Onchain Highlights

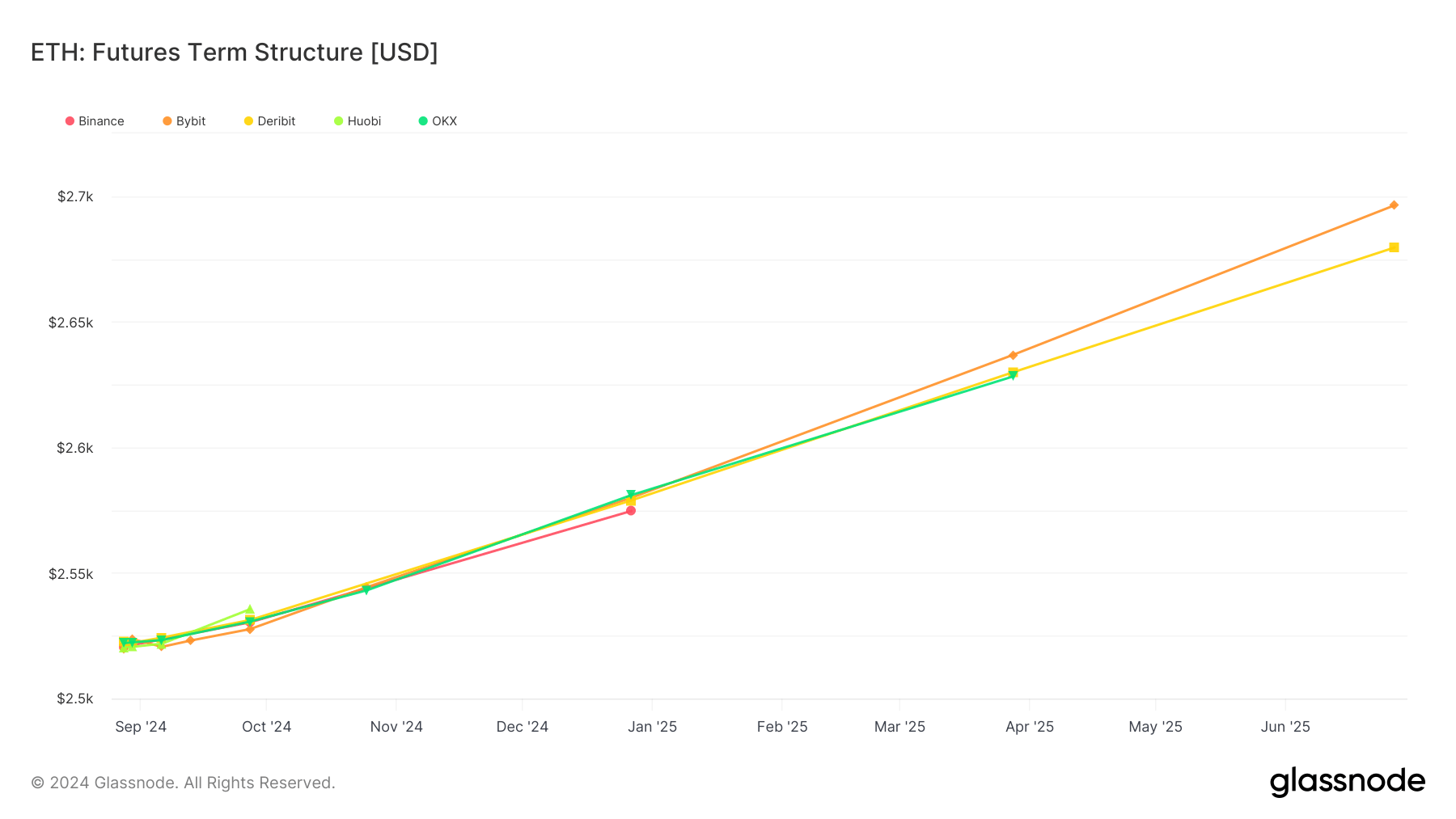

DEFINITION: The Futures Term Structure is a graphical representation of the pricing for futures contracts expiring at increasingly distant dates into the future. The most common state of the graph, an upward slope, indicates a premium must be paid to purchase exposure, or delivery, of an asset in the future. Conversely, a downward slope indicates a discounted rate on delivery of an asset in the future. Trends and dislocations within the graph can paint a picture of supply, demand, and liquidity for futures contracts expiring on different dates.

Ethereum’s futures term structure across major exchanges exhibits a consistent upward slope. This contango pattern reflects the market’s expectation of higher prices for Ethereum in the coming months, with futures contracts maturing in mid-2025 showing a notable premium over those expiring in late 2024. Binance, Bybit, and Deribit lead this upward trajectory, while OKX and Huobi display similar, albeit slightly less pronounced, trends. The uniformity in this upward slope across exchanges suggests strong market confidence in Ethereum’s potential for future appreciation.

This persistent premium in Ethereum futures indicates a broad consensus among traders that the asset will gain value, aligning with the generally bullish sentiment observed in the post-halving period of 2024. Such patterns are indicative of anticipated demand, possibly driven by factors such as growing institutional adoption and the expected impact of upcoming protocol upgrades on Ethereum’s ecosystem.

The post Ethereum futures show strong upward trend across major exchanges appeared first on CryptoSlate.