- Ethereum’s price surge and transaction velocity signal the start of an altcoin season, as per analysts.

- Chainlink shows strong growth with increasing active addresses and open interest, indicating bullish sentiment.

Ethereum [ETH] has recently demonstrated its strength as the second-largest cryptocurrency by market capitalization, seeing notable gains. Over the past 24 hours, ETH surged by nearly 10%, reaching a trading price of $3,374 at the time of writing.

While it remains approximately 30% below its all-time high of $4,878 recorded in 2021, the recent rally signals potential bullish activity in the broader altcoin market.

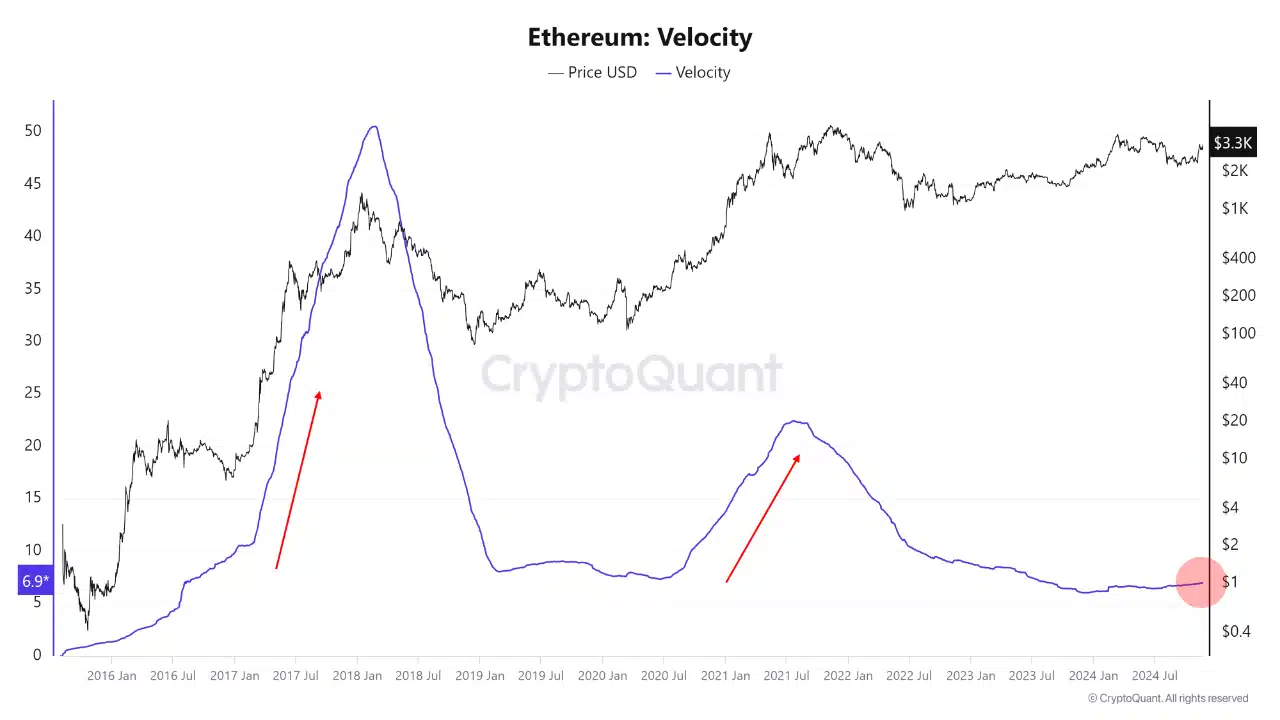

Amid this performance, CryptoQuant analyst Mac.D highlighted the beginning of an altcoin season in a post on the QuickTake platform. The analyst pointed to Ethereum’s circulating velocity and transaction growth as indicators of this rally.

Altcoin season begins

Velocity, which measures how quickly coins circulate in the market by dividing the annual coin movement by the total supply, has historically risen during altcoin market rallies.

Despite currently low velocity levels of approximately seven times the total supply, Ethereum’s role as a primary collateral asset for institutional investors is poised to play a pivotal role.

The analyst emphasized that a rise in ETH’s price could stimulate DeFi liquidity and confirm the onset of an altcoin season.

Ethereum’s recent gains come in the context of a broader narrative. While Bitcoin has outpaced Ethereum in recent rallies, Ethereum’s role as a backbone for DeFi and a top choice for institutional collateral positions it for substantial influence.

However, challenges such as competition from faster and cheaper blockchain networks like Solana, Tron, and Aptos highlight the hurdles Ethereum must overcome. Yet, as Ethereum’s transaction growth and velocity improve, it is expected to drive liquidity creation, benefiting the altcoin ecosystem.

LINK as a case study

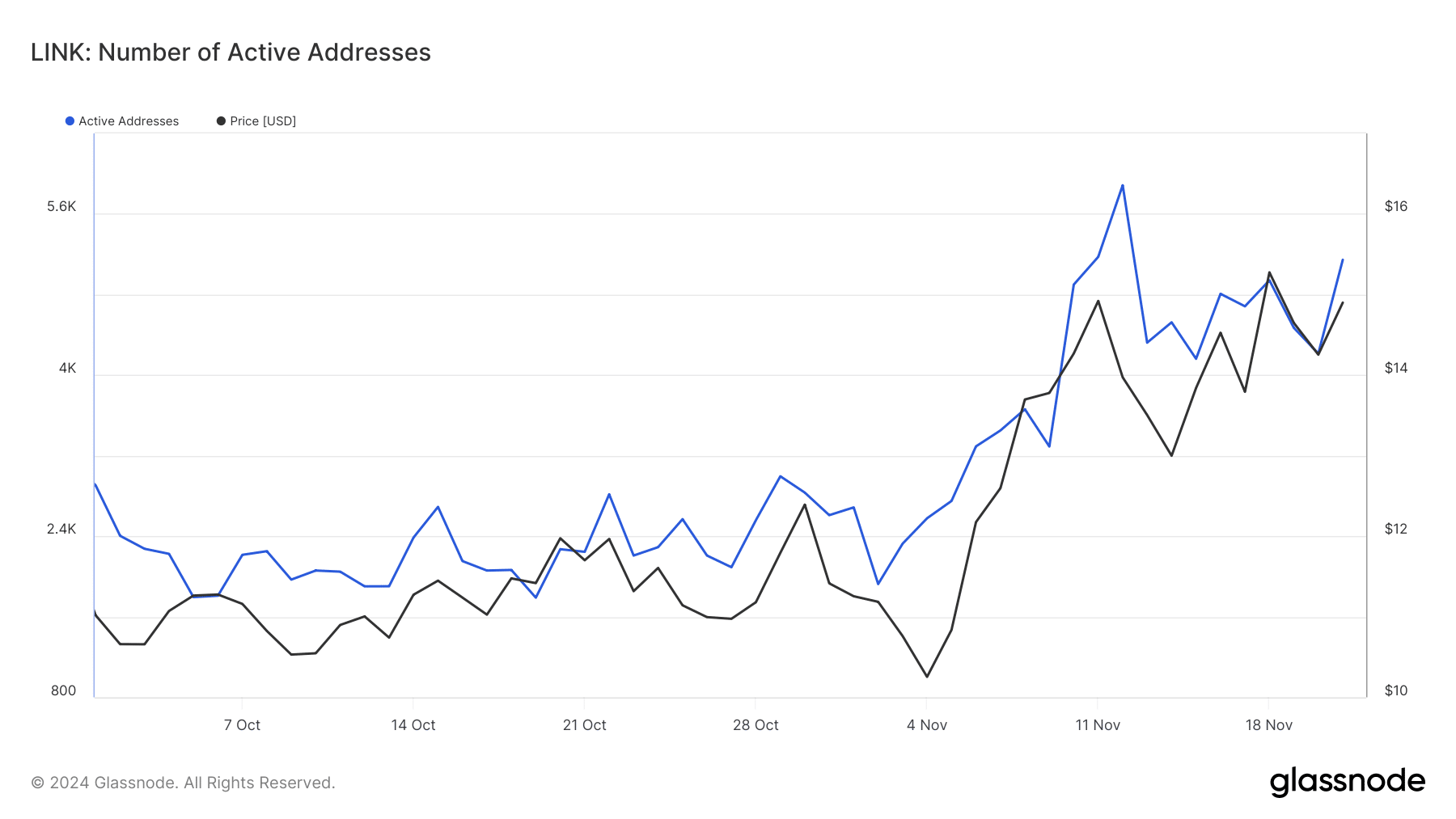

A closer look at one of the prominent altcoins, Chainlink, supports the altcoin season thesis. LINK has recorded a 16.6% increase in the past week, bringing its trading price to $15.26.

This growth aligns with Ethereum’s rising activity and suggests broader altcoin momentum. Key metrics bolster this case: LINK’s active addresses—a measure of retail interest—have surged, increasing from below 2,000 in October to over 5,000 by 21st November, according to Glassnode.

Read Ethereum’s [ETH] Price Prediction 2024–2025

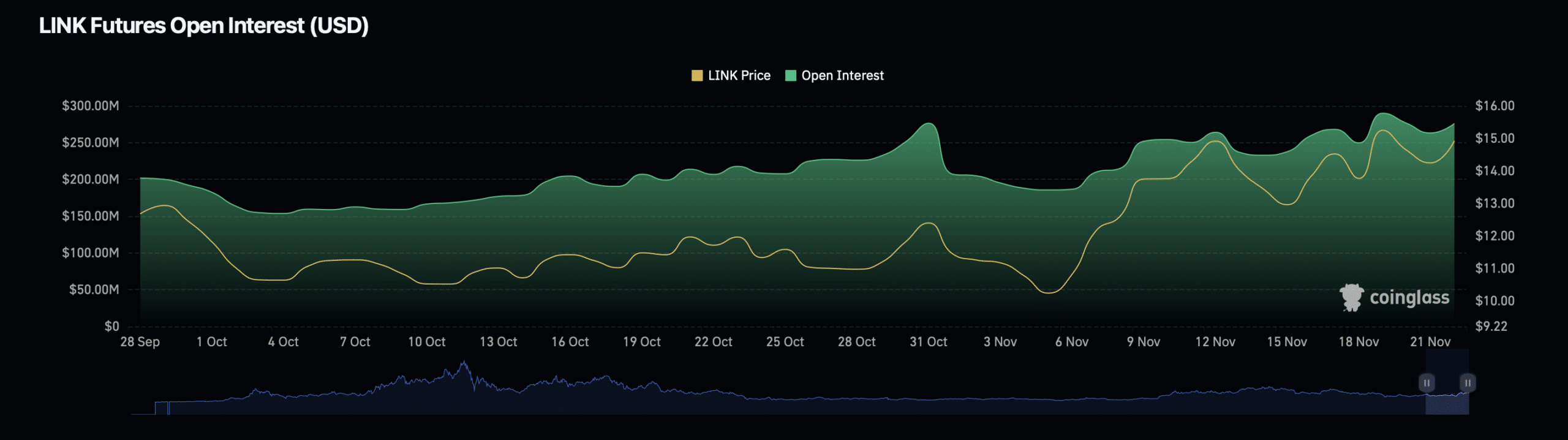

Further strengthening the argument for an altcoin season, Chainlink’s derivatives data also shows bullish signs. Data from Coinglass indicates a 7.76% increase in LINK’s open interest, now valued at $294.88 million.

Additionally, LINK’s open interest volume has risen by 0.86%, reaching $726.97 million. These metrics suggest heightened investor activity and confidence in LINK’s near-term performance.