Court OKs FTX’s $3.6B Crypto Liquidation, Market Dips. Galaxy Digital to Handle Sales in $50M to $100M Weekly Blocks to Maintain Stability.

A recent court decision allows FTX to sell $3.6 billion in cryptocurrencies, causing the market to go down.

Following the court’s decision, Galaxy Digital, led by Mike Novogratz, will manage the sale. This comes after FTX’s significant decline and bankruptcy in November 2022. Many traders are concerned about the market being too crowded, which is driving discussions about FTX’s liquidation.

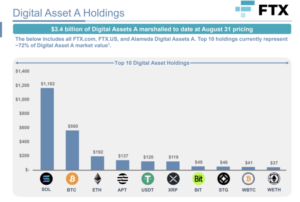

FTX’s Complete Liquidation List

FTX will sell various cryptocurrencies, including:

- $1.16 billion worth of Solana (SOL)

- $560 million worth of Bitcoin (BTC)

- $192 million worth of Ethereum (ETH)

- $137 million worth of Aptos (APT)

- $120 million worth of Tether (USDT)

- $119 million worth of Ripple (XRP)

- $49 million worth of Biconomy Exchange Token (BIT)

- $46 million worth of Stargate Finance (STG)

- $41 million worth of Wrapped Bitcoin (WBTC)

- $37 million worth of Wrapped Ethereum (WETH)

FTX Crypto Holdings. Source: Court Documents

The sale of these cryptocurrencies will start with weekly blocks of $50 million and will gradually increase to $100 million. However, there are stricter rules for selling tokens associated with insiders. For these tokens, FTX must give a 10-day notice to both creditors and the US Trustee before selling them.

Additionally, FTX intends to get involved in cryptocurrency hedging contracts. They will begin by concentrating on Bitcoin and Ethereum.

Impact on Solana and Other Alternative Cryptocurrencies

FTX’s significant ownership of Solana has likely caused a 4% drop in SOL’s price, bringing it down to $18.50 in the past week. FTX holds almost 16% of all circulating Solana tokens. To reduce the immediate impact on the market, FTX plans to release only $9.2 million worth of Solana tokens each month during the liquidation process.

While FTX and Alameda Research jointly own $353 million in Bitcoin, which makes up around 1% of Bitcoin’s weekly trading volume (a relatively small portion for Bitcoin), it’s their holdings in less commonly traded tokens like Dogecoin (DOGE), TRON, and Polygon (MATIC) that raise concerns. These assets, valued between $20 to $30 million each, represent a significant portion of the weekly trading volumes for these cryptocurrencies, ranging from 6% to 12%.

How the Crypto Market Responded to FTX News

When the news was announced, Bitcoin saw a small decrease in value, losing 0.9%. Ethereum also dropped by 1%, and Solana experienced a more significant decline, losing 2.2% of its value.

However, some of this impact was already expected because of news earlier in the week.

Crypto Market Performance. Source: Coin360

Right now, the company has more than $3.4 billion in digital assets. They also have a venture investment portfolio worth around $4.5 billion, along with $200 million in luxury real estate in the Bahamas and $529 million in securities.

Important: Please note that this article is only meant to provide information and should not be taken as legal, tax, investment, financial, or any other type of advice.

Join Cryptos Headlines Community

Follow Cryptos Headlines on Google News