- ETH attracted low investor interest compared to BTC, SOL.

- Per crypto hedge fund, ETH could see renewed interest in 2025.

Ethereum’s [ETH] has struggled this cycle amid record-high FUD, and investors’ attention shifted elsewhere.

According to Zaheer Ebtikar of crypto hedge fund Split Capital, ETH has lagged behind others due to ‘middle child syndrome.’

“$ETH very much struggles with middle-child syndrome. The asset is not in vogue with institutional investors, the asset lost favor in crypto private capital circles, and retail is nowhere to be seen bidding anything at this size.”

Investors abandon ETH

Among the crypto majors, ETH offered investors only 8% on a YTD (year-to-date) basis, compared to double digits seen in Bitcoin [BTC] and Solana [SOL].

Ebtikar linked the underperformance to investors’ focus on BTC and other ETH competitors like SOL and Sui [SUI].

The executive noted that there are three capital sources in the crypto space: institutional (through ETFs/futures), private capital (liquid funds, VCs), and finally, retail. But only the first two mattered at the moment.

He added that institutional capital was heavily focused on BTC (through ETFs). ETH ETFs have seen net negative flows of $546 million since they debuted in July, underscoring the low interest.

On the other hand, Ebtikar stated that private capital viewed ETH as overvalued and redirected capital to other ETH competitors perceived as undervalued, such as SOL, Celestia [TIA], and SUI.

“$ETH is too large for native capital to support while simultaneously being able to support other index assets like $SOL and other large caps like $TIA, $TAO, and $SUI.”

Coinbase analysts also echoed the above sentiment in their September report.

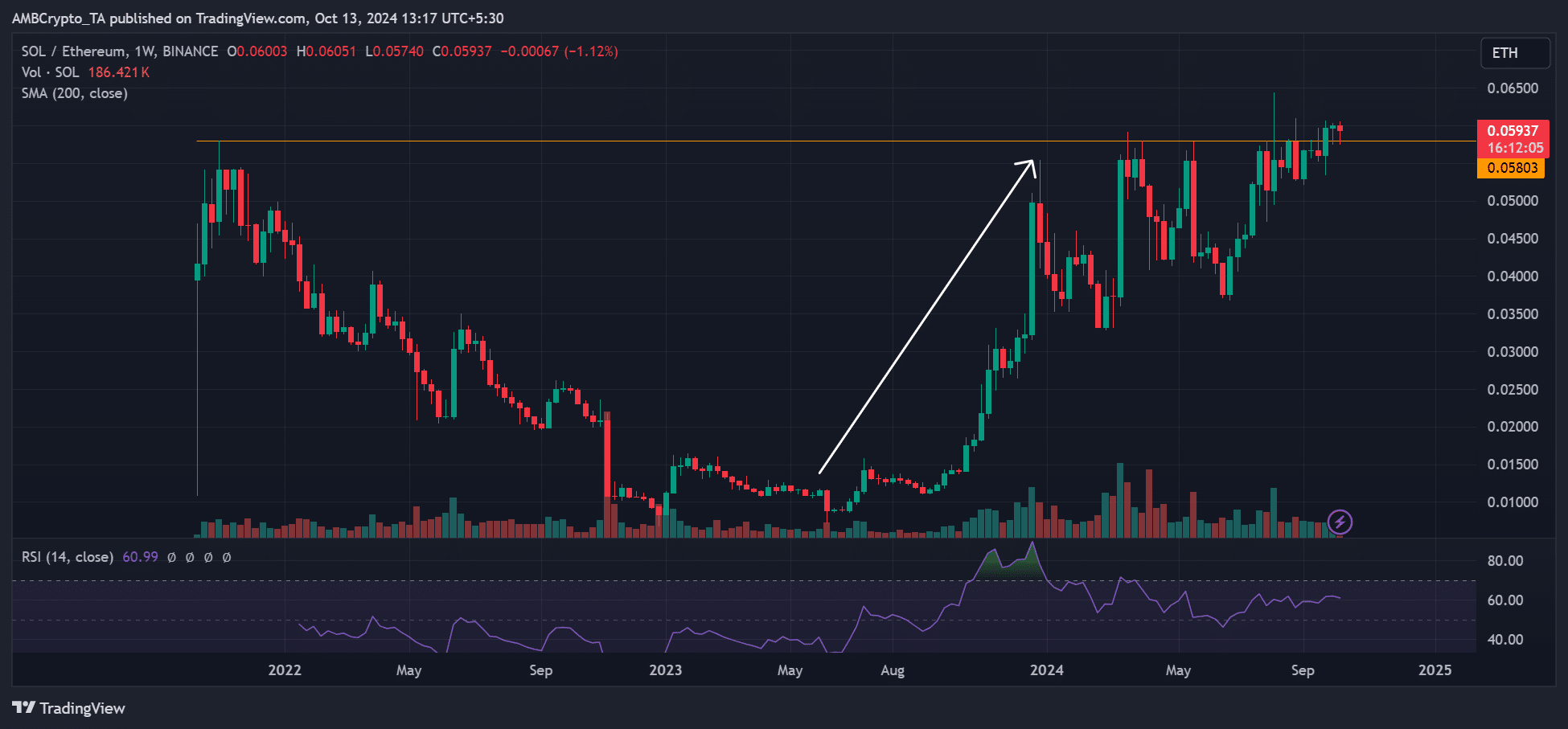

The SOLETH ratio, which tracks SOL’s value relative to ETH, has exploded since last year, cementing Ebtikar’s thesis that investors might have rotated to SOL from ETH.

That being said, Ebitaker also acknowledged that ETH was the only altcoin with an approved ETF in the US.

As such, he projected that the asset could see renewed interest, especially from institutional investors, from 2025.

He cited likely increased demand from ETF buyers, changes within the Ethereum Foundation and Trump’s win.

At press time, ETH was valued at $2.4k and has been consolidating between $2.3K and $2.5K since the beginning of October.