FTX, once a major cryptocurrency exchange, is now dealing with bankruptcy issues. They’re asking the court to allow them to sell a massive $3.4 billion worth of cryptocurrencies on September 13.

Just the news of this planned sell-off has already caused the market to decline, indicating possible negative trends for Wednesday. It’s important to note that FTX holds a significant amount of Solana and various other cryptocurrencies in its holdings.

This situation has created some uncertainty in the crypto market, and traders are closely watching how it unfolds. The sell-off could impact the prices of cryptocurrencies like Solana and influence broader market sentiment.

Will FTX’s Selloff Impact the Crypto Market?

Scheduled for a court hearing on September 13, the bankrupt FTX exchange has put forward a plan to convert its cryptocurrency assets into regular money, also known as fiat currency. The primary goal is to use these funds to pay off the debts it owes to various creditors.

This proposal was initially submitted on August 23 and has generated considerable interest among those who are owed money by FTX, as well as people who hold tokens from the exchange. They are eagerly awaiting the outcome of the upcoming court hearing, as it could lead to the potential recovery of a substantial sum, potentially as much as $3.4 billion.

FTX, in its legal documents, has outlined its strategy to sell digital assets at a gradual pace, aiming to offload between $100 million to $200 million worth of assets per week. This measured approach is intended to avoid causing a sudden drop in the prices of these assets if FTX were to sell its entire portfolio all at once.

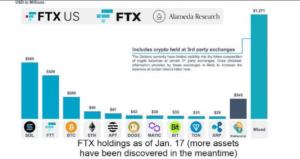

As of January 17, FTX held various cryptocurrencies, including approximately $685 million worth of Solana (SOL), around $42 million in Dogecoin (DOGE), and roughly $268 million in Bitcoin (BTC), among other assets.

Despite this planned weekly selloff, it’s unlikely to have an immediate impact on asset prices. Even if the court approves the plan by September 13, the actual liquidation may not commence right away. Additionally, a significant portion of FTX’s Solana assets is subject to vesting agreements, meaning they cannot be sold immediately and will remain inaccessible for some time.

What Lies Ahead for SOL Price?

Solana’s price has been steadily declining, moving between $19.1 and $17.3. Bearish sentiment persists, with sellers taking advantage of price rallies near the 20-day EMA. Currently, SOL is trading at $17.6, marking a 4% decrease from the previous day.

The price of SOL might be headed downwards if it falls below $17.1, possibly reaching $15.3. On the other hand, the bulls want to push the price above the 20-day EMA. If they succeed, SOL could target the next resistance at $20, and breaking this level could lead to a potential rally towards $22.4.

FTX Estate’s Assets: $7B, $1.16B in SOL, $560M in BTC.

The estate of the bankrupt FTX cryptocurrency exchange has amassed around $7 billion in assets, including $1.16 billion in SOL tokens and $560 million in BTC, according to a court filing. This substantial asset pool should enable the estate to provide significant repayments to its creditors. While the exact reason for FTX’s bankruptcy remains unclear, reports suggest that it was impacted by a mining ban imposed in China earlier this year.

Important: Please note that this article is only meant to provide information and should not be taken as legal, tax, investment, financial, or any other type of advice.

Join Cryptos Headlines Community

Follow Cryptos Headlines on Google News