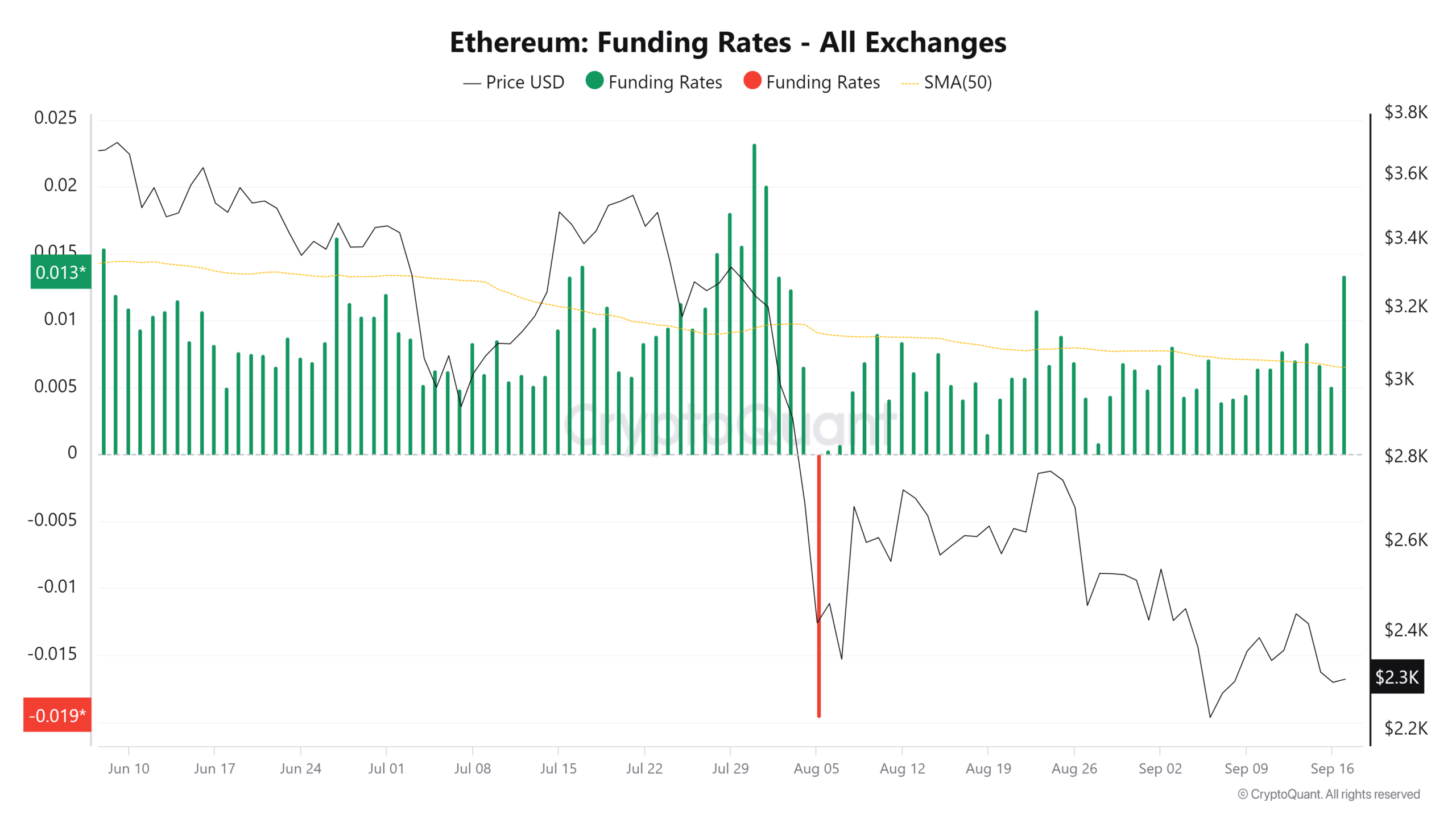

- ETH saw its lowest Funding Rate of the year.

- ETH is trading around the $2,300 price level.

Ethereum [ETH] has seen a notable decline in its derivative market, signaling a potential shift in market sentiment.

However, interpreting this decline can lead to different conclusions depending on how other factors, such as the spot volume, perform.

Ethereum’s Funding Rate declines

The recent data from CryptoQuant revealed that Ethereum’s Funding Rate hit its lowest point of the year, signaling a sharp decline in buying interest from derivative traders.

Funding Rate is a key indicator used in Futures markets to measure the cost of holding long (buy) or short (sell) positions.

A negative Funding Rate means that short sellers are paying long holders to keep their positions open, suggesting a bearish sentiment.

ETH’s Funding Rate dropping to its lowest level this year reflects a decline in demand for buying Ethereum on leverage through derivatives. This could be a bearish sign for the price in the short term.

The decline in the Funding Rate indicates a lack of enthusiasm from traders in the derivatives market, which could further pressure Ethereum’s price.

A potential for Ethereum short squeeze

With fewer traders willing to take long positions, the Ethereum downward trend could continue unless spot buyers step in to absorb the sell pressure.

However, while the low Funding Rate suggests a bearish sentiment, it also sets the stage for a potential short liquidation cascade. The negative Funding Rate could quickly reverse if spot buyers enter the market sufficiently.

This forces short sellers to close their positions, resulting in forced buying (short squeeze), which can increase the price.

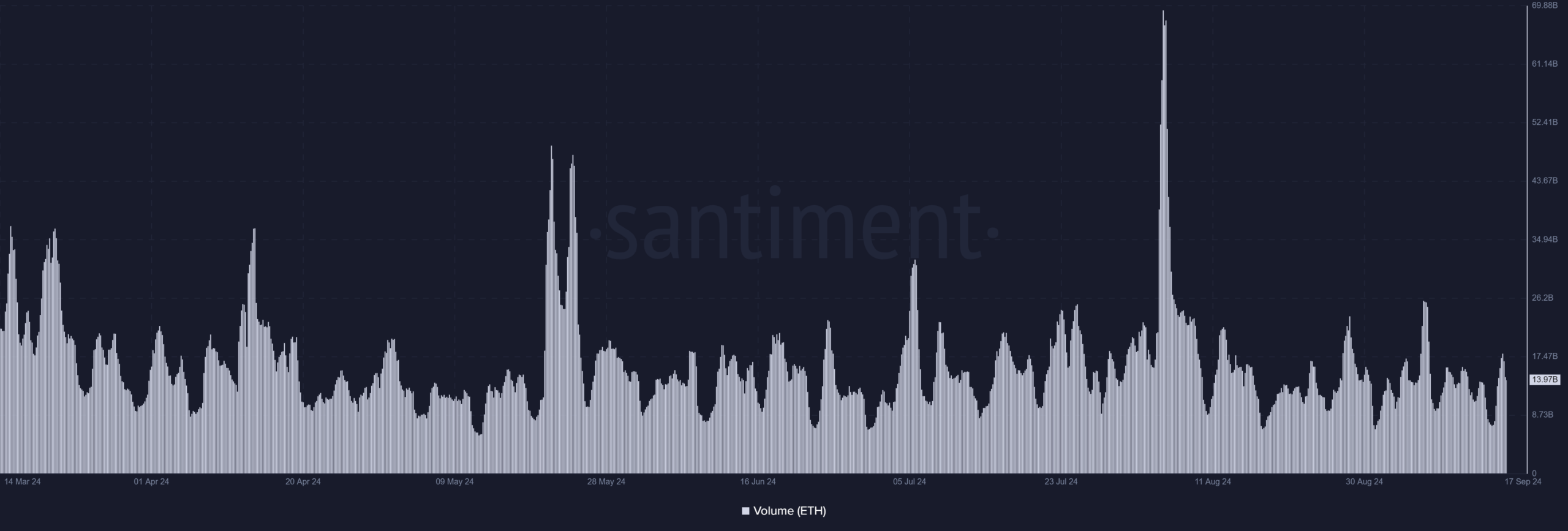

How ETH’s volume has trended

The analysis of Ethereum’s spot volume on Santiment showed that the current average volume has held steady at around $14 billion in recent weeks.

This consistent volume is crucial for maintaining price stability, especially as Ethereum’s funding rate has dipped to its lowest level of the year.

The spot volume for Ethereum has remained relatively stable, averaging $14 billion. This consistent volume has likely helped ETH avoid a more severe price decline.

This is despite the bearish sentiment from derivatives traders, reflected in the negative funding rate.

Furthermore, if the spot volume drops below this $14 billion range, Ethereum could face increased downward pressure.

Read Ethereum’s [ETH] Price Prediction 2024-25

With the Funding Rate already at record lows, a drop in spot volume would reduce the buying interest. The buying interest is needed to counterbalance the negative sentiment in the derivatives market.

The current low Funding Rate signals that short positions dominate the derivatives market. If spot volume declines, there may not be enough demand to absorb the sell pressure, leading to price declines.