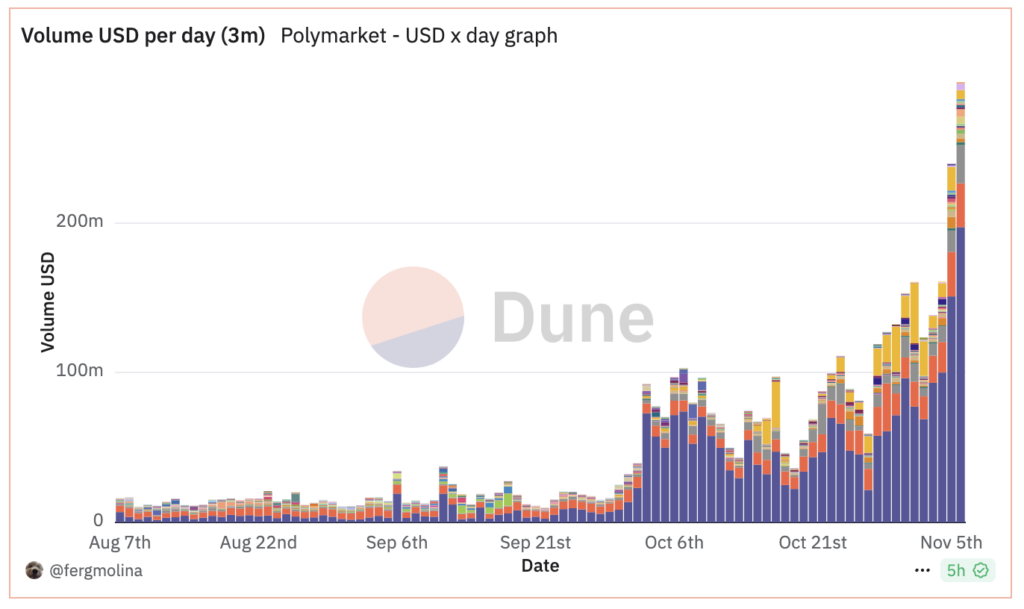

France’s National Gaming Authority is reportedly moving to block Polymarket, the blockchain-based prediction market that saw $3.5 billion in trading volume during the recent U.S. presidential election.

According to French news outlet The Big Whale, the regulator is “currently examining [Polymarket’s] operation as well as its compliance with French gambling legislation.” The scrutiny intensified after a French trader named Theo reportedly placed multimillion-dollar bets on Donald Trump’s win, securing a $47 million payout after Trump claimed a second term. Reuters had first identified Theo two weeks before Election Day.

The proposed ban would be backed by the regulator’s authority to restrict access and block domain names, with potential pressure on media outlets that link to the platform.

Polymarket has reportedly contacted Theo, noting his background in financial services and extensive trading history. Following an internal investigation, Polymarket stated that Theo’s bets reflected his “personal views” on politics. His large wagers initially raised concerns about market manipulation, but he later disclosed his identity to The Wall Street Journal, revealing over $30 million in bets on the U.S. election.

While the National Gaming Authority (ANJ) could impose technical restrictions, users could still access Polymarket using VPNs, as the platform only requires a crypto wallet without identity verification. ANJ has not provided a timeline for any potential ban.

Polymarket has faced increasing regulatory scrutiny worldwide, including from the U.S. Commodity Futures Trading Commission (CFTC), which investigated the platform in 2021 and later proposed rules to mitigate manipulation risks in prediction markets.

Despite regulatory concerns, prediction markets continue to attract significant activity, with billions of dollars in wagers and ongoing worries about insider trading. Polymarket, which raised $74 million from early investors like Ethereum co-founder Vitalik Buterin, is currently inaccessible to U.S. users.

On November 5 alone, Polymarket recorded over $294 million in trading volume as users placed bets on election results. Unlike traditional betting platforms, Polymarket operates on blockchain technology, allowing for direct crypto-based bets without intermediaries.

The company currently manages betting options, but this could shift with a future token launch if it decentralizes. While some doubt its predictive reliability, Polymarket accurately signaled both Biden’s exit from the presidential race and Trump’s victory weeks before either event occurred.