Popular crypto analyst Kripto Mevsimi highlights how the introduction of spot Bitcoin ETFs is influencing BTC’s transformation into a more mature asset.

Mevsimi noted that there has been a shift in Bitcoin exposure since the launch of spot Bitcoin ETFs. For context, spot Bitcoin ETFs launched in the U.S. in January, providing institutional investors exposure to the world’s largest cryptocurrency.

Spot ETFs Influence Bitcoin Transition

According to the expert, the ETFs are influencing Bitcoin’s maturity by facilitating the transition of long-term Bitcoin holders to new owners of spot ETFs.

The expert emphasized that most new owners embracing spot Bitcoin ETFs are not new market entrants. They suggested that the new owners could be moving from Grayscale’s Bitcoin Trust (GBTC) due to the fund’s high fees. GBTC has witnessed billions in outflows since the ETFs went live.

Bitcoin ETF Investors Become Long-Term BTC Holders

Notably, Mevsimi stated that the owners of spot Bitcoin ETFs are gradually becoming long-term Bitcoin holders, saying that they have “crossed the 155-day threshold.”

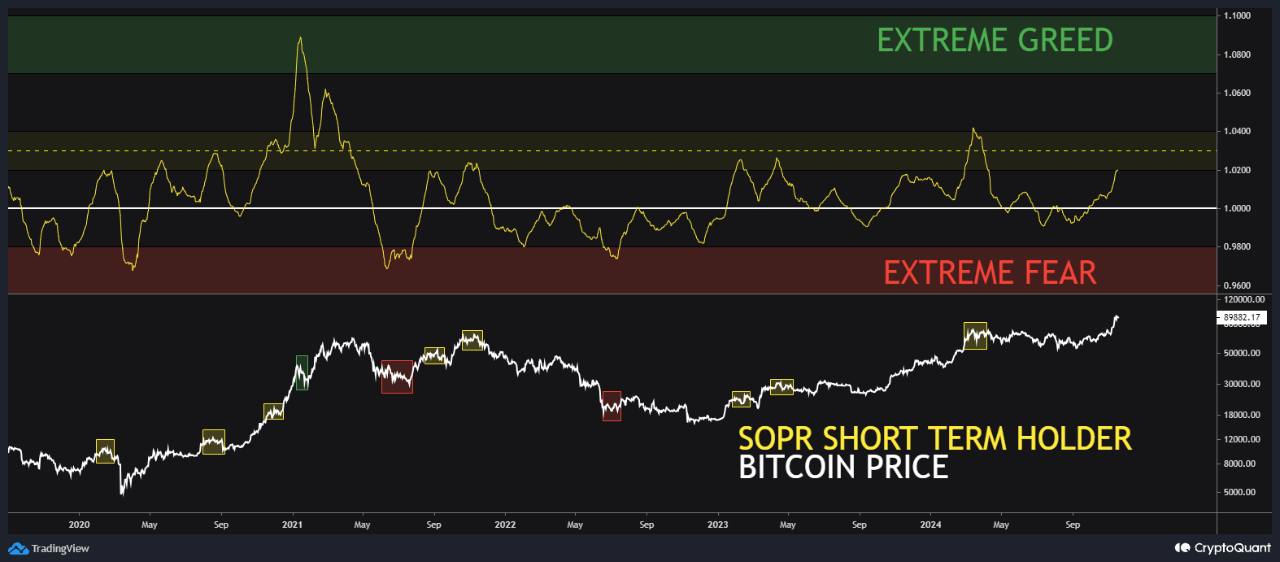

Per Mevsimi, surpassing the six-month threshold is psychologically significant, regardless of whether investors’ price expectations were met. Interestingly, Mevsimi attached a chart from CryptoQuant showing the stats of Bitcoin’s circulating supply held by short-term and long-term holders.

The accompanying chart illustrates that Bitcoin’s supply held by long-term addresses has increased since 2021 compared to short-term addresses.

As of the time of the publication, long-term holders held around 16 million of Bitcoin’s circulating supply, while short-term holders account for around 3.7 million BTC.

Bitcoin Transitions to Mature Asset

Reacting, Mevsimi said this trend usually causes massive volatility in Bitcoin’s price. However, he noted that the influence of spot ETFs and the growing adoption of BTC by traditional finance investors have mitigated these fluctuations.

Consequently, the expert emphasized that Bitcoin is leaving its youthful volatility behind and transitioning to a more mature asset. Meanwhile, Mevsimi projected that Bitcoin could be integrated into the global economy if this transition continues, potentially attracting greater institutional demand.

Bitcoin ETF Performance

Since their launch, Bitcoin ETFs have collectively witnessed a total inflow of $17.94 billion, according to data from Farside Investors. The funds have had an incredible performance so far, with the last five days marked with consistent inflows.

Yesterday, BlackRock’s iShares Bitcoin Trust (IBIT) saw nearly $185 million in inflows, followed by Bitwise’s Bitcoin ETF (BITB), which added around $2.1 million.

Conversely, ARK Invest/21Shares’ Bitcoin ETF (ARK) and Fidelity’s Bitcoin Fund (FBTC) registered outflows of $47.4 million and $33.2 million, respectively. The remaining ETFs did not witness any flow yesterday, bringing the day’s record to an inflow of $105.9 million.

Disclaimer: This content is informational and should not be considered financial advice. The views expressed in this article may include the author’s personal opinions and do not reflect The Crypto Basic’s opinion. Readers are encouraged to do thorough research before making any investment decisions. The Crypto Basic is not responsible for any financial losses.