If GameStop opens at its current after-hours price, Roaring Kitty’s holdings would be worth about $1 billion. Keith Gill, a stock trader famous for the GameStop short squeeze in 2021, is on his way to becoming a billionaire as GME shares continue to rise.

Known online as “Roaring Kitty” and “DeepFuckingValue,” Gill revealed on June 2 that he had resumed trading GameStop stock with $180 million. He posted a $115.7 million position in GameStop shares and $65.7 million in call options on his Reddit account.

Roaring Kitty’s GameStop Revelation Sparks Market Surge

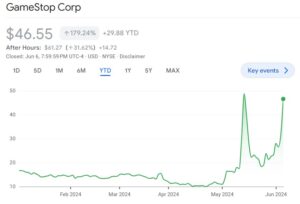

The trader’s revelation of another position on GameStop shook the stock market again, causing an uptick in the GameStop stock price. Robinhood’s overnight markets saw GameStop jump by 19% just 20 minutes after the post, with shares up 38.8% in 2024 so far.

GameStop year-to-date chart. Source: Google Finance

Global capital markets analysts at The Kobeissi Letter believe that Gill is “set to be a billionaire” as GameStop stock catapulted to $67.50 per share in after-hours trading. According to the stock analysts, if it opens at its current levels, Gill’s position will be worth around $1 billion.

The analysts also highlighted that the stock closed 110% higher than June 6 and added $9.5 billion in market capitalization in the previous 12 hours. This puts the company at a $20 billion valuation, making it one of the 400-largest public companies in the United States.

Roaring Kitty’s GameStop Bet Paves Path to Billionaire Status

Global capital markets analysts at The Kobeissi Letter believe that Keith Gill is “set to be a billionaire” as GameStop stock surged to $67.50 per share in after-hours trading. According to the stock analysts, if it opens at its current levels, Gill’s position will be worth around $1 billion.

The analysts also highlighted that the stock closed 110% higher than on June 6, adding $9.5 billion in market capitalization in the previous 12 hours. This surge places the company at a $20 billion valuation, making it one of the 400-largest public companies in the United States.

Controversy Surrounds Roaring Kitty’s GameStop Moves

On June 3, prominent GameStop short-seller Citron Research criticized Keith Gill’s recent move. The company accused Gill of manipulating the markets in an X post, alleging that he was working with someone else. Citron Research stated, “We believe someone is backing Gill — there’s no way he made this size trade alone. His reported finances don’t support this trade. Investors will see through this roaring Icarus.”

On June 4, the Massachusetts securities regulator reportedly opened an investigation into Gill’s actions. In a CNBC interview, former Chicago Securities and Exchange Commission official Lisa Braganca said the investigation would likely examine whether Gill is “moving the market.”

Braganca explained that regulators would check if Gill was potentially collaborating with others or engaging in illegal conduct. She noted that the investigation might involve reviewing Gill’s communications, including texts, emails, and posts on social media platforms like Reddit or X. “They are concerned that this is an effort to manipulate the market and for him to make money for himself through illegal disclosures,” Braganca added.

Important: Please note that this article is only meant to provide information and should not be taken as legal, tax, investment, financial, or any other type of advice.

Join Cryptos Headlines Community

Follow Cryptos Headlines on Google News