- Crypto speculators remain wary of profit-taking and price correction concerns

- There haven’t been consecutive ETH/BTC green weekly candles since April 2024

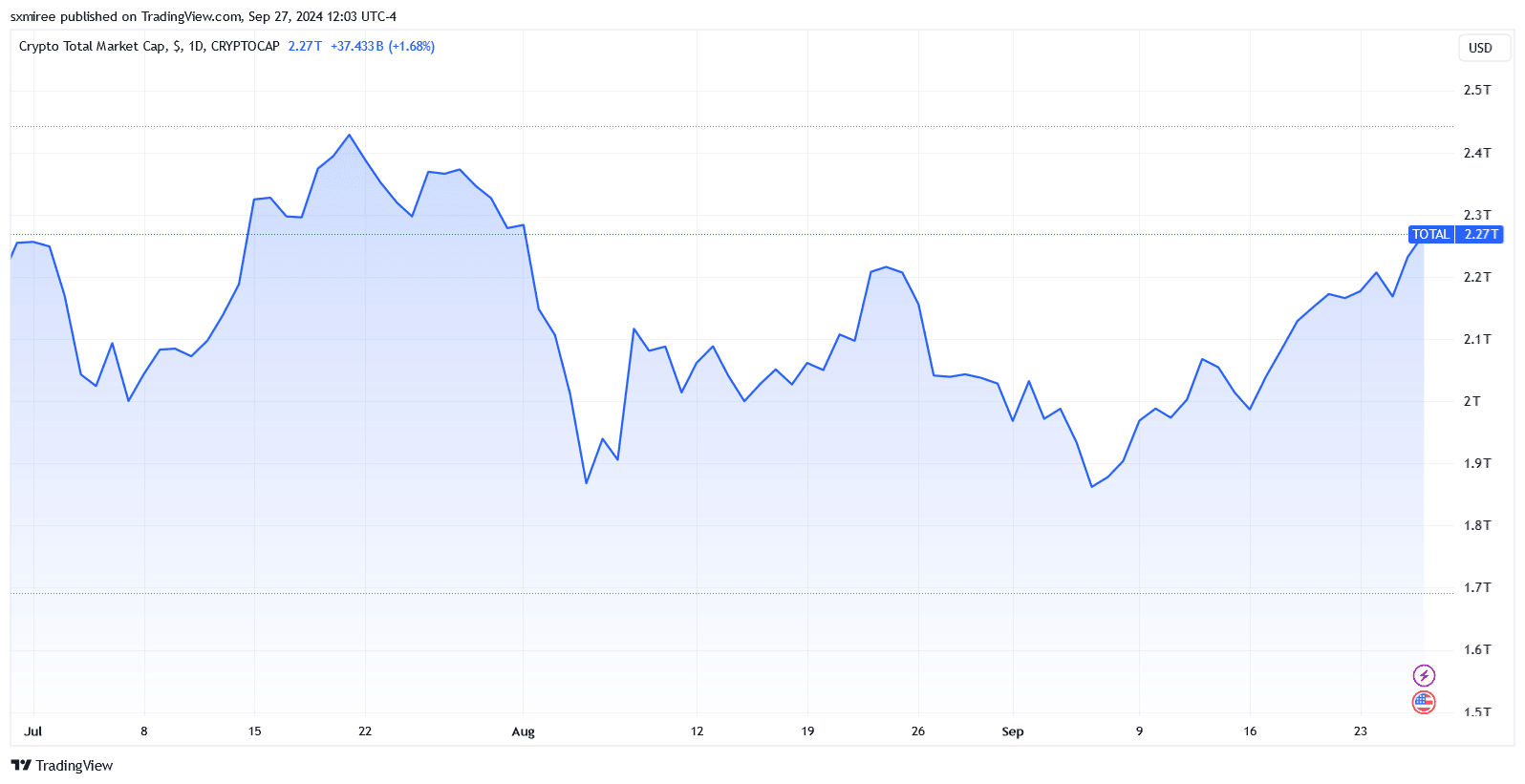

Most cryptocurrencies were trading in the green on Friday after making decent advances between Wednesday and Thursday. In fact, the market-wide gains reversed an early midweek dip, one which ensued after a sluggish start to the week.

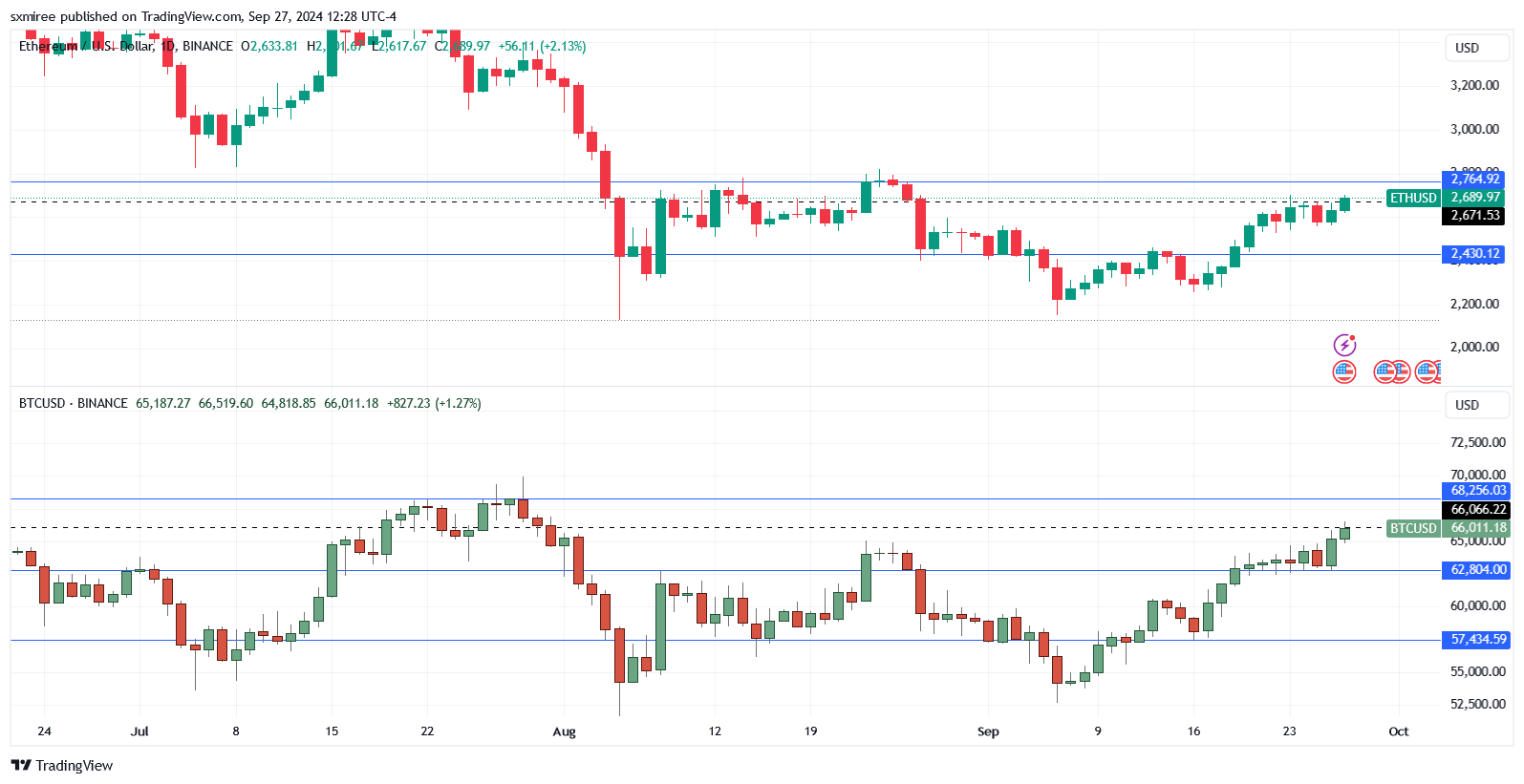

Ethereum (ETH), which has seen renewed its strength in recent weeks, was trading at $2,689 at press time, with bulls targeting a close above $2,770 for the first time since August 24.

Here, it’s worth pointing out that ETH has been pushing past Bitcoin in the second half of the month, racking up gains of 16.34% since 15 September.

That’s not all though. Coinglass data revealed that ETH’s price moved up 11.26% last week, while BTC registered a 7.38% uptick. While both cryptocurrencies have slowed this week, they remain on course for third consecutive weekly gains.

Bitcoin bulls target double-digit monthly gains

Overlooking its recently rejuvenated action though, Ethereum has fallen by 20.75% over the last three months. This decline is especially pronounced given the expectations of a rally after the 23 July launch of a U.S spot Ethereum exchange-traded fund (ETF). The institution-focused offering has failed to live up to the hype, posting mixed results so far.

With three more days to go, Bitcoin leads the flagship altcoin in monthly returns. In fact, BTC price’s trajectory has put it on track to lock in double-digit monthly profits if it maintains a price above $65K. On the contrary, Ether is positioned for a 5.70% gains across September at its press time price.

BTC and ETH price targets ahead of Q4

Heading into the weekend, speculators have their eyes on monthly closes for the respective cryptocurrencies. At press time, Bitcoin was trading in no-man’s land near $66,000, with support established around $62,800. Meanwhile, Ethereum was holding steady above $2,600.

Analysts have set a short-term price target in the $68k to $70k range for BTC and in the $2,760 to $2,820 range for ETH. However, a potential pullback, especially if the momentum wanes, calls for caution on long positions. Momentum exhaustion would pave the way for bears to seize the weekend and drag prices down, as was the case in July.

Bitcoin retracement targets to the downside include a return below $62,000, with a possibility of a slump as deep as $57,400. Ether, for its part, saw rejection at $2,770 on 24 August, pulling its price back to $2,430 three days later.

ETH price’s upside potential also faced pressure from greater Ether issuance, which could weigh on the spot movement. In fact, data from Ultrasound Money revealed that a total of 54,098.4 ETH has been added to the supply over the last 30 days, translating to a 0.547% annualized inflation rate.