- An analyst has outlined key conditions that must be met before FET can break through its resistance levels.

- At the same time, growing selling activity among traders could pressure the asset lower.

Artificial Superintelligence Alliance [FET] has sustained a consistent bullish trend across multiple timeframes—from monthly and weekly to daily charts—yielding gains between 12% and 16%.

Recent developments indicate that FET is preparing for a further rally, but its continued ascent hinges on meeting specific conditions.

FET encounters key challenge as rally progresses

According to analyst Crypto Leo, FET was trading within a symmetrical triangle pattern on the weekly timeframe at press time, a formation often seen before a rally.

This pattern is characterized by price movement within converging support and resistance levels, which typically precedes a breakout.

However, the rally may face a delay due to resistance levels that have emerged within the pattern. These levels are known to contain significant sell pressure, which could trigger a price pullback.

A break above this resistance would likely propel FET to at least $3.50, as indicated by the chart.

Yet, resistance is not the only obstacle to FET’s potential rally. Other key indicators suggest an ongoing sell-off, which could further hinder the asset’s upward momentum.

FET faces a major sell-off

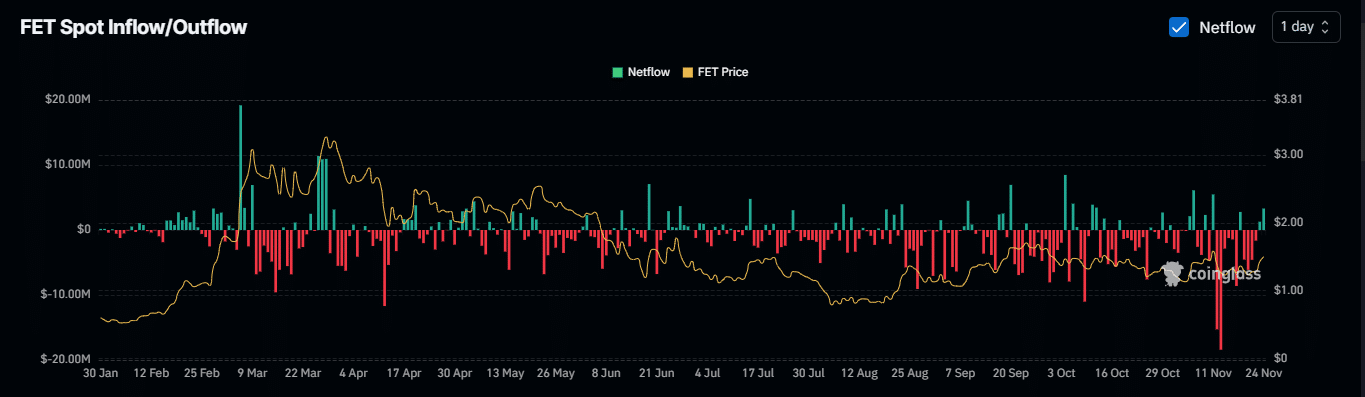

Coinglass data highlighted a significant sell-off among FET holders over the past 24 hours, with traders moving their assets to exchanges for liquidation.

During this period, $4.34 million worth of FET has been transferred to exchanges. If bearish sentiment continues and more traders follow suit, the asset could experience a decline from its current levels.

Additionally, the market has seen a liquidation hit targeting long positions. Coinglass reported that $820.49 thousand worth of long positions were forcefully closed as market movements diverged from traders’ expectations.

With both metrics working against long traders, FET’s rally is likely to be delayed.

Open Interest remains bullish

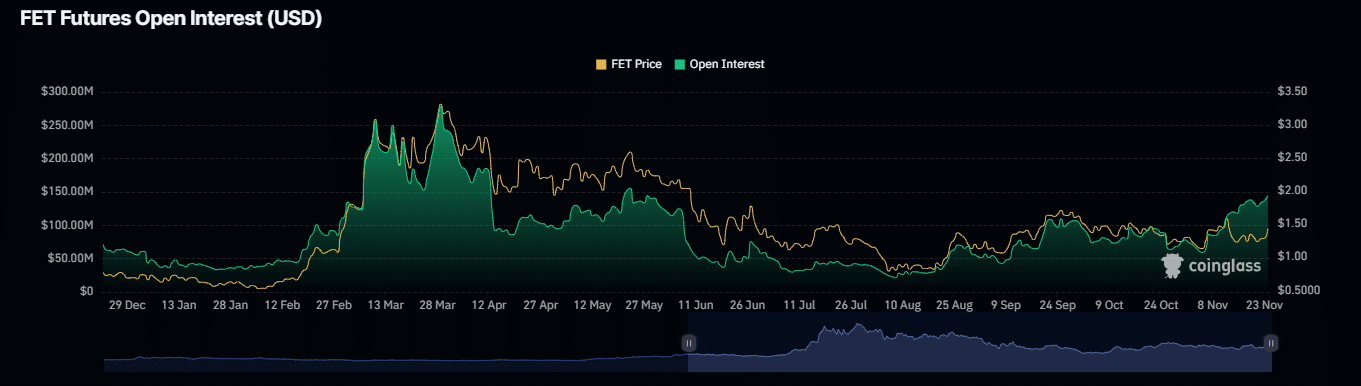

Open Interest, which tracks the number of unsettled derivative contracts on an asset—in this case, FET—provides insight into the asset’s future direction.

Recently, Open Interest surged by 10.20%, reaching $154.86 million.

Read Artificial Superintelligence Alliance’s [FET] Price Prediction 2024–2025

This increase suggests that the market retains a bullish undertone and could see upward movement, provided other indicators align with this optimistic outlook.

However, until that happens, FET is unlikely to break out of the symmetrical triangle pattern and reach new highs.