Ethereum’s bullish push stalls at $3,600 after co-founder Jeffrey Wilcke transferred 20,000 ETH ($72.5 million) to crypto exchange Kraken.

Data from Spotonchain confirmed the transaction, which happened by 12:59 (UTC) today. Notably, “0xa7ef,” the wallet address belonging to the co-founder, moved 20,000 ETH to a deposit wallet tied to Kraken.

At the time of the transfer, the Ethereum tokens were worth $72.5 million, moved at an average price of around $3,627. Meanwhile, the Wilcke-tied account still holds 105,738 ETH, valued at $382 million.

It bears mentioning that this was Wilcke’s fourth Ethereum sale of the year. The Spotonchain data reveals that the wallet sold 10,000 ETH ($37.38 million at the time) in May, taking his total Ethereum sales this year to 44,300 ETH at an average price of $3,342.

Ethereum Stalls at $3,664

Meanwhile, the 20,000 ETH shift coincided with the asset’s renewed downward pressure. Ethereum’s bullish push stalled at an intraday high of $3,664, with the asset dropping over 2% to trade below $3,600.

Notably, the altcoin king joined a broader market recovery yesterday, surging over 9% from the $3,300 zone to a five-month price high. However, its bullish momentum has lost steam, spurred by selling pressure and a broader market correction.

Nonetheless, analysts still expect Ethereum to appreciate substantially in the long term. For instance, market commentator Ali Martinez recently speculated bullish upsides for the altcoin king, asserting $6,000 mid-term and $10,000 long-term targets.

On-chain Analysis Shows Bullish Signs

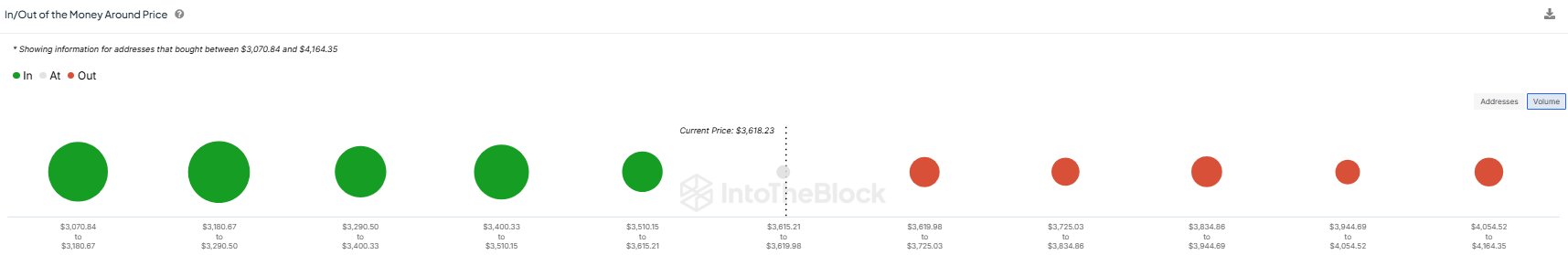

Amidst the downtrend, on-chain analysis still suggests that Ethereum looks bullish. Data from IntoTheBlock indicates a “mostly bullish” signal for the second-largest cryptocurrency by market cap.

Although net network growth and large transactions remain neutral at 0.28% and 3.14%, the “in the money” and concentration metrics show bullishness. The former indicates an uptick in the number of Ethereum holders in profit, while the latter underscores an increase in whales holding between 0.1% and 1% of Ethereum’s circulating supply.

Another indicator shows that 90.8% of Ethereum holders are in profit, the highest since June. Meanwhile, the 9.2% out of the money controls just 2.8% of the asset’s supply, suggesting that selling pressure from them might not substantially affect Ethereum’s price.

DisClamier: This content is informational and should not be considered financial advice. The views expressed in this article may include the author’s personal opinions and do not reflect The Crypto Basic opinion. Readers are encouraged to do thorough research before making any investment decisions. The Crypto Basic is not responsible for any financial losses.