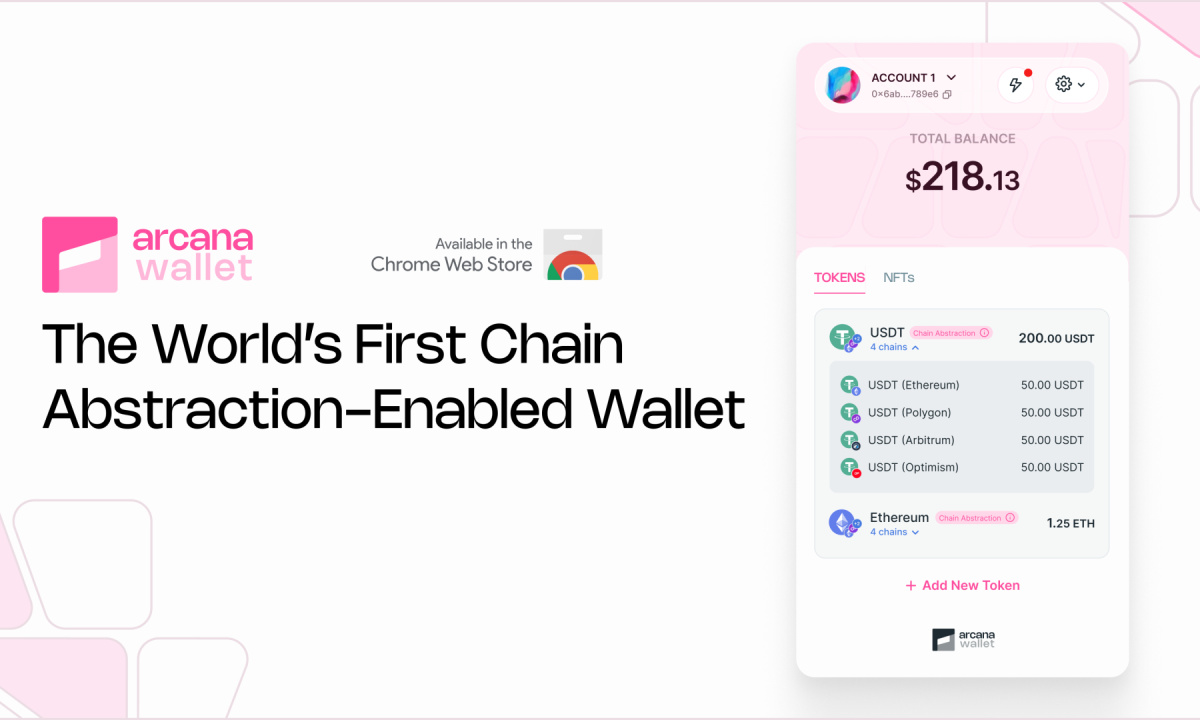

A new development: Another proposed Spot Bitcoin ETF is now listed on the Depository Trust and Clearing Corporation’s (DTCC) website, marking the second such ETF to appear on the corporation’s site.

The Invesco Galaxy Bitcoin ETF, with the ticker ‘BTCO,’ has been added to the DTCC website. This comes after BlackRock’s spot Bitcoin ETF, known as ‘IBTC,’ was also listed. The uncertainty surrounding the approval of these funds is causing increased attention.

Source: DTCC website

DTCC Listing of Bitcoin ETFs Doesn’t Guarantee Approval by SEC

Anticipation for BlackRock’s IBTC approval had grown, but it waned after a spokesperson clarified that the listings were routine and didn’t hint at SEC approval.

An ETF expert emphasized that the DTCC’s listing doesn’t carry significant meaning in the context of SEC approval for Bitcoin ETFs. It simply indicates that asset managers are getting ready in case the SEC grants approval.

Asset managers like BlackRock and VanEck have disclosed their intentions to start seeding their funds. Although this step doesn’t ensure that the SEC will approve these funds in the near future, it does reflect these companies’ optimism that their Spot Bitcoin ETFs will eventually launch.

Valkyrie Joins Spot Bitcoin ETF Amendment Trend

Bloomberg analyst James Seyffart noted that Valkyrie, an asset management firm, has joined others like ARK Invest, BlackRock, Fidelity, and Bitwise in amending their Spot Bitcoin ETF prospectus. These amendments have sparked speculation about the possibility of the SEC approving such a fund in the near future. ARK Invest was the first to make such amendments, leading to predictions that approval could come as early as next year.

BTC price hovering above $34,400 | Source: BTCUSD on Tradingview.com

The SEC has been quiet about Grayscale’s application, and the Commission is scheduled to have a closed meeting on November 2, which is its first meeting since the Grayscale deadline passed. One of the agenda items for the meeting is to address litigation claims, which could potentially involve Grayscale’s application.

Important: Please note that this article is only meant to provide information and should not be taken as legal, tax, investment, financial, or any other type of advice.

Join Cryptos Headlines Community

Follow Cryptos Headlines on Google News