- If Ethereum continues to mimic the S&P 500, it could triple its value.

- Short interest persisted but the potential for ETH to rally remained evident.

Ethereum [ETH] has mirrored the S&P 500 index’s price movement, creating speculation that ETH could potentially surge in the long-term. The resemblance between ETH and the S&P 500 indicates optimism for a significant move upwards.

Currently, ETH still trades below its all-time high that was hit in November 2021, but the pattern hints that a possible bullish momentum is on the horizon.

Analysts speculated that this correlation to traditional markets could signal Ethereum’s ability to reach new heights.

As ETH continues this trajectory, maintaining the S&P500’s course might propel it much higher, potentially leading to a major breakout.

The prospect of ETH tripling its value, surpassing its ATH of $4800, now hinges on sustained market support and similar movements in the S&P500.

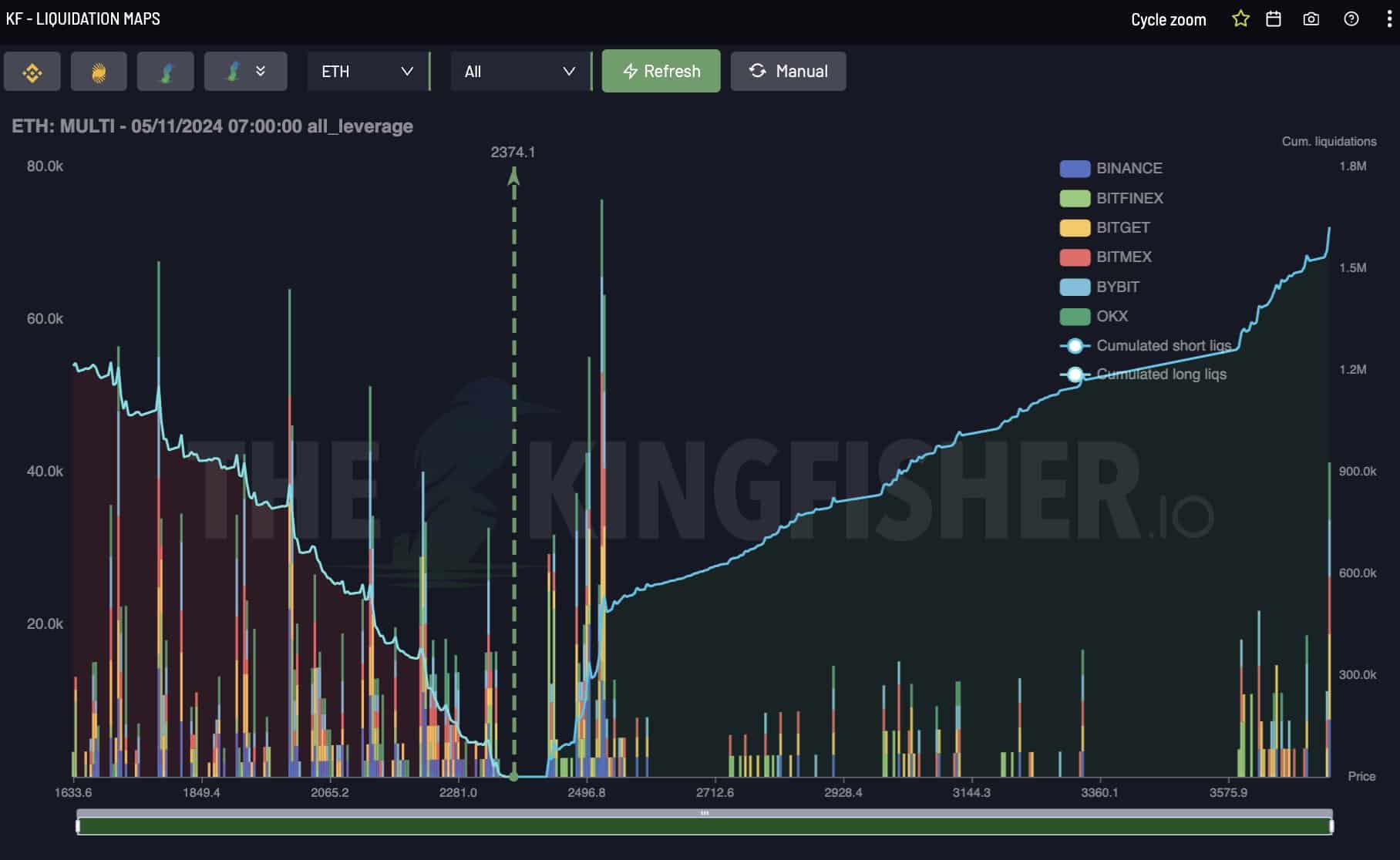

Short leveraged positions pile up ahead of possible rally

ETH’s price faced growing short interest, with traders betting on further declines. However, history suggests that Ethereum’s price often rallies sharply when these shorts get cleared.

The recent surge in liquidations, as observed on the liquidation map, hinted at a significant price move.

Once Ethereum gains enough momentum, clearing these shorts, its price could quickly rally, possibly approaching new heights. Traders eyed ETH closely, predicting that once the shorts cleared, ETH would surge.

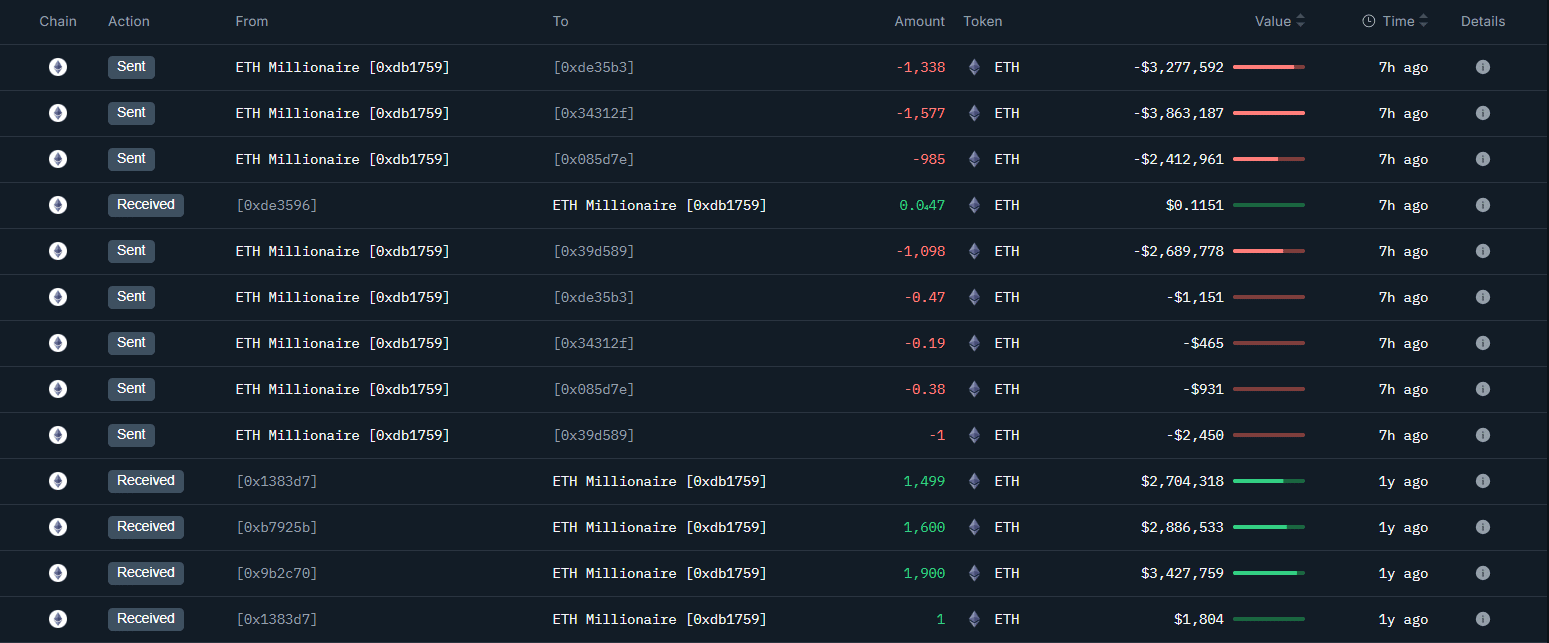

Whale activity suggest ETH could hit $10K…

Whales appeared to believe in ETH’s possibility to reach $10K as they consistently took profits while dollar-cost averaging (DCA) their holdings.

Recent on-chain activity showed that a whale deposited 5,000 ETH into Binance, netting a profit of $3.22 million. This same whale had previously withdrawn 5,000 ETH, valued at $9.02 million, a year ago.

After a period of dormancy, the whale decided to re-deposit the ETH, now worth $12.24 million. This move resulted in a solid profit of over $3.22 million, highlighting the confidence among large holders in Ethereum’s future potential.

Source: Onchain Lens

Ethereum’s ongoing price action and its relationship with the S&P500 provided optimism among investors that ETH could regain its upward trajectory.

As Ethereum moves forward, many eyes will stay fixed on whether it could break through and ultimately achieve the $10,000 milestone as Ali speculated on X.

“#Ethereum $ETH has been mimicking the S&P500, and this could be the last dip before it triples and hits $10,000!”

Read Ethereum’s [ETH] Price Prediction 2024–2025

The continued presence of whales, their profit-taking, and reinvestments indicated underlying bullish sentiment that could drive ETH’s price much higher.

Whether or not ETH reaches these ambitious targets would depend on broader market conditions, traditional financial markets, and continued on-chain activity by influential stakeholders.