activity.

This balance of netflows and rising Open Interest may represent what the analyst describes as “the calm before the storm,” with the potential for ETH to experience a significant price shift in either direction.

Rising Open Interest and Active Address growth

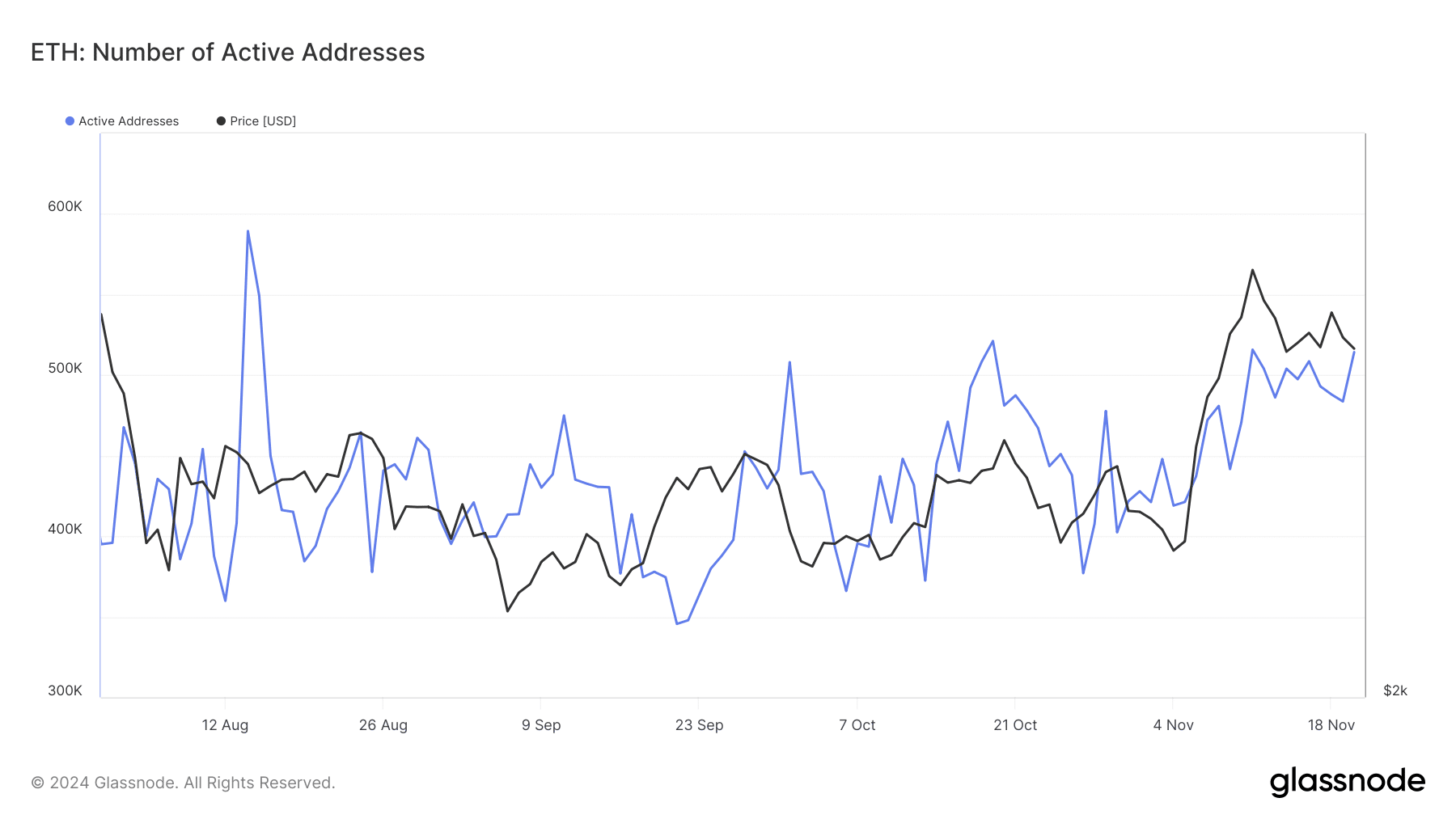

Ethereum’s fundamentals also showed positive signs of market engagement. Data from Glassnode revealed that ETH’s active addresses, a measure of retail participation, have been steadily increasing.

After dipping below 500,000 earlier this month, the number of active addresses has risen to 514,000 as of the 20th of November.

This growth in active addresses suggested renewed interest from retail investors, which could support ETH’s price in the near term.

Increased activity often correlates with higher trading volumes and greater price volatility, hinting at the possibility of upward momentum.

Read Ethereum’s [ETH] Price Prediction 2024–2025

Additionally, Ethereum’s Open Interest in the Futures markets has surged by 3.86%, reaching $18.56 billion. This rise is accompanied by a substantial 40.41% increase in Open Interest volume, at $42.88 billion at press time.

These figures indicated growing engagement in Ethereum’s derivatives markets, highlighting investor interest in both short-term and long-term opportunities.