Over the past day, Ethereum has seen a big jump, making traders optimistic about its future. They believe it could go even higher than $4,000.

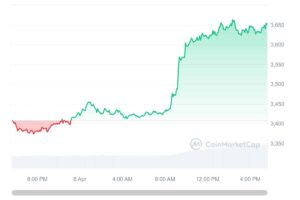

Ethereum (ETH) is off to a strong start this week as cryptocurrencies bounce back after a rough patch. Over the past day, Ethereum has risen by 6.83%, bringing its weekly gains to 4% following a small dip in the market.

Cryptocurrency Market Rebounds, Altcoins Lead Surge

Today, the cryptocurrency market is witnessing a rebound, with leading altcoins taking the forefront. Bitcoin, the pioneer cryptocurrency, has surged by 2.89%, reaching a trading price of $71,625. This uptick in Bitcoin’s value has sparked excitement among traders, hinting at potential further investments as attention shifts slightly towards altcoins.

Among the standout performers, Toncoin (TON) and Ripple (XRP) have demonstrated significant gains, with Toncoin soaring by 9.4% and Ripple by 2.9% respectively. These increases contribute to pushing the overall market capitalization beyond $2.6 trillion, marking a 2% rise for the day.

Notably, the resurgence is not limited to major cryptocurrencies alone. Decentralized finance (DeFi) protocols and meme coins are also experiencing a surge in interest and investment, reflecting a broader trend of increasing inflows and positive sentiment observed over the past day.

Ethereum’s Institutional Interest Sparks Price Surge Predictions

Ethereum has been attracting institutional funds throughout this year, indicating a growing interest in the cryptocurrency market. Although it surpassed $4,000 in price last month, it later dipped below $3,500. Presently, Ethereum is trading at $3,653, showing resilience above resistance levels, with bullish investors expecting further price movements upwards.

The recent approval of spot Bitcoin ETFs has driven Bitcoin’s price to new heights, introducing a fresh avenue for investment. Institutional investors are now eagerly awaiting the approval of spot Ethereum ETFs in the United States. Market participants view this development as a bullish catalyst that could propel Ethereum’s price to unprecedented levels.

Social media discussions among crypto enthusiasts currently center around the $4,000 mark, with many predicting a potential rebound if a bull run kicks off in the market. Despite experiencing outflows totaling $22 million this week, Ethereum has seen significant institutional inflows, amounting to $52 million this year. This influx of institutional capital has contributed to Ethereum accumulating a total of $14 billion in assets under management (AUM).

Further US$646m inflows into Bitcoin ETFs, but signs of hype moderatinghttps://t.co/gZEvJgr90T

— James Butterfill (@jbutterfill) April 8, 2024

Bullish Sentiment Fuels Activity in Perpetual Market: CryptoQuant Report

A recent report from CryptoQuant highlights a surge in funding rate metrics and Open Interest, indicating a rise in bullish sentiment within the Perpetual Market.

According to on-chain analysis, there has been a notable increase in these metrics coinciding with the upward momentum in prices. This suggests that market participants are aggressively entering long positions.

Moreover, the uptrend in Open Interest further emphasizes the heightened activity, pointing towards an overall fervent state within the futures market.

Important: Please note that this article is only meant to provide information and should not be taken as legal, tax, investment, financial, or any other type of advice.

Join Cryptos Headlines Community

Follow Cryptos Headlines on Google News