The bearish pattern seen on Ethereum’s chart can no longer be ignored. There was not enough activity in October. Ethereum began trading in October at $2400 and entered November at $2500. Now, analysts predict ETH could lose $1K in market price.

Ethereum has suffered a notable loss as the entire crypto market endured price corrections. The second-largest crypto by market cap has depreciated 5.30% over the last 24 hours.

No Ethereum buy signal and bearish on-chain data

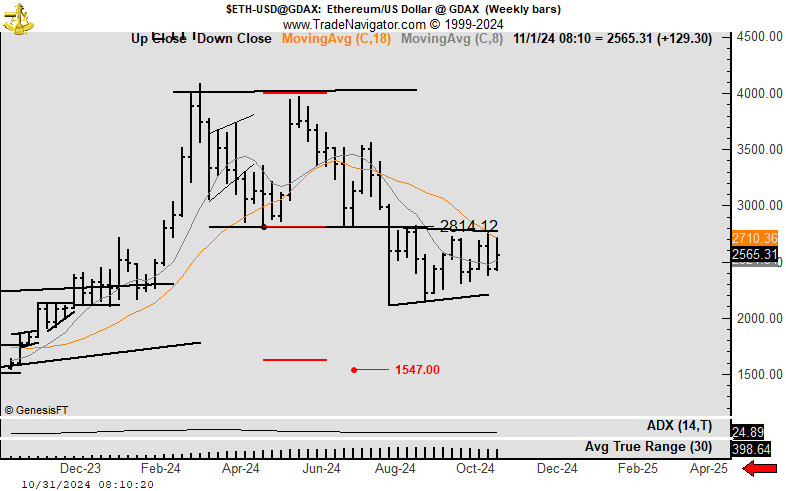

As highlighted by crypto analyst Peter Brandt, the lack of a buy signal for Ethereum (ETH) shows the chart trending toward bearish. According to Brandt, ETH still has an unmet downside target of $1,551. Meanwhile, a downtrend to $1,551 would translate to a 62% capitulation from the current market price.

On October 31, Peter Brandt posted an X tweet, saying, “Interesting to note that there was not a buy signal in $ETH. In fact, chart remains bearish with unmet target at 1551.”

Brandt insisted that there has not been any indication of a change in momentum in the asset’s price pattern. He also shared a 24-hour Ethereum chart to support his bearish claims.

Another analyst, Kotter came out to support Brandt’s predictions. The market speculator claims that Ethereum will continue to underperform against Bitcoin, with the ETH/BTC chart trending toward the 0.0265 zone.

Ether’s price has declined by over 5%, while the other cryptocurrencies retraced by between 4 to 7%. According to on-chain data from CoinGecko, ETH is worth $2,522 today, with a 4.2% decline in the last 24 hours. ETH is 0.7% lower than its value seven days ago.

Halloween ushers in a bloody market decline

Halloween turned out to be a bad day for investors. The crypto market experienced a strong sell-off on Thursday. Currently, the entire crypto market has been hit with a strong bearish sentiment.

According to on-chain data from CoinGecko, the global crypto market cap is $2.46 trillion today, a -4.48% change in the last 24 hours.

In addition, crypto analyst Michael van de Poppe suggested that if ETH continues with its current downward momentum, the asset could see an additional 10-20% decline from here.

However, not all crypto market analysts see doom for crypto. Crypto analyst Mammon highlighted that the price of Ethereum is approaching a critical demand. In a tweet, he said “Ethereum is reaching crucial demand here where it should form a higher low if it wants to avoid moving back to the range lows…”

If Ethereum successfully forms a high within the support zones, Mammon sees strong potential for a bullish trend. Reclaiming this level could set the stage for a significant price rally, according to his analysis. Some market analysts are also setting $18,000 targets for Ether.

Furthermore, inflows into spot Ethereum ETFs have picked up again. Over the last three days, spot Ether ETFs have registered net positive inflows. On Thursday, October 31, the BlackRock Ethereum ETF (ETHA) recorded inflows of $50 million.

On the other hand, the Grayscale Ethereum ETF (ETHE) saw outflows of $36.6 million, taking the total inflows to $13 million.

Crypto analyst Michael van de Poppe pointed out that today’s US unemployment data release will be key, potentially influencing broader market direction.

The US general elections remain a great driver of the crypto market. Former POTUS, Donald Trump promised to make the US a crypto-friendly nation. If he wins the election, it could mean more investors from the US entering the crypto market.

Ethereum, being the largest altcoin, is still attractive to many investors. It has a market cap of $300 billion following behind Bitcoin with $1.3 trillion. ETH has a chance to enter bullish regions again if the stars align. However, the opposite scenario is also a possibility.