- ETH traded above the $2,700 price level in the last trading session.

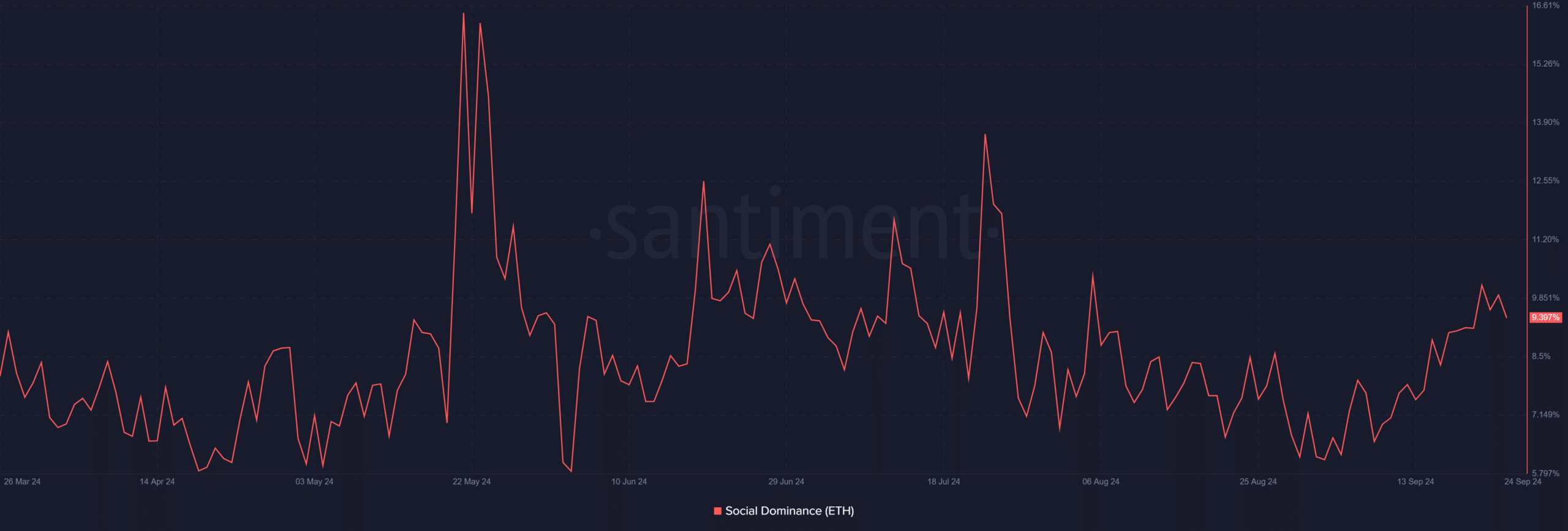

- At press time, the ETH social dominance was close to 10%.

Ethereum [ETH] has recently broken through its short-term resistance after staying below its moving averages since the end of July, a period during which it witnessed a death cross. The second-largest cryptocurrency has also seen an uptick in market chatter over the past few weeks, along with growing interest from derivative traders.

Ethereum sees increased social dominance

Analysis from Santiment reveals that Ethereum’s social dominance has noticeably increased recently. On 21st September, social dominance rose to over 10%.

Although it slightly dipped to around 9.9% by 23rd September, this marks the first time in about seven weeks it reached such levels.

This rise indicates a surge in discussions about Ethereum, reflecting the heightened attention the asset is receiving. The increased social dominance correlates with Ethereum’s recent price movements, suggesting that market sentiment is turning more bullish.

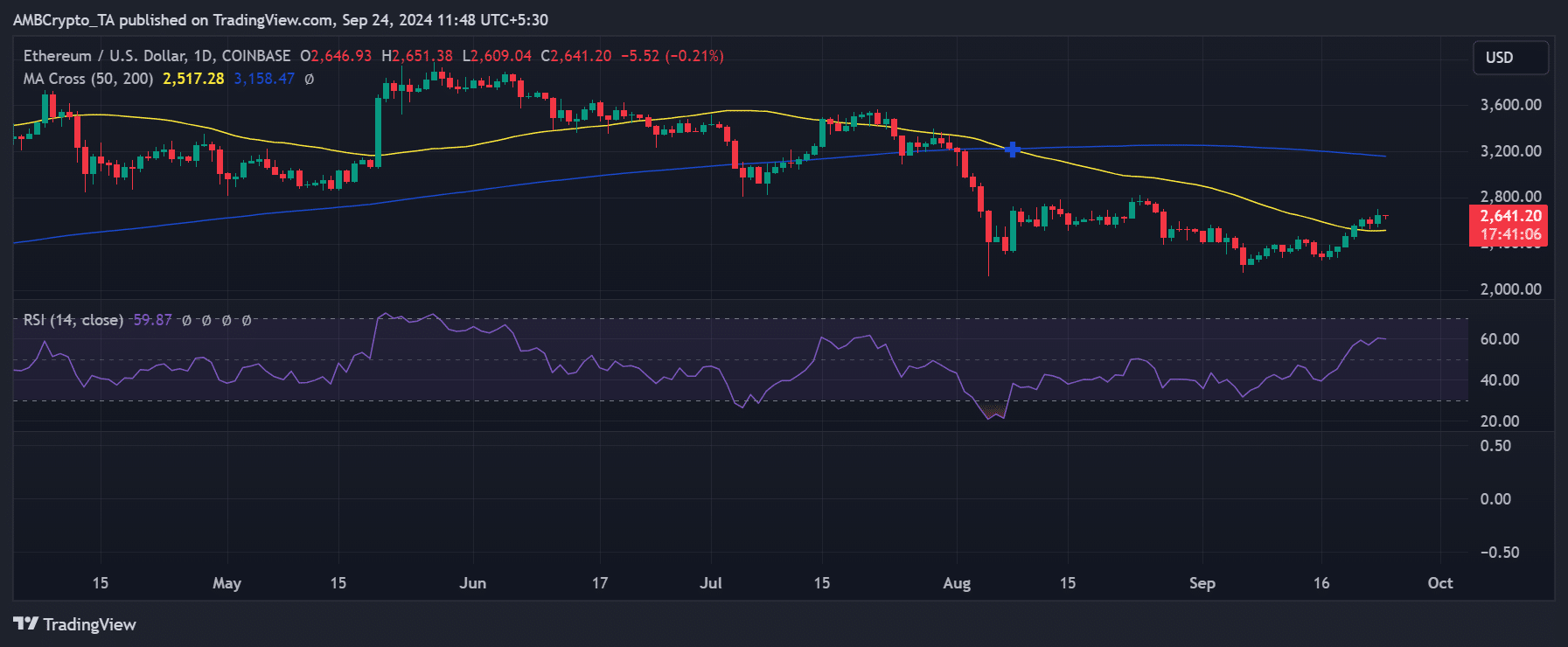

Ethereum price breaks short-term resistance

Examining Ethereum’s price chart sheds light on the growing social interest. Over the past seven days, ETH has seen consecutive gains.

It broke above its short-term moving average (yellow line) on 20th September after a 3.90% increase that pushed its price to around $2,562.

By the end of the last trading session, Ethereum was trading at approximately $2,642 and even surpassed the $2,700 mark at one point. Also, the short-term moving average has now flipped to become a stronger support level.

Further analysis indicates that the next critical resistance is at the $2,800 price level. If ETH breaks through it, the $3,000 threshold could be retested. This price increase has also boosted interest from derivative traders.

Read Ethereum’s [ETH] Price Prediction 2024–2025

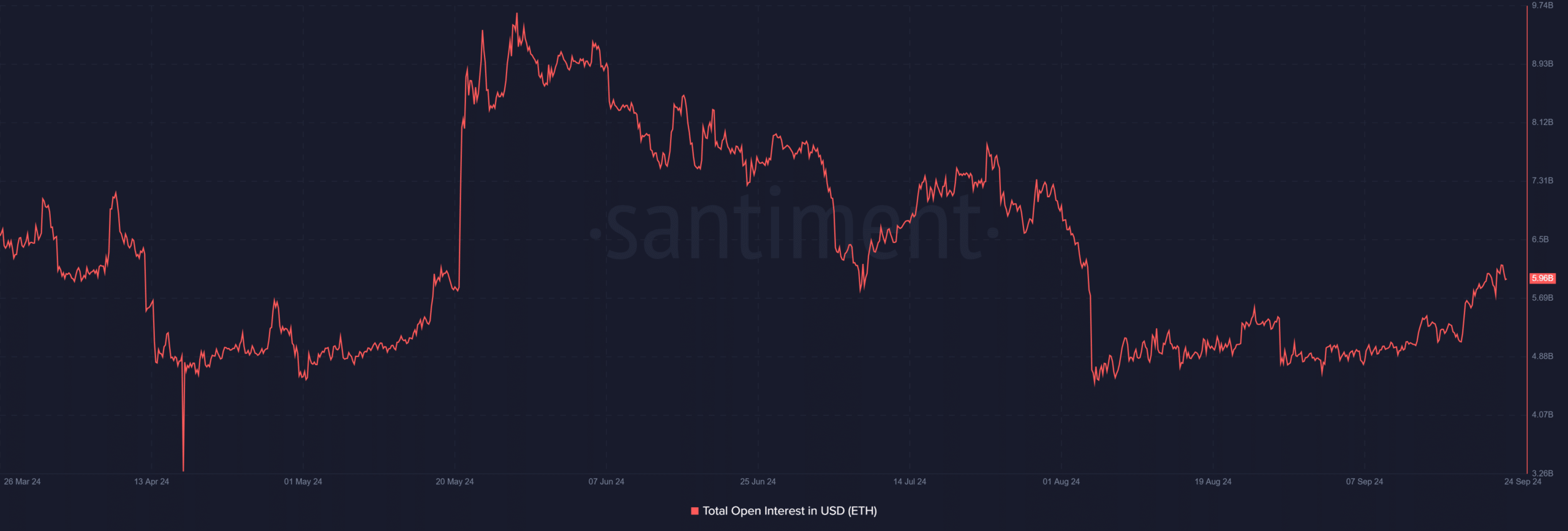

Open interest sees increased volume

Another key indicator showing positive momentum is Ethereum’s open interest. Recent analysis reveals that open interest climbed to over $6 billion on 23rd September, the highest in about seven weeks.

The surge in open interest suggests an influx of funds from derivative traders, likely motivated by Ethereum’s recent price rally. If these positive indicators continue, ETH may be on track to retest the $3,000 price range shortly.